Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.1 Calculate the Net Present Value for both the Oil Fryers. Show all your calculations as marks may be awarded for this. 1.2 Calculate the

1.1 Calculate the Net Present Value for both the Oil Fryers. Show all your calculations as marks may be awarded for this.

1.2 Calculate the payback period for both the Oil Fryers.

1.3 Based on your previous analyses (1.1. and 1.2), advise what machine you would purchase.

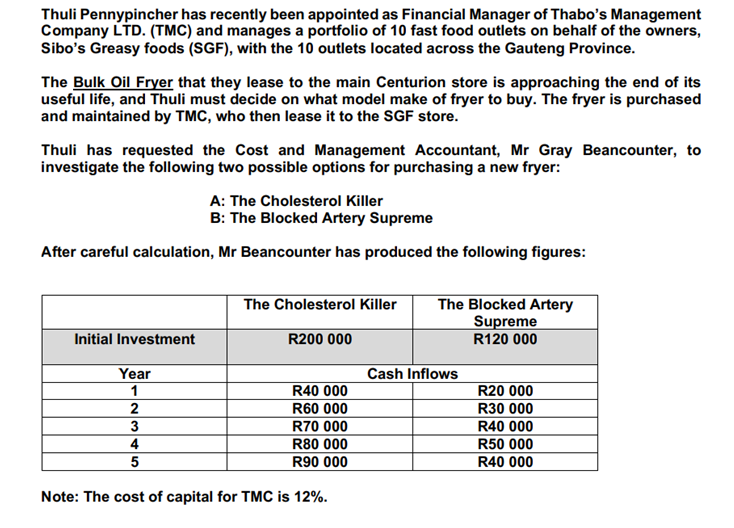

Thuli Pennypincher has recently been appointed as Financial Manager of Thabo's Management Company LTD. (TMC) and manages a portfolio of 10 fast food outlets on behalf of the owners, Sibo's Greasy foods (SGF), with the 10 outlets located across the Gauteng Province. The Bulk Oil Fryer that they lease to the main Centurion store is approaching the end of its useful life, and Thuli must decide on what model make of fryer to buy. The fryer is purchased and maintained by TMC, who then lease it to the SGF store. Thuli has requested the Cost and Management Accountant, Mr Gray Beancounter, to investigate the following two possible options for purchasing a new fryer: A: The Cholesterol Killer B: The Blocked Artery Supreme After careful calculation, Mr Beancounter has produced the following figures: Note: The cost of capital for TMC is 12%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started