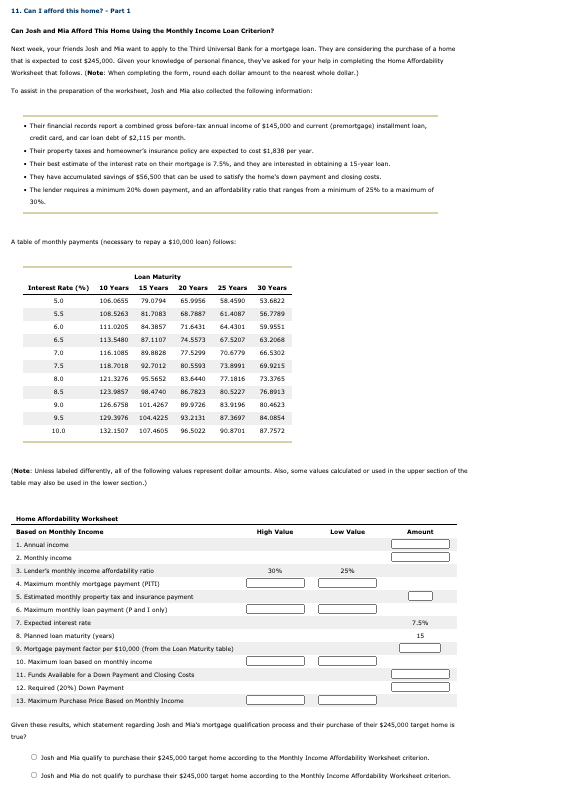

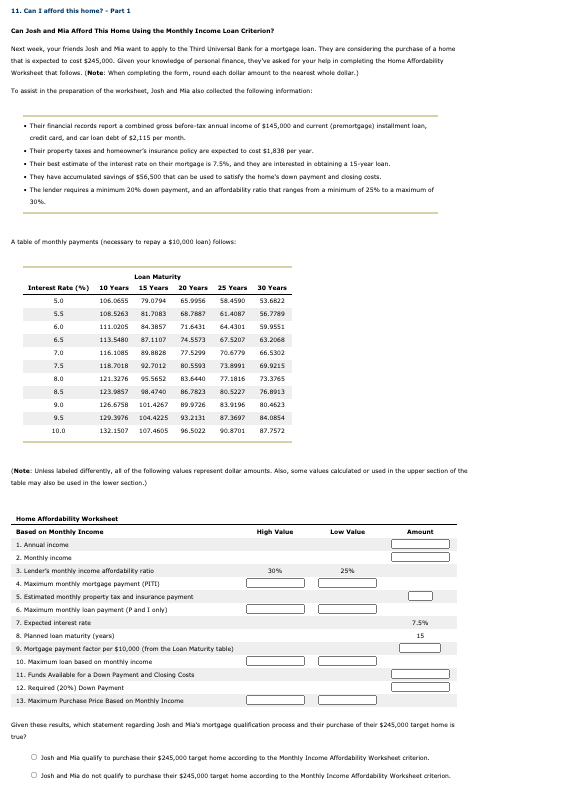

11. Can 1 affora this home? = Part 1 Can Josh and Mia Afford This Heme Using the Menthly Ineome Loan Criterion? Next week, your friends Jesh and Ma want to apply to the Third universal Bank for a mertgape loan. They are esnsidering the purcharse of a hente that di expected to cust $245,000. Civen your knowiedge of persenal finarice, they've asked for your help in eonpieting the Hame Affordabiaity Worksheet thac folewsi. (Wote: When esmpleting the form, round each dollar artiount to the nearest whole dolar.) To amsist. in the preparation ef the morkshest, dush and Mialso eslected the following information: - Their francial records report a cambired griws before-tan annual income ef $145,000 and current \{premrtgage) ifsialiment loan, crodit card, and car loan debt of $2,115 per month. - Their property taxis and honteowner's ifsurance policy are expected to cost $1,838 per year. - Their best estimate of the interest rate en their morteage is 7.5%, and they are interested in obtaning a 15 year lean. - They have accumulated sarvingor of \$56,500 that can be used to satisfy the honer's dem payment and elasing cesta. - The lender requires a minimum 20% domn payment, and an affordabilty racio that ranges frem a minimum of 25% to a manimum of A table of menthly parymenta (fecessary to repary a $10,000 isan) fellsws: (Nete: Lniess labeled differentiy, al of the foltowing values represent dolar amsunts. Abo, some values calculated er used in the upper section of the cable may also be used in the lawer section. Given these results, which statement regarding Jselh and Ma's mortgage qualfication process and their purchase of their $245,000 target hame is true? Jush and Mia qualfy to purchawe their $245,000 target hame acoording to the Monthly Income afferdability worksinees triterian. Jush and Mia do nst qualify to purchase their $245,000 target honte ascording to the Mankhiy Inceme Affordability Wrarksheat ariterion. 11. Can 1 affora this home? = Part 1 Can Josh and Mia Afford This Heme Using the Menthly Ineome Loan Criterion? Next week, your friends Jesh and Ma want to apply to the Third universal Bank for a mertgape loan. They are esnsidering the purcharse of a hente that di expected to cust $245,000. Civen your knowiedge of persenal finarice, they've asked for your help in eonpieting the Hame Affordabiaity Worksheet thac folewsi. (Wote: When esmpleting the form, round each dollar artiount to the nearest whole dolar.) To amsist. in the preparation ef the morkshest, dush and Mialso eslected the following information: - Their francial records report a cambired griws before-tan annual income ef $145,000 and current \{premrtgage) ifsialiment loan, crodit card, and car loan debt of $2,115 per month. - Their property taxis and honteowner's ifsurance policy are expected to cost $1,838 per year. - Their best estimate of the interest rate en their morteage is 7.5%, and they are interested in obtaning a 15 year lean. - They have accumulated sarvingor of \$56,500 that can be used to satisfy the honer's dem payment and elasing cesta. - The lender requires a minimum 20% domn payment, and an affordabilty racio that ranges frem a minimum of 25% to a manimum of A table of menthly parymenta (fecessary to repary a $10,000 isan) fellsws: (Nete: Lniess labeled differentiy, al of the foltowing values represent dolar amsunts. Abo, some values calculated er used in the upper section of the cable may also be used in the lawer section. Given these results, which statement regarding Jselh and Ma's mortgage qualfication process and their purchase of their $245,000 target hame is true? Jush and Mia qualfy to purchawe their $245,000 target hame acoording to the Monthly Income afferdability worksinees triterian. Jush and Mia do nst qualify to purchase their $245,000 target honte ascording to the Mankhiy Inceme Affordability Wrarksheat ariterion