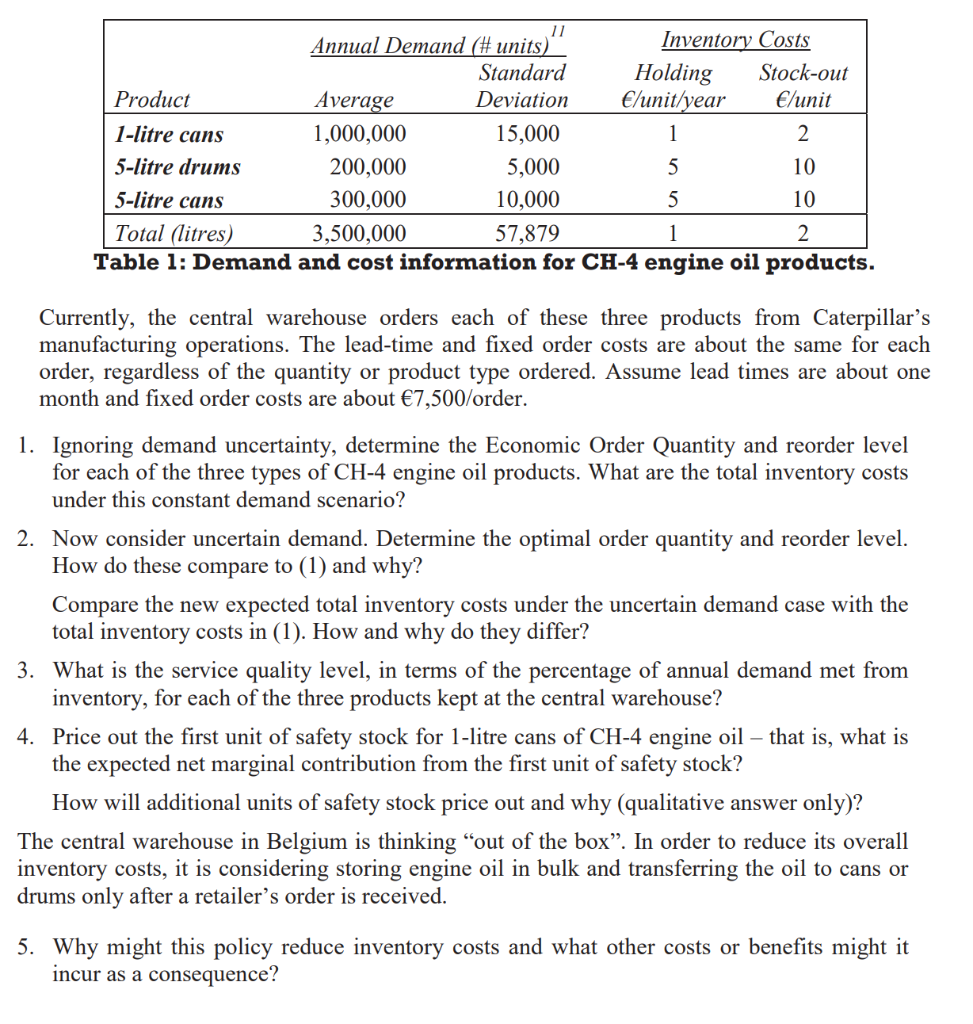

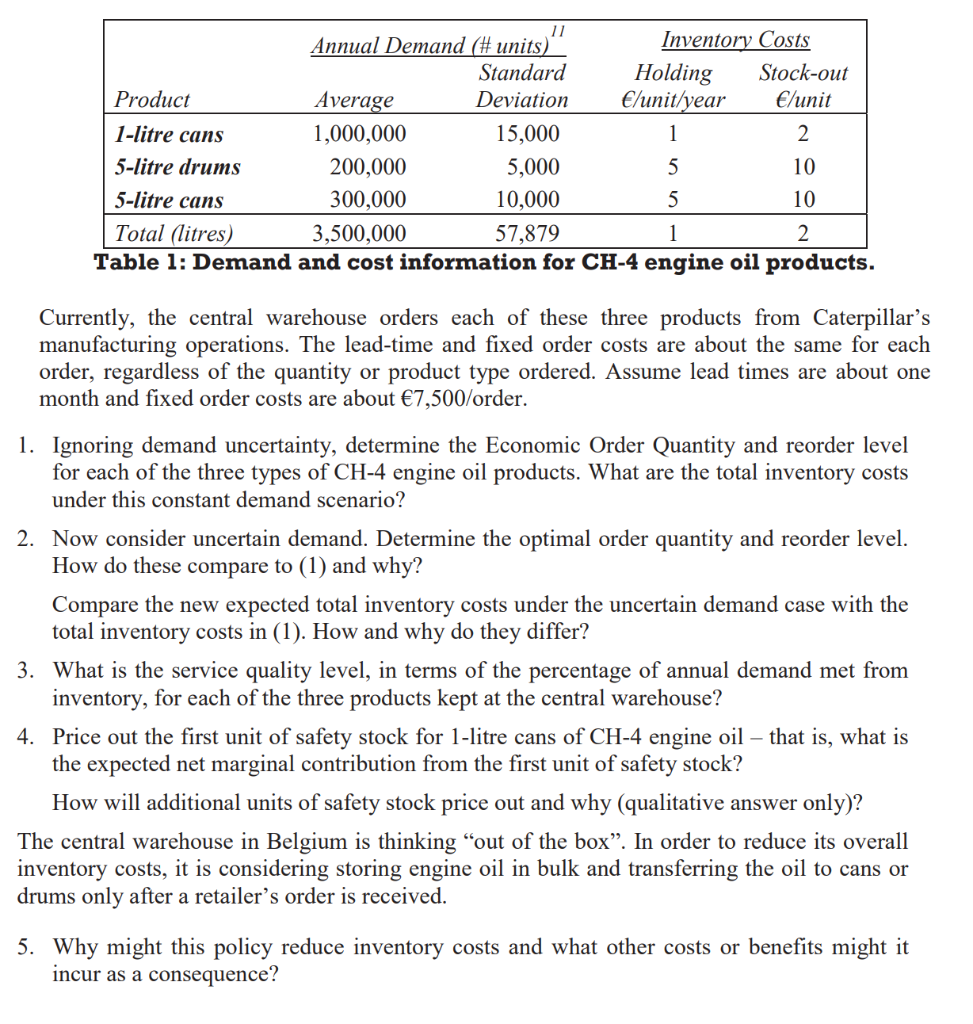

11 Annual Demand (#units) Inventory Costs Standard Holding Stock-out Product Average Deviation /unit/year /unit 1-litre cans 1,000,000 15,000 1 2 5-litre drums 200,000 5,000 5 10 5-litre cans 300,000 10,000 5 10 Total (litres) 3,500,000 57,879 1 2 Table 1: Demand and cost information for CH-4 engine oil products. Currently, the central warehouse orders each of these three products from Caterpillar's manufacturing operations. The lead-time and fixed order costs are about the same for each order, regardless of the quantity or product type ordered. Assume lead times are about one month and fixed order costs are about 7,500/order. 1. Ignoring demand uncertainty, determine the Economic Order Quantity and reorder level for each of the three types of CH-4 engine oil products. What are the total inventory costs under this constant demand scenario? 2. Now consider uncertain demand. Determine the optimal order quantity and reorder level. How do these compare to (1) and why? Compare the new expected total inventory costs under the uncertain demand case with the total inventory costs in (1). How and why do they differ? 3. What is the service quality level, in terms of the percentage of annual demand met from inventory, for each of the three products kept at the central warehouse? 4. Price out the first unit of safety stock for 1-litre cans of CH-4 engine oil that is, what is the expected net marginal contribution from the first unit of safety stock? How will additional units of safety stock price out and why (qualitative answer only)? The central warehouse in Belgium is thinking "out of the box. In order to reduce its overall inventory costs, it is considering storing engine oil in bulk and transferring the oil to cans or drums only after a retailer's order is received. 5. Why might this policy reduce inventory costs and what other costs or benefits might it incur as a consequence? 11 Annual Demand (#units) Inventory Costs Standard Holding Stock-out Product Average Deviation /unit/year /unit 1-litre cans 1,000,000 15,000 1 2 5-litre drums 200,000 5,000 5 10 5-litre cans 300,000 10,000 5 10 Total (litres) 3,500,000 57,879 1 2 Table 1: Demand and cost information for CH-4 engine oil products. Currently, the central warehouse orders each of these three products from Caterpillar's manufacturing operations. The lead-time and fixed order costs are about the same for each order, regardless of the quantity or product type ordered. Assume lead times are about one month and fixed order costs are about 7,500/order. 1. Ignoring demand uncertainty, determine the Economic Order Quantity and reorder level for each of the three types of CH-4 engine oil products. What are the total inventory costs under this constant demand scenario? 2. Now consider uncertain demand. Determine the optimal order quantity and reorder level. How do these compare to (1) and why? Compare the new expected total inventory costs under the uncertain demand case with the total inventory costs in (1). How and why do they differ? 3. What is the service quality level, in terms of the percentage of annual demand met from inventory, for each of the three products kept at the central warehouse? 4. Price out the first unit of safety stock for 1-litre cans of CH-4 engine oil that is, what is the expected net marginal contribution from the first unit of safety stock? How will additional units of safety stock price out and why (qualitative answer only)? The central warehouse in Belgium is thinking "out of the box. In order to reduce its overall inventory costs, it is considering storing engine oil in bulk and transferring the oil to cans or drums only after a retailer's order is received. 5. Why might this policy reduce inventory costs and what other costs or benefits might it incur as a consequence