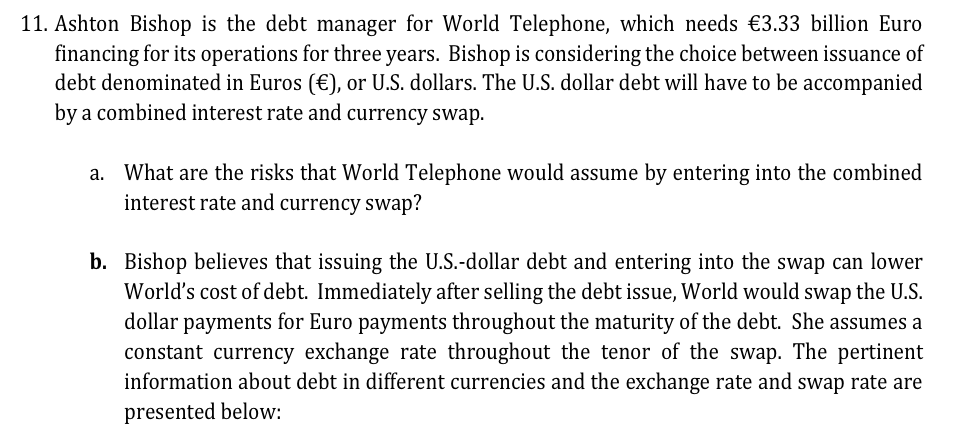

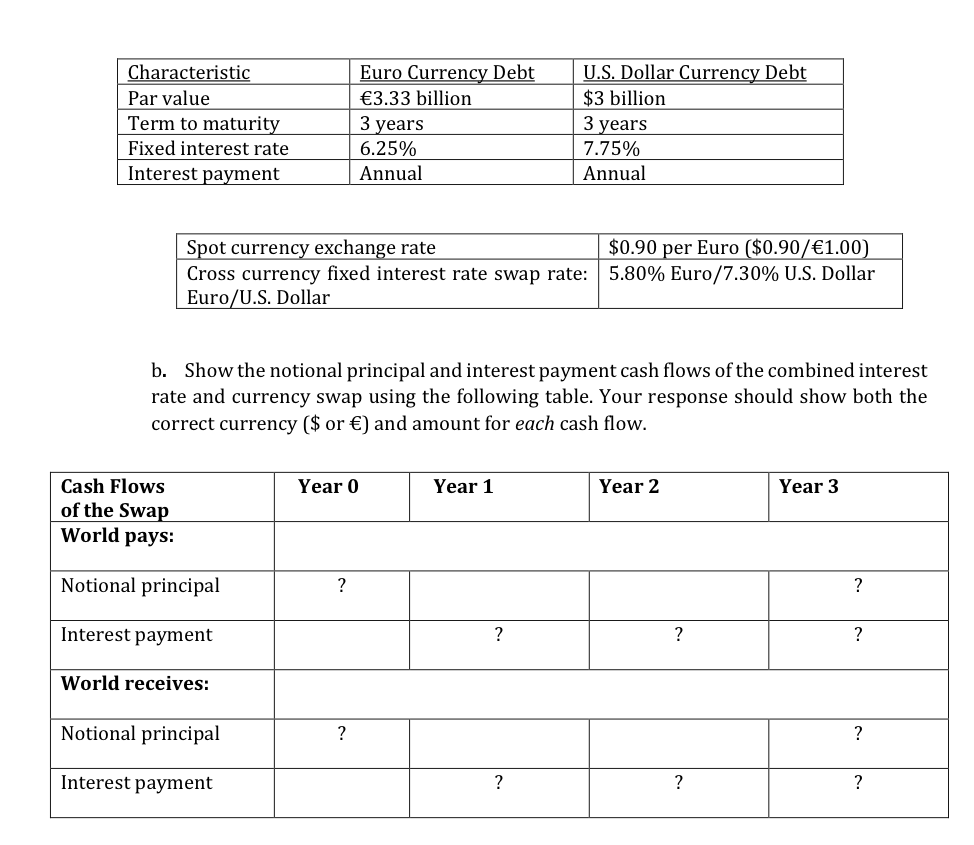

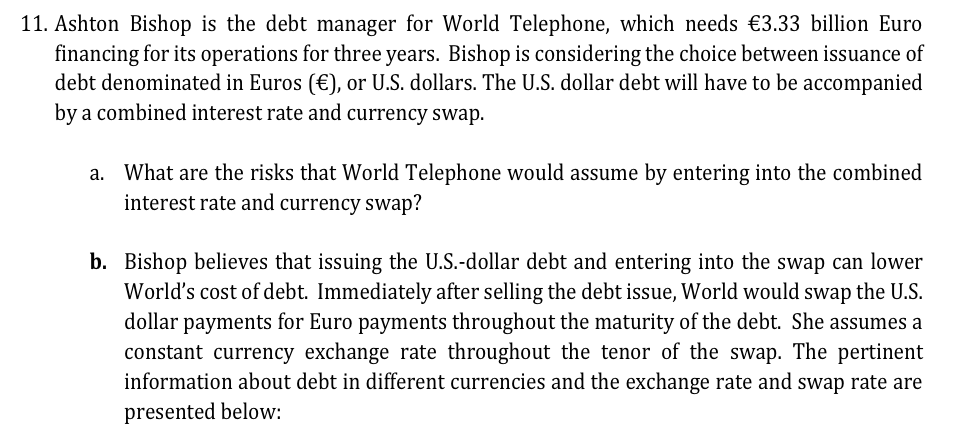

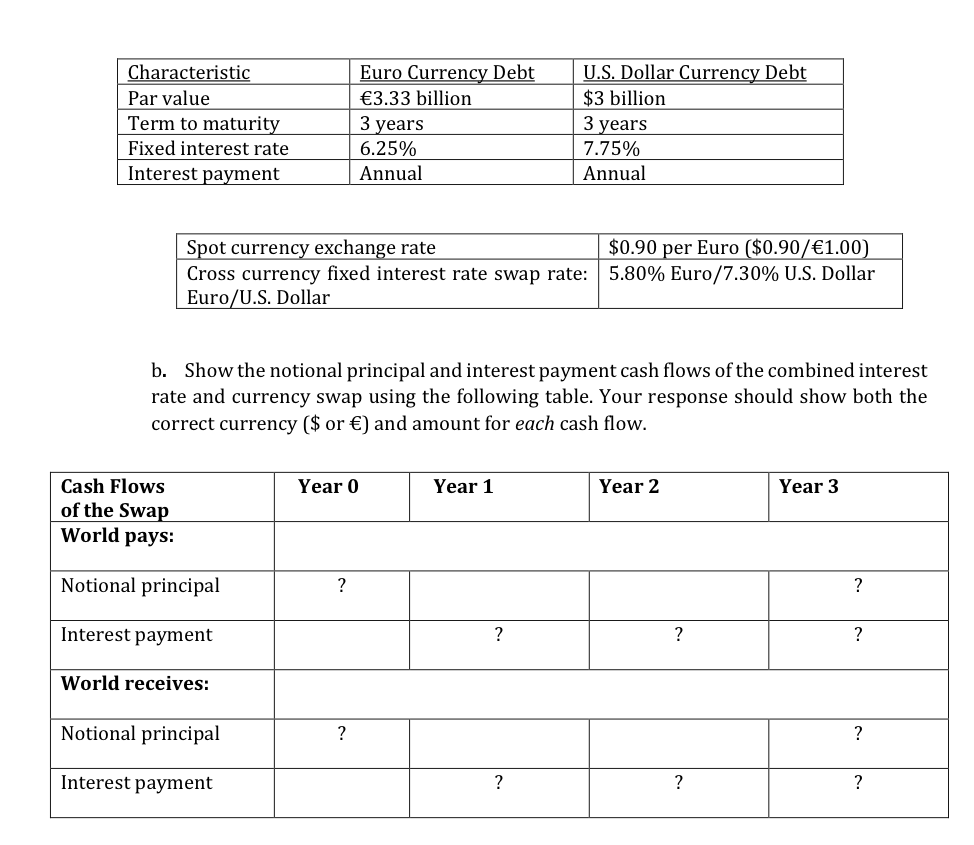

11. Ashton Bishop is the debt manager for World Telephone, which needs 3.33 billion Euro financing for its operations for three years. Bishop is considering the choice between issuance of debt denominated in Euros (), or U.S. dollars. The U.S. dollar debt will have to be accompanied by a combined interest rate and currency swap. a. What are the risks that World Telephone would assume by entering into the combined interest rate and currency swap? b. Bishop believes that issuing the U.S.-dollar debt and entering into the swap can lower World's cost of debt. Immediately after selling the debt issue, World would swap the U.S. dollar payments for Euro payments throughout the maturity of the debt. She assumes a constant currency exchange rate throughout the tenor of the swap. The pertinent information about debt in different currencies and the exchange rate and swap rate are presented below: Characteristic Par value Term to maturity Fixed interest rate Interest payment Euro Currency Debt 3.33 billion 3 years 6.25% Annual U.S. Dollar Currency Debt $3 billion 3 years 7.75% Annual Spot currency exchange rate $0.90 per Euro ($0.90/1.00) Cross currency fixed interest rate swap rate: 5.80% Euro/7.30% U.S. Dollar Euro/U.S. Dollar b. Show the notional principal and interest payment cash flows of the combined interest rate and currency swap using the following table. Your response should show both the correct currency ($ or ) and amount for each cash flow. Year 0 Year 1 Year 2 Year 3 Cash Flows of the Swap World pays: Notional principal Interest payment World receives: Notional principal ? Interest payment 11. Ashton Bishop is the debt manager for World Telephone, which needs 3.33 billion Euro financing for its operations for three years. Bishop is considering the choice between issuance of debt denominated in Euros (), or U.S. dollars. The U.S. dollar debt will have to be accompanied by a combined interest rate and currency swap. a. What are the risks that World Telephone would assume by entering into the combined interest rate and currency swap? b. Bishop believes that issuing the U.S.-dollar debt and entering into the swap can lower World's cost of debt. Immediately after selling the debt issue, World would swap the U.S. dollar payments for Euro payments throughout the maturity of the debt. She assumes a constant currency exchange rate throughout the tenor of the swap. The pertinent information about debt in different currencies and the exchange rate and swap rate are presented below: Characteristic Par value Term to maturity Fixed interest rate Interest payment Euro Currency Debt 3.33 billion 3 years 6.25% Annual U.S. Dollar Currency Debt $3 billion 3 years 7.75% Annual Spot currency exchange rate $0.90 per Euro ($0.90/1.00) Cross currency fixed interest rate swap rate: 5.80% Euro/7.30% U.S. Dollar Euro/U.S. Dollar b. Show the notional principal and interest payment cash flows of the combined interest rate and currency swap using the following table. Your response should show both the correct currency ($ or ) and amount for each cash flow. Year 0 Year 1 Year 2 Year 3 Cash Flows of the Swap World pays: Notional principal Interest payment World receives: Notional principal ? Interest payment