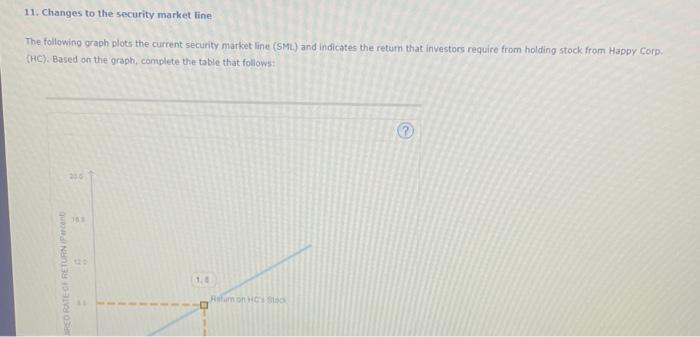

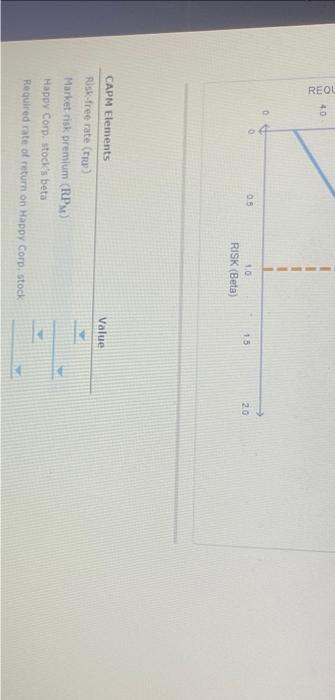

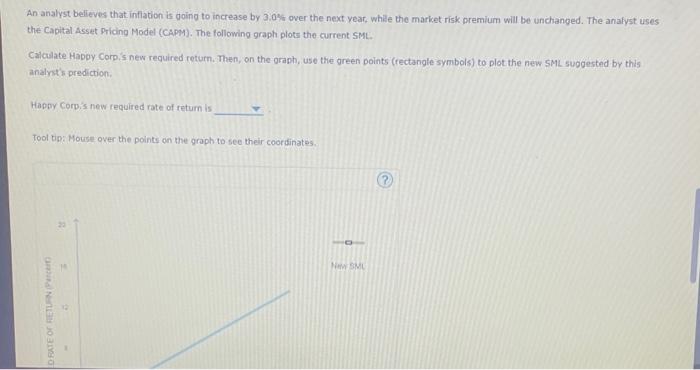

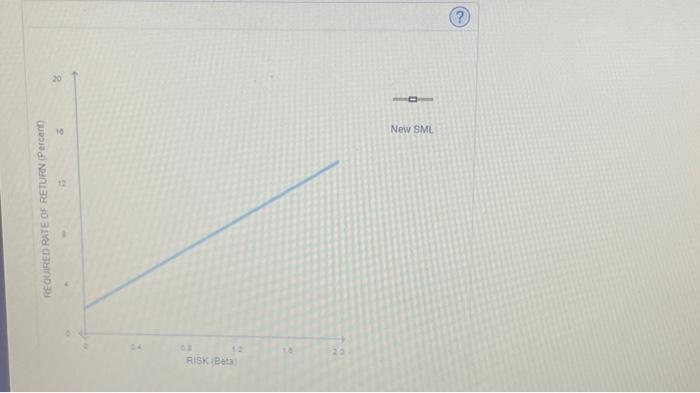

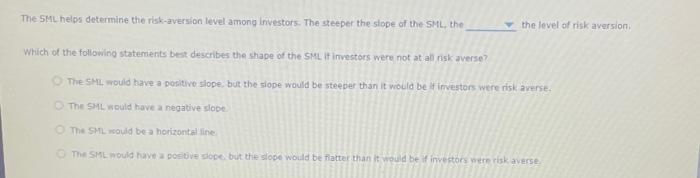

11. Changes to the security market line The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC). Based on the graph, complete the table that follows: An analyst believes that inflation is poing to increase by 3.0% over the next year, while the market risk premium will be unchanged. The anafyst uses the Canital Aceut priding Moded (cams). The fotfowing graph plots the current SML. Calculate Happy Corpis new required return. Then, on the oraph, use the green points (rectangle symbols) to plot the new sML suggested by this analrst's prediction. Happr Corpis new required rate of retum is Tool tip: House over the points on the graph to see their coordinates. The SML helps determine the risk-aversion level among investors. The steeper the slape of the SML, the the level of risk aversion, Which of the following statements best describes the shape of the SML if investors were not at ali risk averse? The SMIL mould bave a positive slope, but the siope would be steeper this it would be if irvestors were risk averse. The shi would be horizontal line 11. Changes to the security market line The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC). Based on the graph, complete the table that follows: An analyst believes that inflation is poing to increase by 3.0% over the next year, while the market risk premium will be unchanged. The anafyst uses the Canital Aceut priding Moded (cams). The fotfowing graph plots the current SML. Calculate Happy Corpis new required return. Then, on the oraph, use the green points (rectangle symbols) to plot the new sML suggested by this analrst's prediction. Happr Corpis new required rate of retum is Tool tip: House over the points on the graph to see their coordinates. The SML helps determine the risk-aversion level among investors. The steeper the slape of the SML, the the level of risk aversion, Which of the following statements best describes the shape of the SML if investors were not at ali risk averse? The SMIL mould bave a positive slope, but the siope would be steeper this it would be if irvestors were risk averse. The shi would be horizontal line