Question

1.1 BELLA Ltds liquidity: A. Improved from 2018 to 2019 as measured by the acid test ratio. B. Deteriorated from 2018 to 2019 as measured

1.1 BELLA Ltds liquidity: A. Improved from 2018 to 2019 as measured by the acid test ratio. B. Deteriorated from 2018 to 2019 as measured by the acid test ratio. C. Remained the same from 2018 to 2019 as measured by the current ratio. D. Improved from 2018 to 2019 as measured by the current ratio.

1.2 BELLA Ltds profitability: A. Remained constant from 2018 to 2019 as measured by the gross profit margin. B. Worsened from 2018 to 2019 as measured by the net profit margin. C. Improved from 2018 to 2019 as measured by the gross profit margin. D. Improved from 2018 to 2019 as measured by the net profit margin

1.3 If the debtors collection period of BELLA Ltd. for 2018 was 62 days, and the credit policy of BELLA Ltd. is 60 days, which one of the following statements is true when taking the debtors collection period of 2019 into consideration? A. The debtors collection period improved from 2018 to 2019, which is also good for the cash flow of BELLA Ltd. B. The debtors collection period worsened from 2018 to 2019, which is also good for the cash flow of BELLA Ltd. C. The debtors collection period worsened from 2018 to 2019, which is also bad for the cash flow of BELLA Ltd. D. The debtors collection period improved from 2018 to 2019, which is also bad for the cash flow of BELLA Ltd.

1.4 What is the debtors collection period of BELLA Ltd. for 2019? A. 98,85 days B. 59,31 days C. 36,5 days D. 60,83 days

1.5 Which one of the following statements is true when analysing the debt/equity ratio of BELLA Ltd.? A. The debt/equity ratio worsened from 2018 to 2019, and BELLA Ltd. now has more debt than equity financing in 2019. B. The debt/equity ratio worsened from 2018 to 2019, but BELLA Ltd. still has less debt than equity financing in 2019. C. The debt/equity ratio improved from 2018 to 2019, and BELLA Ltd. now has less debt than equity financing in 2019. D. The debt/equity ratio improved from 2018 to 2019, but BELLA Ltd. still has more debt than equity financing in 2019.

1.6 If the inventory turnover rate of BELLA Ltd. for 2018 was 7 times per year, which one of the following statements is true when taking the 2019 inventory turnover rate into consideration? A. The inventory turnover rate increased from 2018 to 2019 which entails that inventory is moving faster in 2019 when compared to 2018. B. The inventory turnover rate increased from 2018 to 2019 which entails that inventory is moving slower in 2019 when compared to 2018. C. The inventory turnover rate decreased from 2018 to 2019 which entails that inventory is moving faster in 2019 when compared to 2018. D. The inventory turnover rate decreased from 2018 to 2019 which entails that inventory is moving slower in 2019 when compared to 2018.

1.7 Which one of the following statements is correct? A. BELLA Ltd. must close their doors as they are in serious financial distress. B. Although the net profit percentage of BELLA Ltd. decreased from 2018 to 2019, sales volumes doubled which attributed to more net profit in Rand value. C. BELLA Ltd. is in a better cash position in 2019 when compared to 2018. D. The decrease in BELLA Ltds gross profit percentage from 2018 to 2019 could be attributed in increased operating expenses.

1.8 When considering the trade payables (creditors) of BELLA Ltd., which one of the following statements would represent the correct effect in the cash flow statement of 2019? A. Cash inflow from operating activities of R5 000 000. B. Cash inflow from financing activities of R 5 000 000. C. Cash outflow from operating activities of R5 000 000. D. Cash outflow from financing activities of R5 000 000.

1.9 Which one of the following statements is correct? A. BELLA Ltd. had a positive cash flow of R20 000 000 for the year ending 2019. B. BELLA Ltd. had a negative cash flow of R20 000 000 for the year ending 2019. C. BELLA Ltd. had a positive cash flow of R5 000 000 for the year ending 2019. D. BELLA Ltd. had a negative cash flow of R5 000 000 for the year ending 2019.

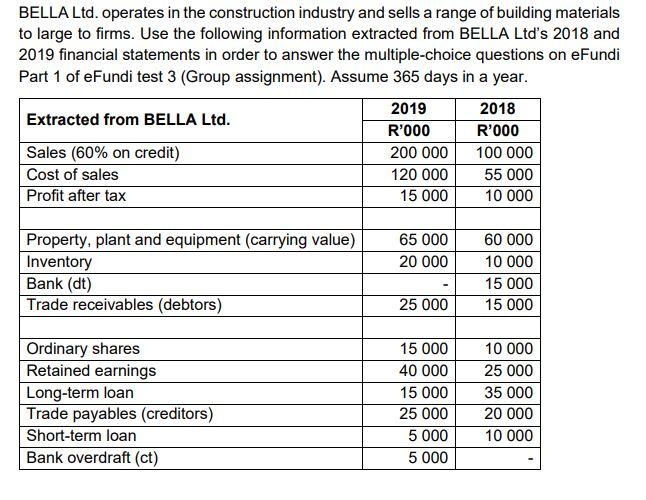

BELLA Ltd. operates in the construction industry and sells a range of building materials to large to firms. Use the following information extracted from BELLA Ltd's 2018 and 2019 financial statements in order to answer the multiple-choice questions on eFundi Part 1 of eFundi test 3 (Group assignment). Assume 365 days in a year. 2019 2018 Extracted from BELLA Ltd. R'000 R'000 Sales (60% on credit) 200 000 100 000 Cost of sales 120 000 55 000 Profit after tax 15 000 10 000 65 000 20 000 Property, plant and equipment (carrying value) Inventory Bank (dt) Trade receivables (debtors) 60 000 10 000 15 000 15 000 25 000 Ordinary shares Retained earnings Long-term loan Trade payables (creditors) Short-term loan Bank overdraft (ct) 15 000 40 000 15 000 25 000 5 000 5 000 10 000 25 000 35 000 20 000 10 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started