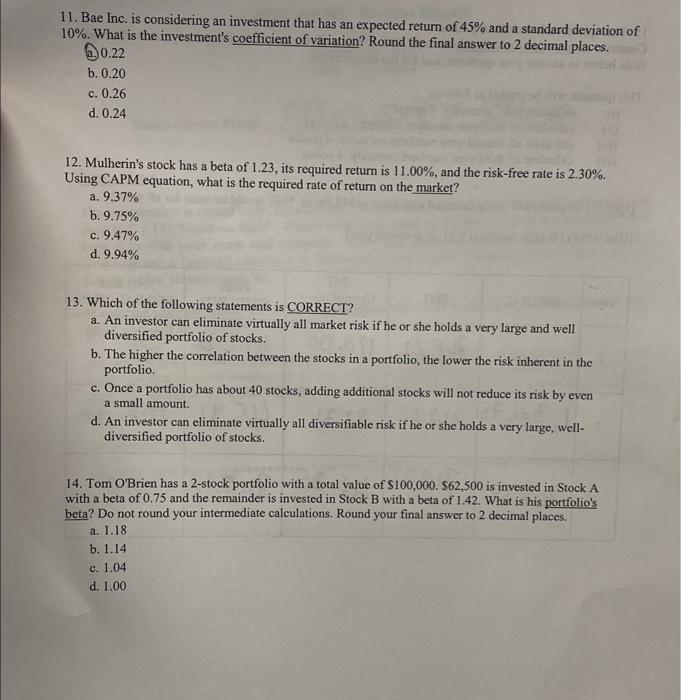

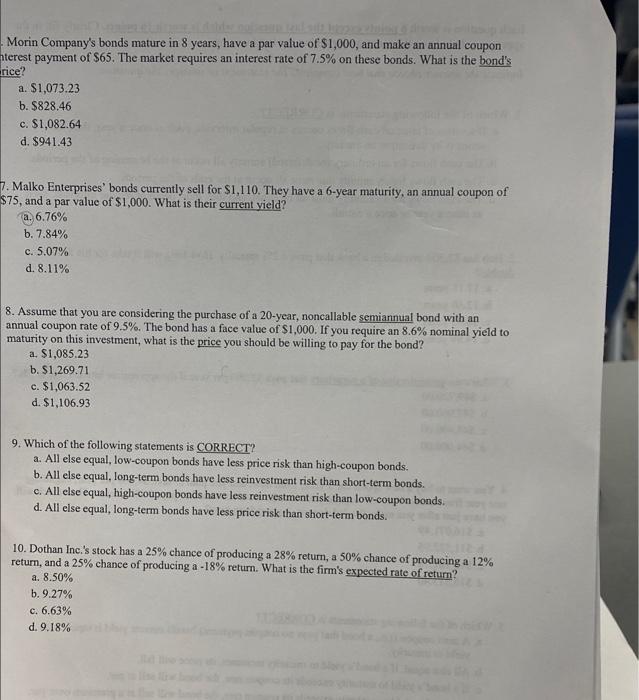

11. Bae Inc. is considering an investment that has an expected return of 45% and a standard deviation of 10%. What is the investment's coefficient of variation? Round the final answer to 2 decimal places. @ 0.22 b. 0.20 c. 0.26 d. 0.24 12. Mulherin's stock has a beta of 1.23, its required return is 11.00%, and the risk-free rate is 2.30%. Using CAPM equation, what is the required rate of return on the market? a. 9.37% b. 9.75% c. 9.47% d. 9.94% 13. Which of the following statements is CORRECT? a. An investor can eliminate virtually all market risk if he or she holds a very large and well diversified portfolio of stocks. b. The higher the correlation between the stocks in a portfolio, the lower the risk inherent in the portfolio c. Once a portfolio has about 40 stocks, adding additional stocks will not reduce its risk by even a small amount. d. An investor can eliminate virtually all diversifiable risk if he or she holds a very large, well- diversified portfolio of stocks. 14. Tom O'Brien has a 2-stock portfolio with a total value of $100,000. 562,500 is invested in Stock A with a beta of 0.75 and the remainder is invested in Stock B with a beta of 1.42. What is his portfolio's beta? Do not round your intermediate calculations. Round your final answer to 2 decimal places. a. 1.18 b.1.14 c. 1.04 d. 1.00 Morin Company's bonds mature in 8 years, have a par value of $1,000, and make an annual coupon nterest payment of $65. The market requires an interest rate of 7.5% on these bonds. What is the bond's rice? a. $1,073.23 b. $828.46 c. $1,082.64 d. $941.43 7. Malko Enterprises' bonds currently sell for $1,110. They have a 6-year maturity, an annual coupon of $75, and a par value of $1,000. What is their current yield? a. 6.76% b. 7.84% c. 5.07% d. 8.11% 8. Assume that you are considering the purchase of a 20-year, noncallable semiannual bond with an annual coupon rate of 9.5%. The bond has a face value of $1,000. If you require an 8.6% nominal yield to maturity on this investment, what is the price you should be willing to pay for the bond? a. $1,085.23 b. $1,269.71 c. $1,063.52 d. $1,106.93 9. Which of the following statements is CORRECT? a. All else equal, low-coupon bonds have less price risk than high-coupon bonds. b. All else equal, long-term bonds have less reinvestment risk than short-term bonds. c. All else equal, high-coupon bonds have less reinvestment risk than low-coupon bonds. d. All else equal, long-term bonds have less price risk than short-term bonds. 10. Dothan Inc.'s stock has a 25% chance of producing a 28% return, a 50% chance of producing a 12% return, and a 25% chance of producing a -18% return. What is the firm's expected rate of return? a. 8.50% b. 9.27% c. 6.63% d. 9.18%