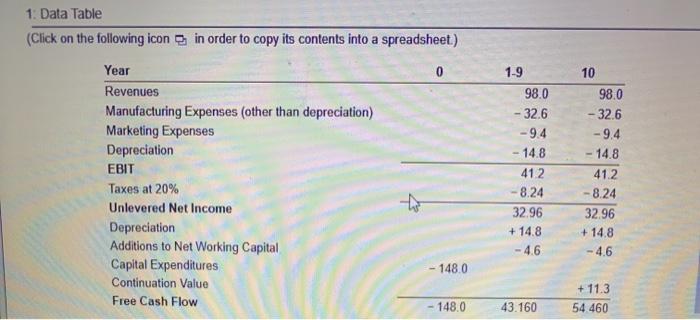

11 blauer dan tombi madh Mary Vating a proposal te buta land that will manufacture wights Bar plans to me and of capital of 119 to vse onderse has prepared the following in free cash flow in milions of dollars) for these and what is the NIV of the plant to make light bucha? 1. Bed on input from the marketing department Busincetan abesten fiecast in para managed to contine the serviety of the NPV to the reviews.comption What is the NPV pod 10% higher than forecast? What is the NV 10% ethaca c. Barthing that canh this project are constant management would be to explore the semivos analysis to pierwth in and operating expenses Special managed the to share and dating expenses are given in the for year and grow by 2 per year every year ring in Manhattan spinduces and therefore recen) on to working capital and continuation value remains tyd in the late What is the NPV ali pod under the audiendumfons? How does the NPV change the revenues and operating expenses grow by 5% porywany do caminte sve of this project to the contact with NV de docunt Crear with the docente on the ran and the Von the discounts ranging from 30% for what does the cheap NPV? a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? Print The NPV of the estimated free cash flow is $ million. (Round to two decimal places.) b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV if revenues are 10% lower than forecast? The NPV of the estimated free cash flow is $ million (Round to two decimal places.) The NPV of the estimated free cash flow is $ million (Round to two decimal places.) c. Rather than assuming that cash flows for this project are constant management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 2% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures (and therefore depreciation), additions to working capital, and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 5% per year rather than by 2%? The NPV of the estimated free cash flow is $ million (Round to two decimal places.) The NPV of the estimated free cash flow is 5 million (Round to two decimal places) d. To examine the sensitivity of this (base-case scenario) project to the discount rate, management would like to compute the NPV for different discount rates. Create a graph, with the discount rate on the x-axis and the NPV on the y-axis, for discount rates ranging from 5% to 30%. For what ranges of discount rates does the project have a positive NPV? The NPV is positive for discount rates below the IRR of % (Round to one decimal place.) 1. Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) 0 Year Revenues Manufacturing Expenses (other than depreciation) Marketing Expenses Depreciation EBIT Taxes at 20% Unlevered Net Income Depreciation Additions to Net Working Capital Capital Expenditures Continuation Value Free Cash Flow 1-9 98.0 - 32.6 -9.4 14.8 412 -8.24 32.96 + 14.8 - 4.6 10 98.0 - 32.6 -9.4 - 14.8 412 -8.24 32.96 + 14.8 -4.6 148.0 + 11.3 54 460 148.0 43 160 11 blauer dan tombi madh Mary Vating a proposal te buta land that will manufacture wights Bar plans to me and of capital of 119 to vse onderse has prepared the following in free cash flow in milions of dollars) for these and what is the NIV of the plant to make light bucha? 1. Bed on input from the marketing department Busincetan abesten fiecast in para managed to contine the serviety of the NPV to the reviews.comption What is the NPV pod 10% higher than forecast? What is the NV 10% ethaca c. Barthing that canh this project are constant management would be to explore the semivos analysis to pierwth in and operating expenses Special managed the to share and dating expenses are given in the for year and grow by 2 per year every year ring in Manhattan spinduces and therefore recen) on to working capital and continuation value remains tyd in the late What is the NPV ali pod under the audiendumfons? How does the NPV change the revenues and operating expenses grow by 5% porywany do caminte sve of this project to the contact with NV de docunt Crear with the docente on the ran and the Von the discounts ranging from 30% for what does the cheap NPV? a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? Print The NPV of the estimated free cash flow is $ million. (Round to two decimal places.) b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV if revenues are 10% lower than forecast? The NPV of the estimated free cash flow is $ million (Round to two decimal places.) The NPV of the estimated free cash flow is $ million (Round to two decimal places.) c. Rather than assuming that cash flows for this project are constant management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 2% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures (and therefore depreciation), additions to working capital, and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 5% per year rather than by 2%? The NPV of the estimated free cash flow is $ million (Round to two decimal places.) The NPV of the estimated free cash flow is 5 million (Round to two decimal places) d. To examine the sensitivity of this (base-case scenario) project to the discount rate, management would like to compute the NPV for different discount rates. Create a graph, with the discount rate on the x-axis and the NPV on the y-axis, for discount rates ranging from 5% to 30%. For what ranges of discount rates does the project have a positive NPV? The NPV is positive for discount rates below the IRR of % (Round to one decimal place.) 1. Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) 0 Year Revenues Manufacturing Expenses (other than depreciation) Marketing Expenses Depreciation EBIT Taxes at 20% Unlevered Net Income Depreciation Additions to Net Working Capital Capital Expenditures Continuation Value Free Cash Flow 1-9 98.0 - 32.6 -9.4 14.8 412 -8.24 32.96 + 14.8 - 4.6 10 98.0 - 32.6 -9.4 - 14.8 412 -8.24 32.96 + 14.8 -4.6 148.0 + 11.3 54 460 148.0 43 160