Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11 calculating the cash budget 12 sources and uses c. Compute the cash collections from sales for eacn mum 11. Calculating the Cash Budget Here

11 calculating the cash budget

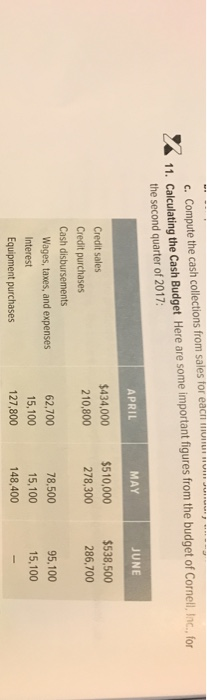

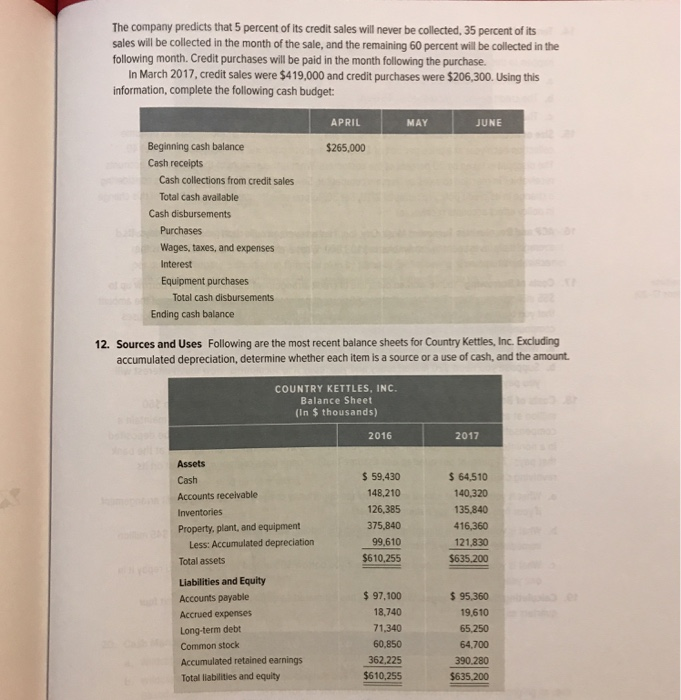

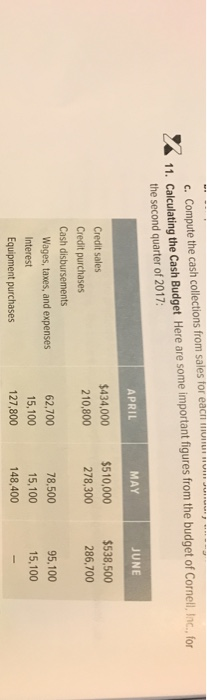

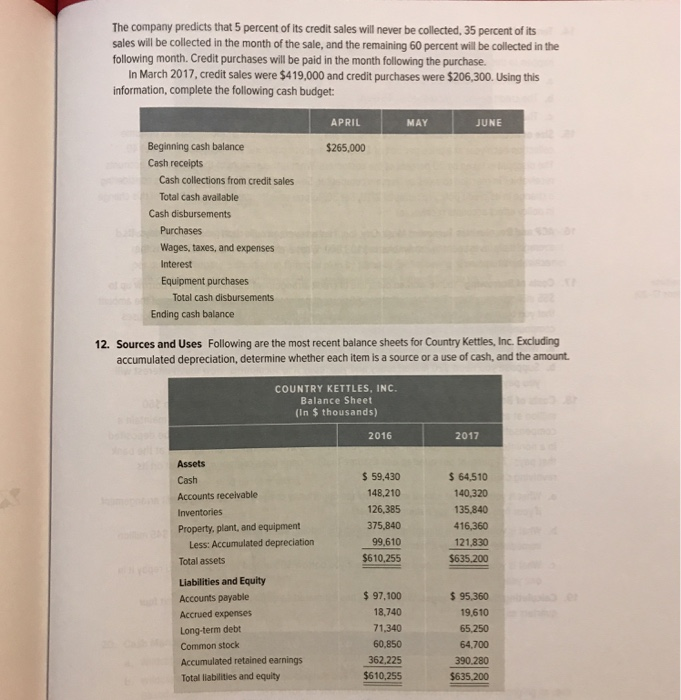

c. Compute the cash collections from sales for eacn mum 11. Calculating the Cash Budget Here are some important figures from the budget of Cornell.Inc, forn the second quarter of 2017 APRIL MAY JUNE Credit sales Credit purchases Cash disbursements $434,000 210,800 $510,000$538,500 286,700 278,300 Wages, taxes, and expenses Interest Equipment purchases 62,700 15,100 127,800 78,500 15,100 148,400 95.100 15,100 The company predicts that 5 percent of its credit sales will never be collected, 35 percent of its sales will be collected in the month of the sale, and the remaining 60 percent will be collected in the following month. Credit purchases will be paid in the month following the purchase. In March 2017, credit sales were $419,000 and credit purchases were $206,300 Using this information, complete the following cash budget: APRIL MAY JUNE Beginning cash balance Cash receipts $265,000 Cash collections from credit sales Total cash available Cash disbursements Purchases Wages, taxes, and expenses Interest Equipment purchases Total cash disbursements Ending cash balance 12. Sources and Uses Following are the most recent balance sheets for Country Kettles, Inc. xcluding accumulated depreciation, determine whether each item is a source or a use of cash, and the amount COUNTRY KETTLES, INC. Balance Sheet (In $ thousands) 2016 2017 Assets Cash Accounts receivable Inventories Property, plant, and equipment $59.430 148,210 126,385 375,840 99,610 $610,255 64,510 140.320 135,840 416,360 121,830 $635.200 Less: Accumulated depreciation Total assets Liabilities and Equity Accounts payable Accrued expenses Long-term debt Common stock Accumulated retained earnings Total liabilities and equity $ 97,100 18,740 71,340 60,850 362,225 $610,255 $ 95,360 19,610 65,250 64,700 390.280 $635.200 12 sources and uses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started