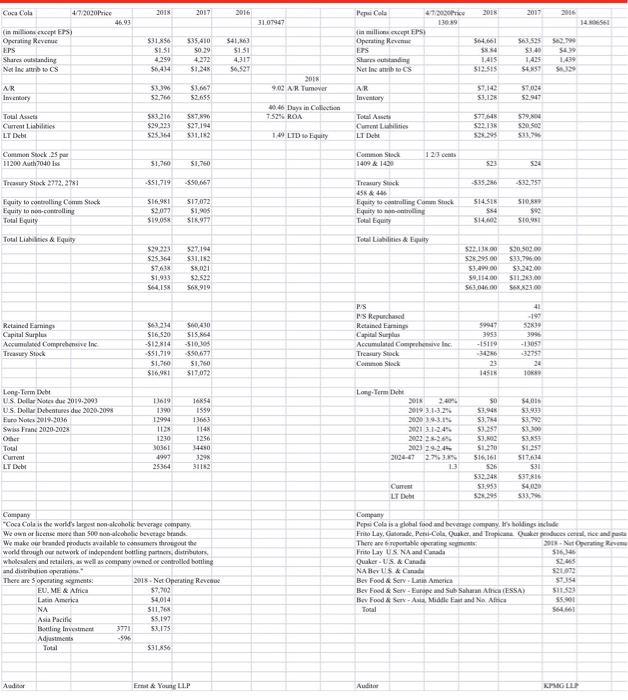

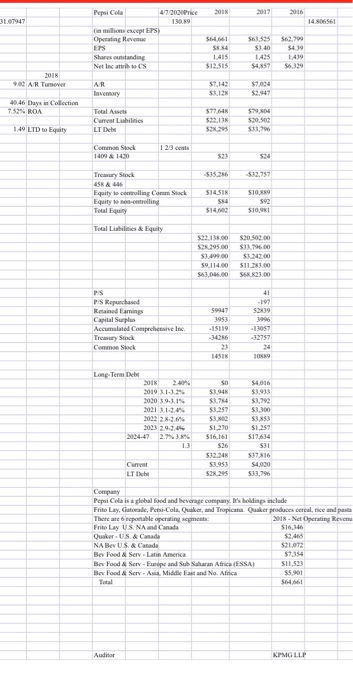

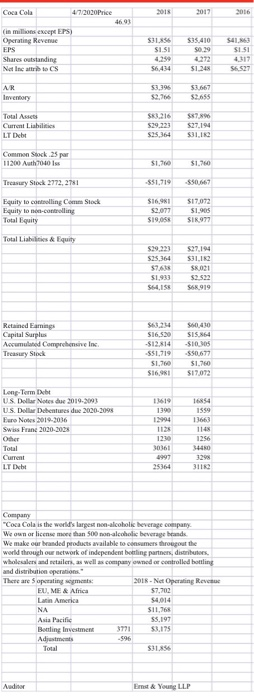

11. Coke: Tot Debt ________+Tot EQ to Com. _______+ Tot EQ to non Cont______= TA $83,216

12. Pepsi : Tot Debt ________+Tot EQ to Com. _______+ Tot EQ to non Cont______= TA $77,648

13. Coke : FY2018 Current Debt = _______% of Total Debt, LTDebt = _______% of Total Debt.

14. Pepsi : FY2018 Current Debt = _______% of Total Debt, LTDebt = _______% of Total De

2018 2017 2016 Pepa Cola 2018 2017 31.07947 130.9 14 Coca Cola 472020 Price 4693 (in millions except) Operating Revenue EPS Shares outstanding Net Incrocs $31.56 SI.SI 4.30 $6414 $63.525 $340 $35,410 $0.29 4272 S1.248 in millions scept EPS Operating Race EPS Shures standing Net Inc bocs $41,863 $1.SI 4,317 $6.527 $64.661 SX4 1.415 $12.515 $ 143 S485 S. $2.766 2015 9.02 AR Tumor AR Inventory $7.142 53.12 $2.655 $2.949 AR Inventory Total Assets Current Liabilities LTDb 10.46 Days in Collection 7.52% ROA $83.216 5.29.223 $25.367 $87.896 527,194 $31.12 Total Assets Current Les LT Date 57764 $22,13 SON 579.00 San SI 149 LTD Equity Common Stock 25 11200 Auth7040 Iss Comme Stock 1409 & 1430 51.700 $1.760 Treasury Stack 2772, 2781 -$51,719 -S$0,667 -$35.286 -58253 Equity to controlling CommStack Equity tone-controlling Total liquity $14.SI $16,931 $2.072 $19.058 Treasury Stock 458 & 445 Equity to controlling Cow Stack Equity to montrolling Total Equity $17,072 $1.2015 SIK 977 SIR Se S10 $14.000 Total Lib & Equity Total Lities & Equity 525364 57.638 $1,933 564158 52,194 $31,182 SK.021 $2.522 566919 $22.138.00 200 52.295.00 $33.796.00 S100 $12000 $9,114.00 SIIS 563,046,00 56% 23.00 Retained aming Capital Surplus Accumulated Comprehensive Inc Trasy Stock S430 SI5.864 -S10305 PS PS Repurchased Retained Earning Capital Susplus Accumulated Comprehensive Inc Treasury Stock Come Stock 59947 3953 -15119 -190 5230 399 -1105 $63214 $16.520 SI2814 -551,719 51.760 $16.981 S1,150 $17,072 14518 10 16854 1559 13663 Long Term Date 2018 2019 3.1.3.2% 2009.15 Long-Term Ibe US Dollar Notes de 2019-2003 U.S. Dollar Debentures due 2020-2098 Euro Notes 2019-2036 Swiss Franc 2020-2024 Other Total Current LT Debt 13619 1390 12994 1123 1230 30361 1997 25364 1256 34450 SO $3.945 53, $3.57 53,00 S1.270 $16161 526 $32.34 $3.953 $26.295 $4.018 $3.933 53 St 53S SI 253 SIA 531 $37. $4020 31182 1.3 Cum LT Debt Company "Coca Cola is the world's largest alcoholk beverage company We own or license meee than 500 non-alcoholic beverage brands We make our branded products wailable to consumers thropout the world through our network of independent bottling partners, distributors wholesalers and retailers, as well as company owned or controlled bottling and distribution operation. There are operating symets 2018. Net Operating Revenue EU, ME & Africa $7.202 Latin America $4.014 NA $11.768 Asia Pacific $5,197 Bottling Investment 3771 SUITS Adjustments Total $31.856 Company Pepsi Cola is a global food and beverage company. It's holdings include Frito Lay, Gatoradie. Perso-Cola Quaker, and Tropicana Quaker produces cereals and pasta There are reportable paratingements 2018. Reven Frito Lay US NA and Canada Quaker US & Canada $2.05 NA BUS & Canada $21.072 Bev Food & Serv - Latin America 57.354 Bev Food & Serv - Europe and SubSaharan Africa (ESSA) $11.923 Bev Food & Serv-Asia Middle East and Ne Africa SS.901 Total Audio Ernst & Young LLP Auditor Pepsi Cola 2018 2017 2016 31947 4/7/2020 Price 130.00 in millions except Operating Reven Share outstanding Net Inc attitos $8.54 1.415 $12515 $65 $1.40 14 $4,57 $410 1439 S619 2015 902 AR Tumover AR Bemary 57.142 5.12 $7,034 40.46 Days in Collection 75 ROA STAN Total Assets Current Liabilities LTD 5794 530.00 $316 1:49 LTD Equity Come Stock 1409 & 1430 Trey Stock $35.286 $32.757 SIASIS Equity to cling Comm Stock Equity locating Total Equity SIO 592 $10.95 514 Total L & Equity $22,135.00 $28.295.00 $3,499.00 59.114.00 563,056.00 $20.502.00 SI76.00 S4700 $113100 568 23.00 41 -197 PS PS Repurchased Retained Emin Capital Surplus Accumulated Comprehensive in Trey Stock Com 59947 3953 -15119 -34286 23 -13057 24 Long Terme 2019 3020 30.3.1% 30239.24 14-47 1.3 SO $3.945 $3.74 53357 $3.00 SI 20 $16.161 5.26 $32.34 $3.953 5229 $4,016 $3933 $3.92 S100 $3.53 SI 357 $ 14 531 51716 $4,020 533,796 Current LTD Company Pepsi Cola is a global food and beverage company. It's holdings include Frito Lay, Gateade, Peti-Cola Quiker, and Tropicana Quaker produces cercal, rice and paste There are reportable operating seperti 2018. Net Operating Revem Frito Lay US. NA and Canada $16.146 Quaker US & Canada NA BE US & Canada $21.972 Be Food & Sery. Latin America 57.354 Be Food & Serv - Europe and SubSaharan Africa (ESSA) S11,523 Be Food & Serv - Middle East and No Africa $5,901 Total 564661 Auditor KPMG LLP SOS 2017 2016 Coca Cola 4/72020 Price 4693 (in millions creep EPS) Operating Revenue EPS Shares outstanding Net Inc attrib tocs SI 5 42 56,414 $35.410 S029 4272 $1.34 S41.63 SISI 41 $3.396 AR Inventory 53.667 $2655 Total Asset Current Liabilities LT Debt $63.216 $29.223 $25,364 $7.96 $27.194 $31.12 Common Stock 25 par 11200 Auth7040 Iss $1. $1.760 Treasury Stack 2772, 2731 -$51.919 S50667 Equity to controlling Com Stock Equity to non-controlling Total Equity $16,91 $2.079 $19,056 $17,072 $1,905 SIR 972 Total Lisbes & Equity $29,223 $25,364 57 418 $1933 56415 $7.194 $31.1 SR.021 S232 S6919 Retained Earnings Capital Surplus Accumulated Comprehensive in Trasy Stock S16,520 -$12.814 -551,719 $1,60 $16.981 S6040 SIS.864 SIO 105 S80677 $1.700 $17.072 1390 I904 1654 1559 1366 Long-Term Ibe US Dollar Notes de 2019-2093 US Dollar Debentures due 2020-2098 Euro Notes 2019-2036 Swiss Franc 2020-2025 Other Total Current LTD 1256 1230 30361 1997 25364 3298 3118 Company "Coca Cola is the world's largest non-alcoholic beverage company We own or license mere than 500 non-alcoholic beverage hands We make our branded products wailable to consumers thropout the world through our network of independent berling partners, distributors wholesales and retailers, as well as company owned or controlled battling and distribution operation There are operating syments 2018. Net Operating Revenue , & Africa 57,202 Latin America $4.014 NA SI1.765 Asia Pacific 55,197 Banting Investment 3771 53.175 Adjustmes -596 Total Andiner Ernst & Young LLP