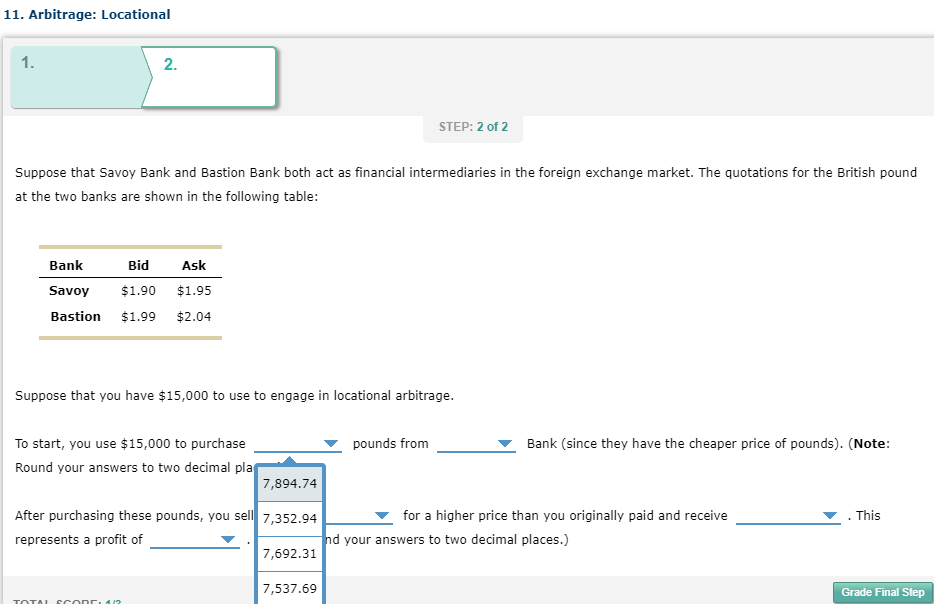

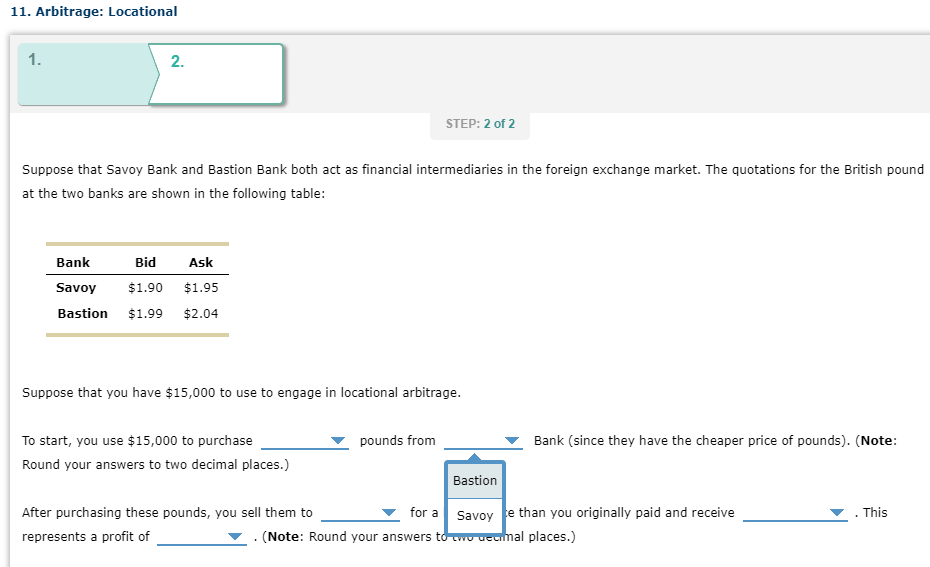

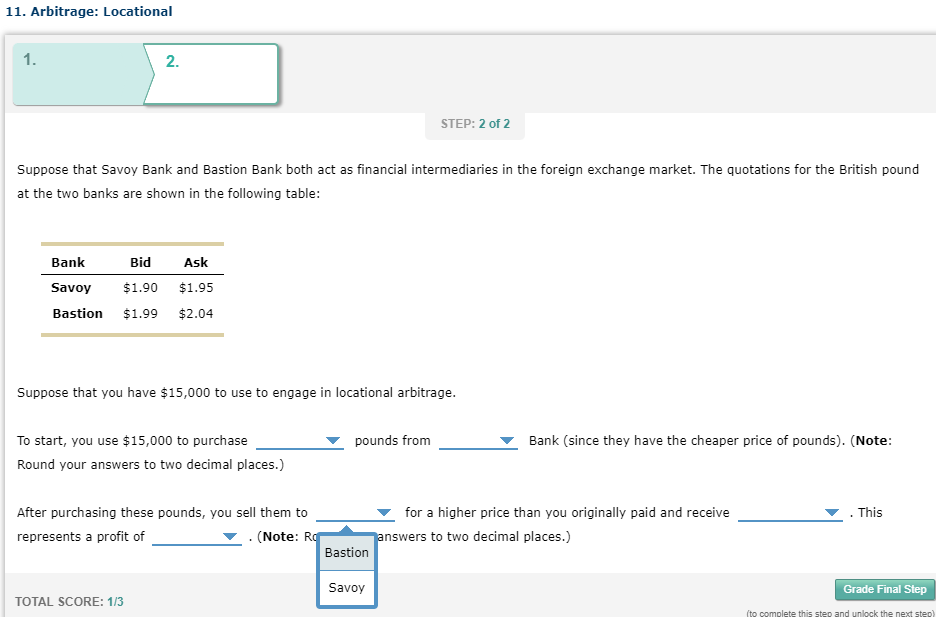

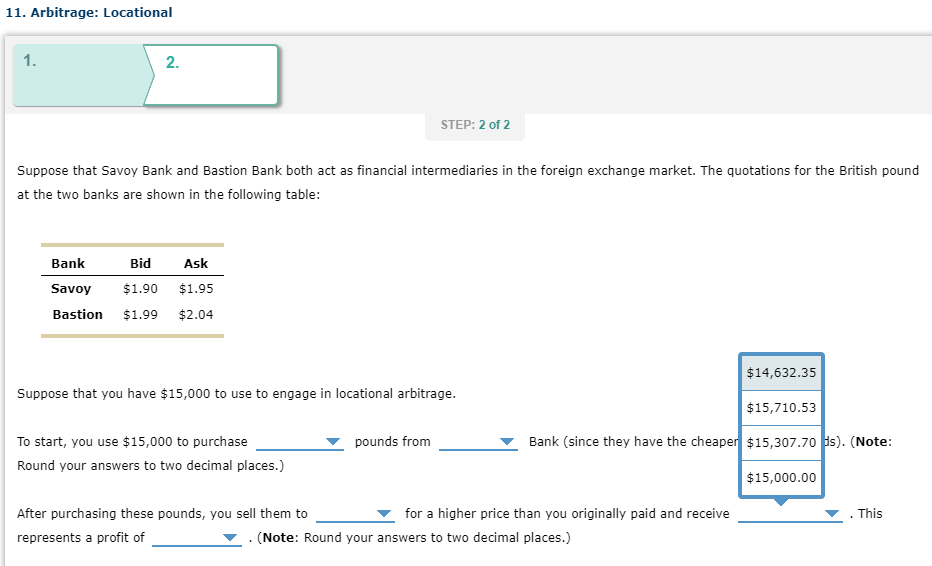

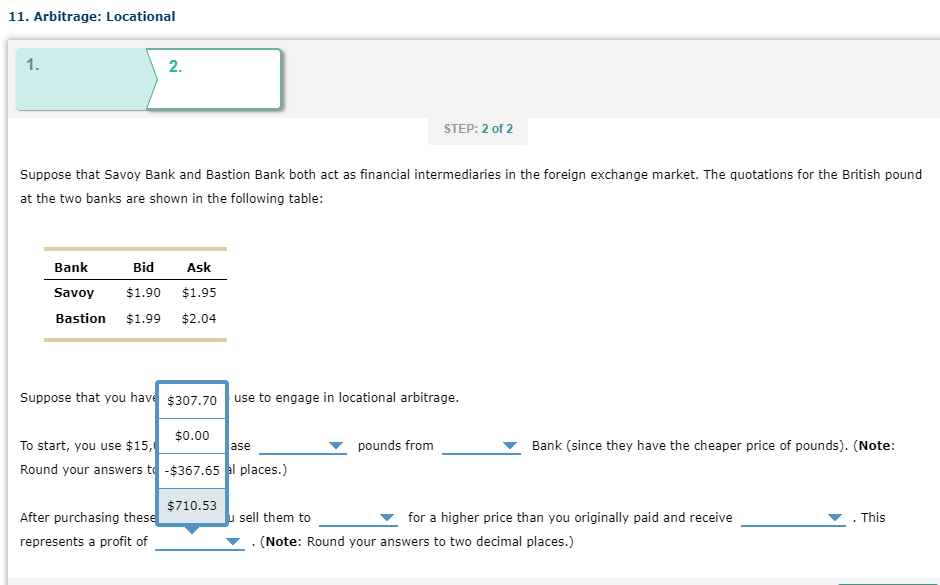

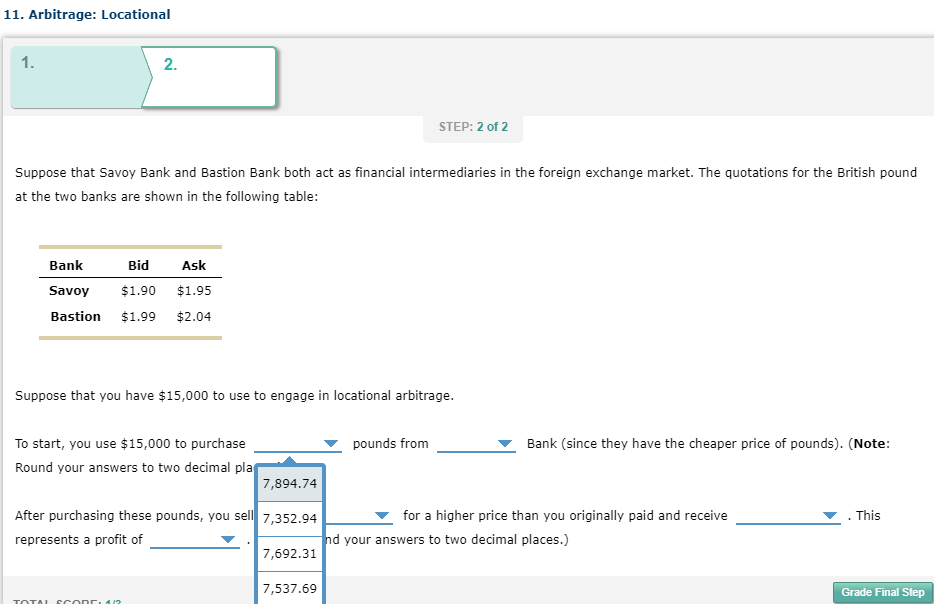

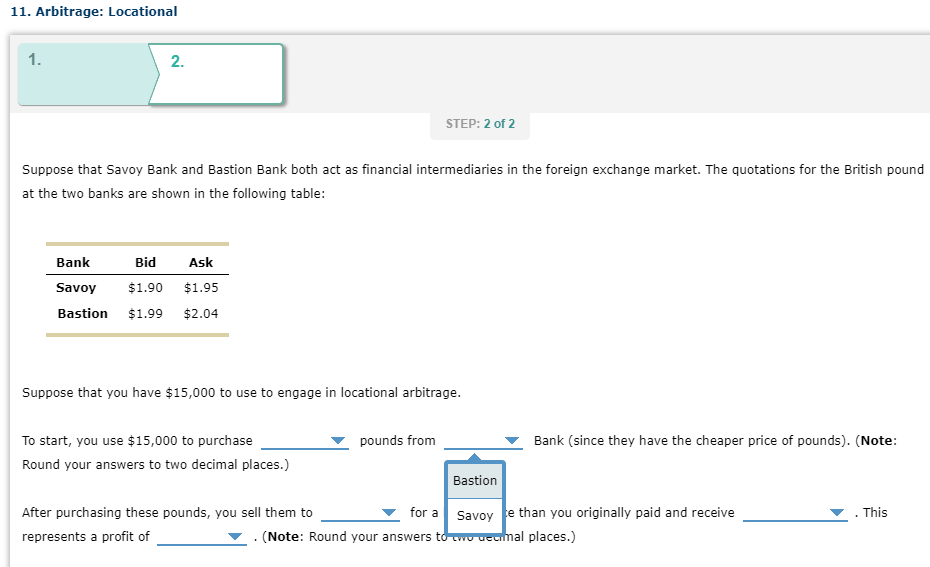

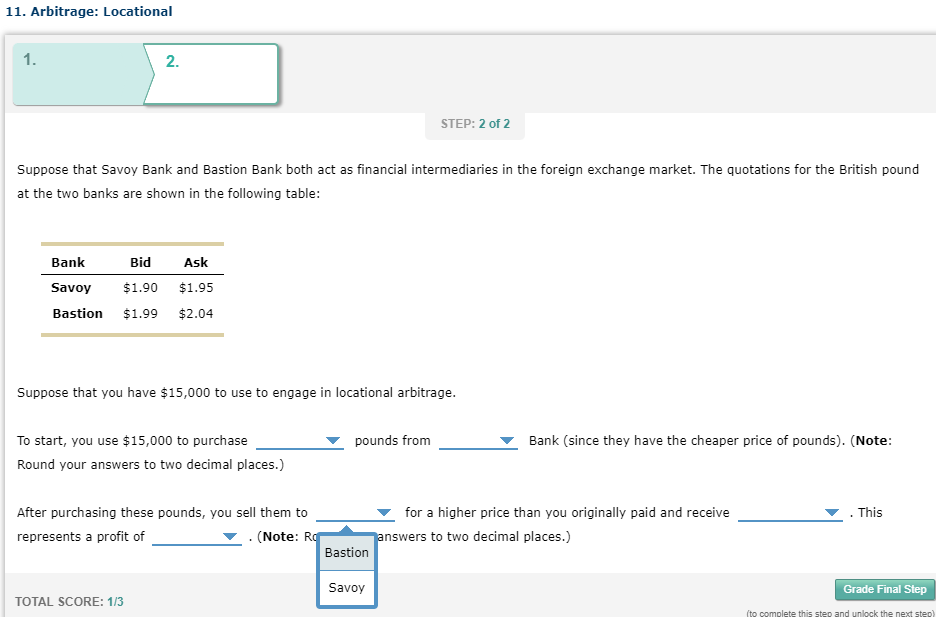

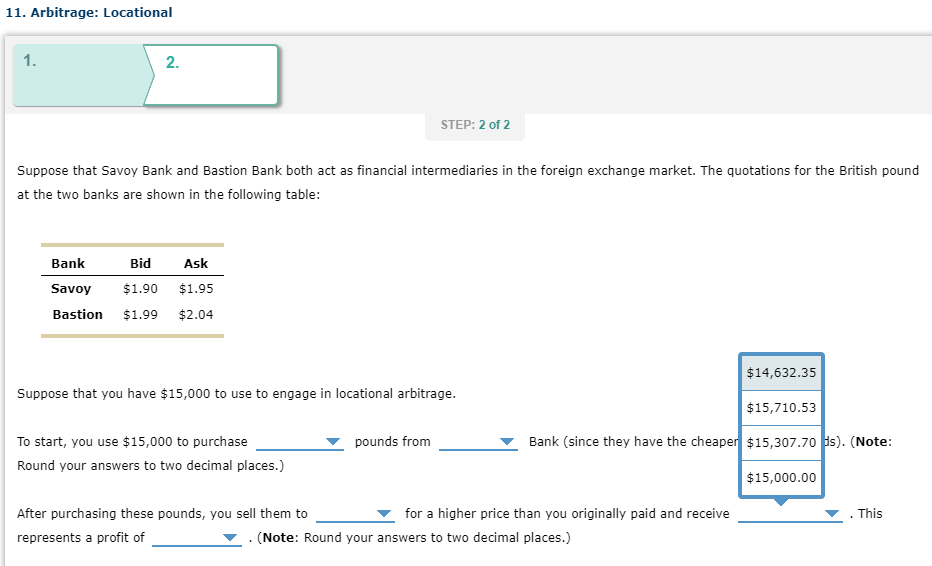

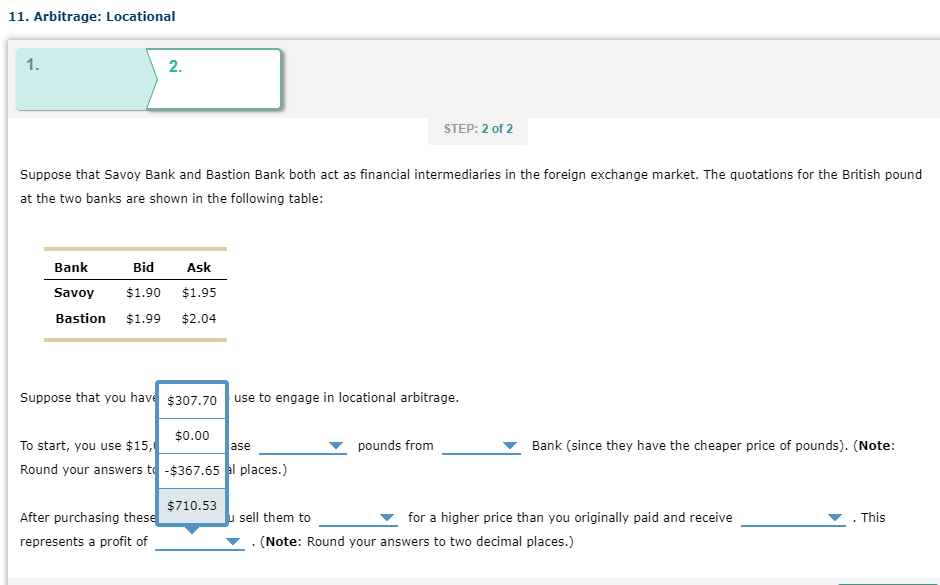

11. Arbitrage: Locational 1. 2. STEP: 2 of 2 Suppose that Savoy Bank and Bastion Bank both act as financial intermediaries in the foreign exchange market. The quotations for the British pound at the two banks are shown in the following table: Bank Bid Savoy $1.90 Bastion $1.99 Ask $1.95 $2.04 Suppose that you have $15,000 to use to engage in locational arbitrage. To start, you use $15,000 to purchase pounds from Bank (since they have the cheaper price of pounds). (Note: Round your answers to two decimal pla 7,894.74 After purchasing these pounds, you sell 7,352.94 for a higher price than you originally paid and receive represents a profit of nd your answers to two decimal places.) 7,692.31 This 7,537.69 Grade Final Step TOTALCO 11. Arbitrage: Locational 1. 2. STEP: 2 of 2 Suppose that Savoy Bank and Bastion Bank both act as financial intermediaries in the foreign exchange market. The quotations for the British pound at the two banks are shown in the following table: Bank Bid $1.90 Savoy Bastion Ask $1.95 $2.04 $1.99 Suppose that you have $15,000 to use to engage in locational arbitrage. pounds from Bank (since they have the cheaper price of pounds). (Note: To start, you use $15,000 to purchase Round your answers to two decimal places.) Bastion for a . This After purchasing these pounds, you sell them to Savoy te than you originally paid and receive represents a profit of (Note: Round your answers to two decimal places.) 11. Arbitrage: Locational 1. 2. STEP: 2 of 2 Suppose that Savoy Bank and Bastion Bank both act as financial intermediaries in the foreign exchange market. The quotations for the British pound at the two banks are shown in the following table: Bid Ask Bank Savoy Bastion $1.90 $1.95 $2.04 $1.99 Suppose that you have $15,000 to use to engage in locational arbitrage. pounds from Bank (since they have the cheaper price of pounds). (Note: To start, you use $15,000 to purchase Round your answers to two decimal places.) This After purchasing these pounds, you sell them to for a higher price than you originally paid and receive represents a profit of . (Note: Rg answers to two decimal places.) Bastion Savoy Grade Final Step TOTAL SCORE: 1/3 (to complete this step and unlock the next step) 11. Arbitrage: Locational 1. 2. STEP: 2 of 2 Suppose that Savoy Bank and Bastion Bank both act as financial intermediaries in the foreign exchange market. The quotations for the British pound at the two banks are shown in the following table: Bank Bid Ask $1.90 Savoy Bastion $1.95 $2.04 $1.99 $14,632.35 Suppose that you have $15,000 to use to engage in locational arbitrage. $15,710.53 pounds from Bank (since they have the cheaper $15,307.70 Hs). (Note: To start, you use $15,000 to purchase Round your answers to two decimal places.) $15,000.00 This After purchasing these pounds, you sell them to for a higher price than you originally paid and receive represents a profit of . (Note: Round your answers two decimal places.) 11. Arbitrage: Locational 1. 2. STEP: 2 of 2 Suppose that Savoy Bank and Bastion Bank both act as financial intermediaries in the foreign exchange market. The quotations for the British pound at the two banks are shown in the following table: Bid Bank Savoy Bastion Ask $1.95 $1.90 $1.99 $2.04 Suppose that you have $307.70 use to engage in locational arbitrage. ase pounds from $0.00 To start, you use $15, Round your answers t-$367.65 l places.) Bank (since they have the cheaper price of pounds). (Note: $710.53 After purchasing these represents a profit of This u sell them to for a higher price than you originally paid and receive (Note: Round your answers to two decimal places.)