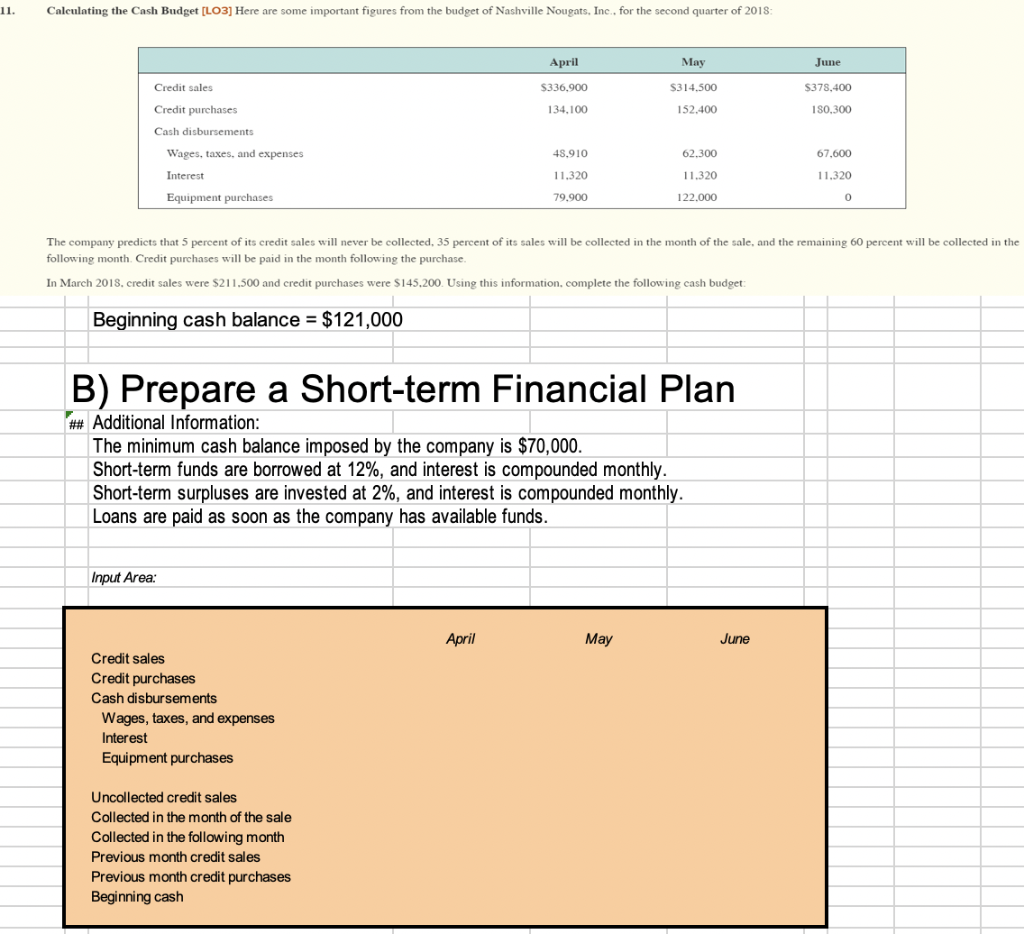

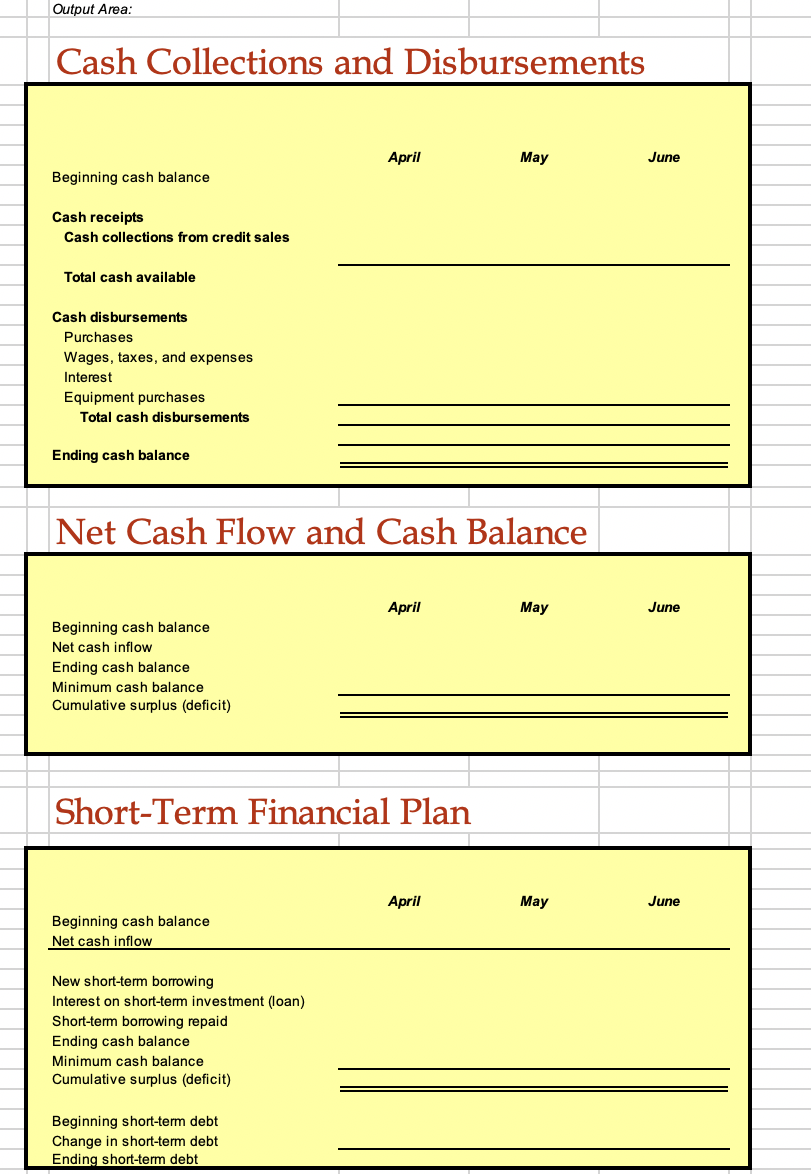

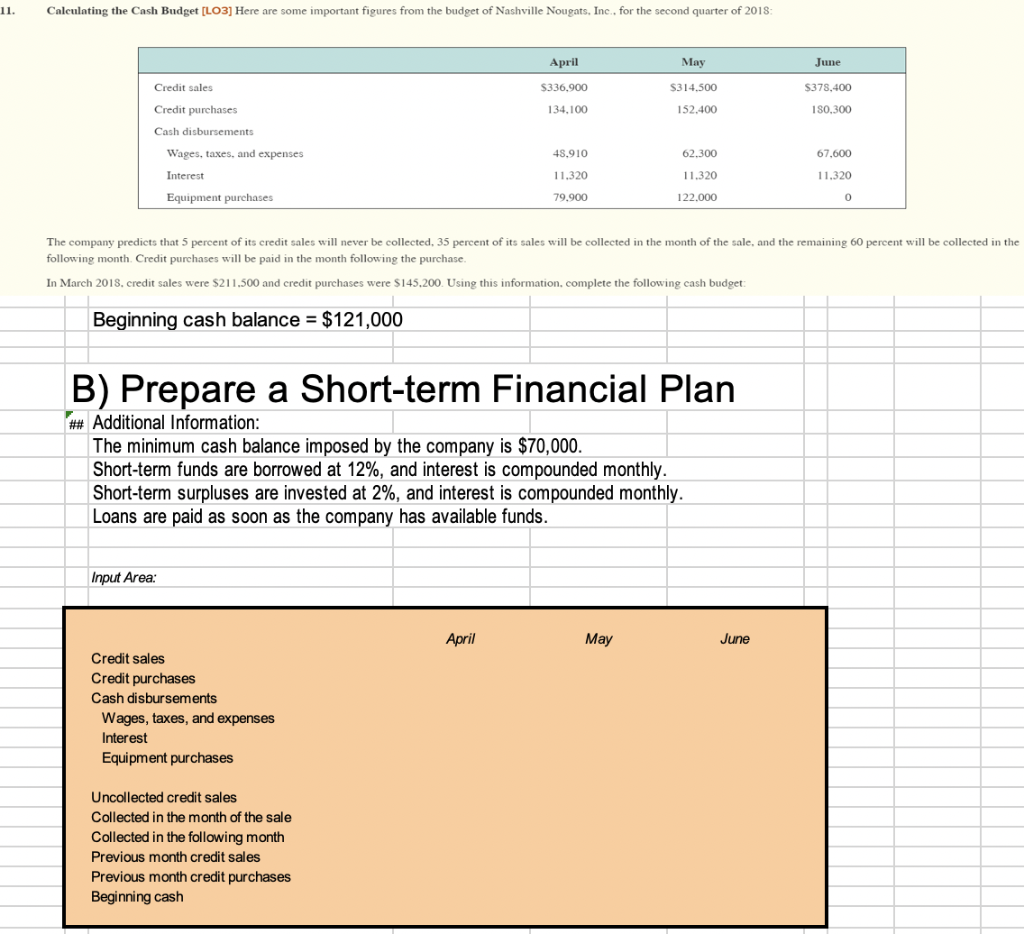

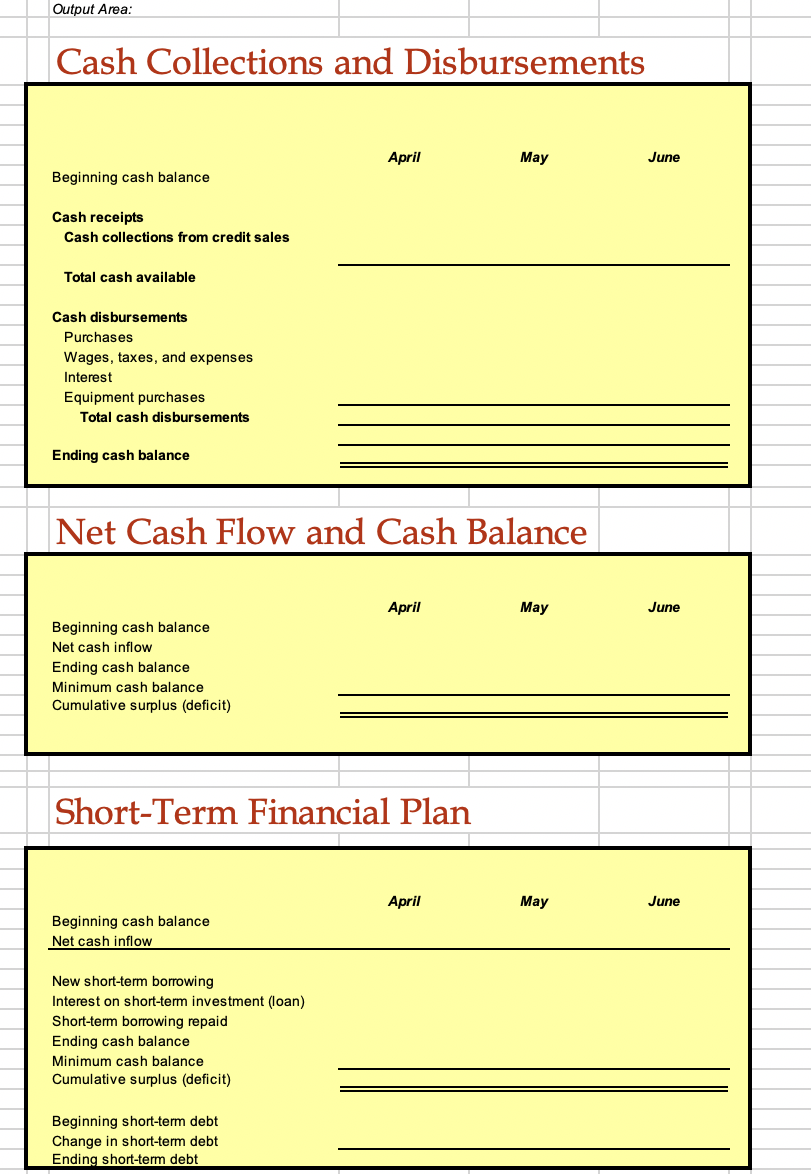

11. Calculating the Cash Budget [LO3] Here are some important figures from the budget of Nashville Nougats, Inc., for the second quarter of 2018 April May June Credit sales $336,900 S314.500 $378,400 134,100 152.400 180,300 Credit purchases Cash disbursements Wages, taxes, and expenses Interest Equipment purchases 48.910 62.300 67.600 11,320 11.320 11,320 79.900 122.000 0 The company predicts that 5 percent of its credit sales will never be collected, 35 percent of its sales will be collected in the month of the sale, and the remaining 60 percent will be collected in the following month Credit purchases will be paid in the month following the purchase. In March 2018. credit sales were $211.500 and credit purchases were $145.200 Using this information, complete the following cash budget Beginning cash balance = $121,000 B) Prepare a Short-term Financial Plan ## Additional Information: The minimum cash balance imposed by the company is $70,000. Short-term funds are borrowed at 12%, and interest is compounded monthly. Short-term surpluses are invested at 2%, and interest is compounded monthly. Loans are paid as soon as the company has available funds. Input Area: April May June Credit sales Credit purchases Cash disbursements Wages, taxes, and expenses Interest Equipment purchases Uncollected credit sales Collected in the month of the sale Collected in the following month Previous month credit sales Previous month credit purchases Beginning cash Output Area: Cash Collections and Disbursements April May June Beginning cash balance Cash receipts Cash collections from credit sales Total cash available Cash disbursements Purchases Wages, taxes, and expenses Interest Equipment purchases Total cash disbursements Ending cash balance Net Cash Flow and Cash Balance April May June Beginning cash balance Net cash inflow Ending cash balance Minimum cash balance Cumulative surplus (deficit) Short-Term Financial Plan April May June Beginning cash balance Net cash inflow New short-term borrowing Interest on short-term investment (loan) Short-term borrowing repaid Ending cash balance Minimum cash balance Cumulative surplus (deficit) Beginning short-term debt Change in short-term debt Ending short-term debt 11. Calculating the Cash Budget [LO3] Here are some important figures from the budget of Nashville Nougats, Inc., for the second quarter of 2018 April May June Credit sales $336,900 S314.500 $378,400 134,100 152.400 180,300 Credit purchases Cash disbursements Wages, taxes, and expenses Interest Equipment purchases 48.910 62.300 67.600 11,320 11.320 11,320 79.900 122.000 0 The company predicts that 5 percent of its credit sales will never be collected, 35 percent of its sales will be collected in the month of the sale, and the remaining 60 percent will be collected in the following month Credit purchases will be paid in the month following the purchase. In March 2018. credit sales were $211.500 and credit purchases were $145.200 Using this information, complete the following cash budget Beginning cash balance = $121,000 B) Prepare a Short-term Financial Plan ## Additional Information: The minimum cash balance imposed by the company is $70,000. Short-term funds are borrowed at 12%, and interest is compounded monthly. Short-term surpluses are invested at 2%, and interest is compounded monthly. Loans are paid as soon as the company has available funds. Input Area: April May June Credit sales Credit purchases Cash disbursements Wages, taxes, and expenses Interest Equipment purchases Uncollected credit sales Collected in the month of the sale Collected in the following month Previous month credit sales Previous month credit purchases Beginning cash Output Area: Cash Collections and Disbursements April May June Beginning cash balance Cash receipts Cash collections from credit sales Total cash available Cash disbursements Purchases Wages, taxes, and expenses Interest Equipment purchases Total cash disbursements Ending cash balance Net Cash Flow and Cash Balance April May June Beginning cash balance Net cash inflow Ending cash balance Minimum cash balance Cumulative surplus (deficit) Short-Term Financial Plan April May June Beginning cash balance Net cash inflow New short-term borrowing Interest on short-term investment (loan) Short-term borrowing repaid Ending cash balance Minimum cash balance Cumulative surplus (deficit) Beginning short-term debt Change in short-term debt Ending short-term debt