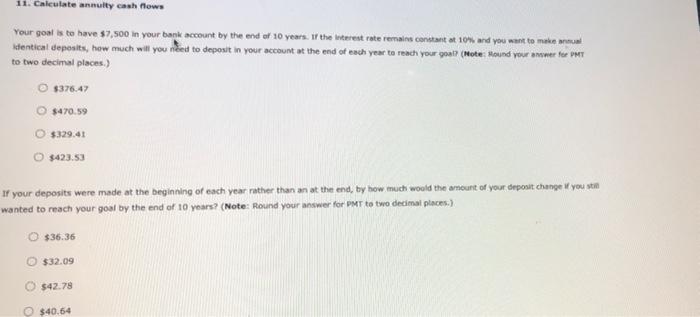

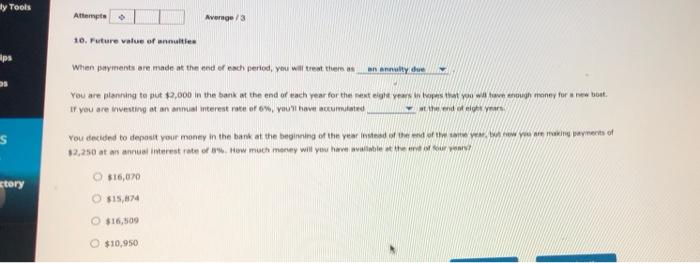

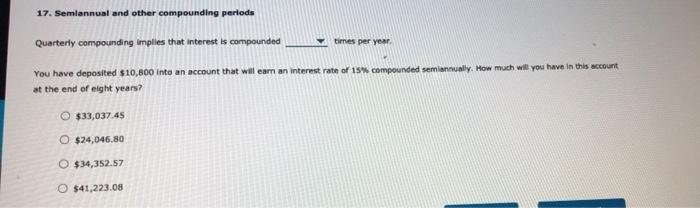

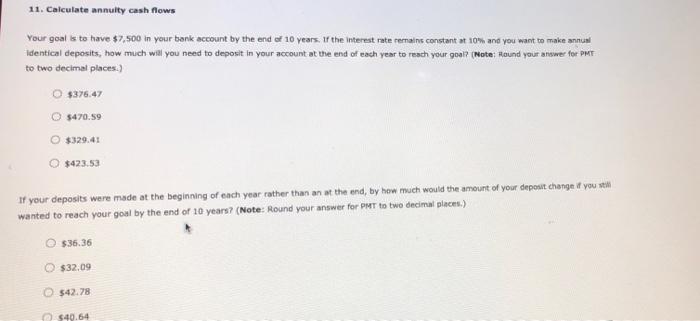

11. Calculate annuity cash flows Your goal is to have $7,500 in your bank account by the end of 10 years. If the interest rate remains constant at 10% and you want to make Identical deposits, how much will you need to deposit in your account at the end of each year to reach your goal? (Mote: Round your answer to PMT to two decimal places.) $376.47 $470.59 $329.41 $423.53 If your deposits were made at the beginning of each year rather than an at the end, by how much would the amount of your deponit change you stin wanted to reach your goal by the end of 10 years? (Note: Round your answer for PMT to two decimal places.) $36.36 $32.09 $42.78 $40.64 y Tools Attempts Average/3 10. Future value of annuities ps When payments are made at the end of each period, you will treat them as an analty.de You are planning to put $2,000 in the bank at the end of each year for the next eight years tropes at you was have enough enoney for new tout If you are investing at an annual interest rate of 6%, You have accumulated end of s You decided to deposit your money in the bank at the beginning of the year instead of the end of the wees of 12,250 at an annual interest ratesHow much money will you have wallable $16,070 story $15,874 $16,500 $10.950 17. Semiannual and other compounding periods Quarterly compounding implies that interest is compounded y times per year. You have deposited $10,800 into an account that will eam an interest rate of 15% compounded semiannually. How much will you have in this account at the end of eight years? O $33,037.45 O $24,046.80 O $34,352.57 O $41,223.08 11. Calculate annuity cash flows Your goal is to have $7,500 in your bank account by the end of 10 years. If the interest rate remains constant at 10% and you want to make annum identical deposits, how much will you need to deposit in your account at the end of each year to reach your goal? (Note: Hound your answer for PME to two decimal places) $376.47 $470.59 $329.41 $423.53 If your deposits were made at the beginning of each year rather than anat the end, by how much would the amount of your deposit change if you still wanted to reach your goal by the end of 10 years? (Note: Round your answer for PMT to two decimal places.) e $36.36 $32.09 $42.78 $40.64