Answered step by step

Verified Expert Solution

Question

1 Approved Answer

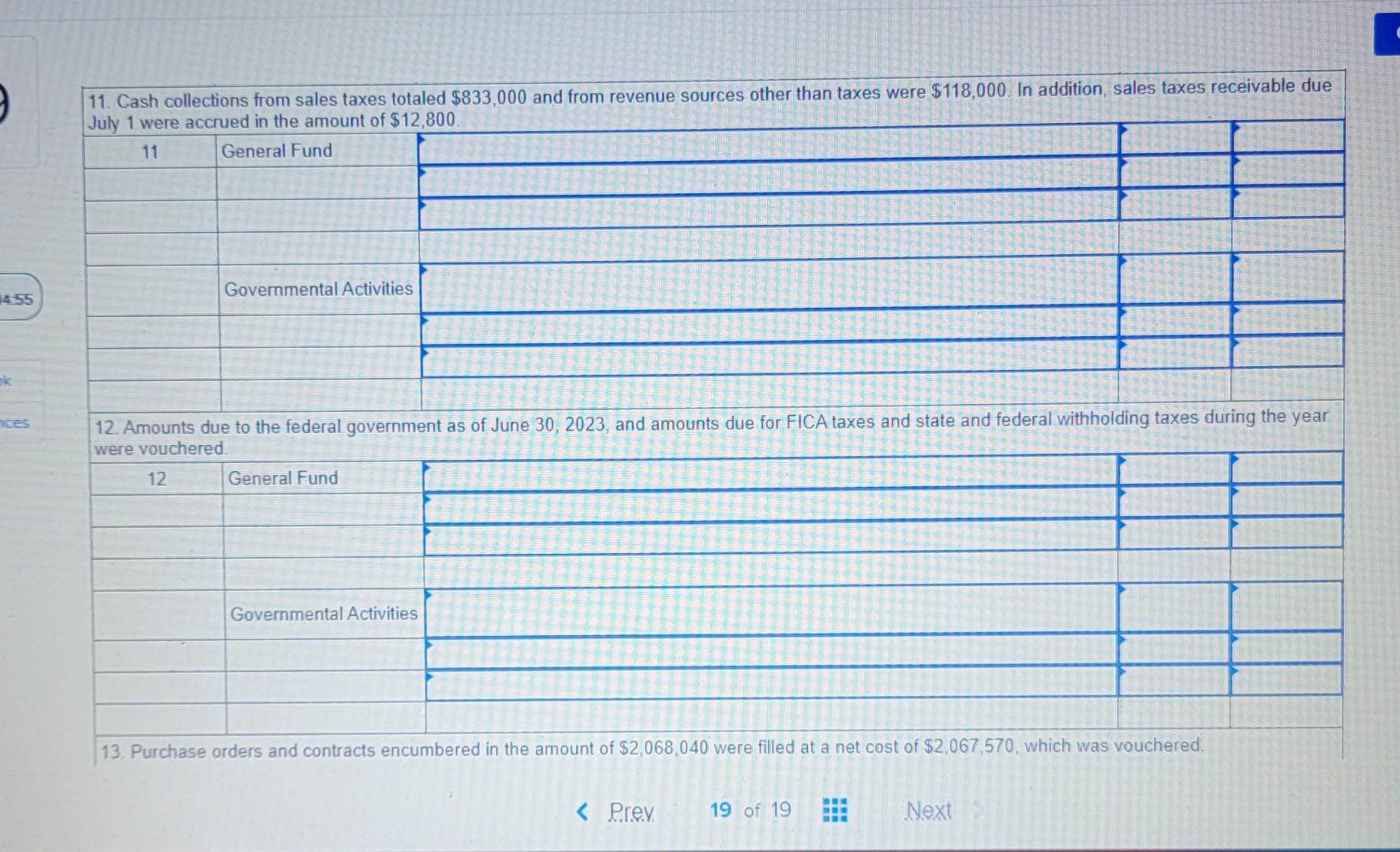

11. Cash collections from sales taxes totaled $833,000 and from revenue sources other than taxes were $118,000. In addition, sales taxes receivable due July 1

11. Cash collections from sales taxes totaled $833,000 and from revenue sources other than taxes were $118,000. In addition, sales taxes receivable due July 1 were accrued in the amount of $12,800. 12. Amounts due to the federal government as of June 30,2023, and amounts due for FICA taxes and state and federal withholding taxes during the year were vouchered. 13. Purchase orders and contracts encumbered in the amount of $2,068,040 were filled at a net cost of $2,067,570, which was vouchered. 11. Cash collections from sales taxes totaled $833,000 and from revenue sources other than taxes were $118,000. In addition, sales taxes receivable due July 1 were accrued in the amount of $12,800. 12. Amounts due to the federal government as of June 30,2023, and amounts due for FICA taxes and state and federal withholding taxes during the year were vouchered. 13. Purchase orders and contracts encumbered in the amount of $2,068,040 were filled at a net cost of $2,067,570, which was vouchered

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started