Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11. Dividend reinvestment plans Dividend reinvestment plans (DRIPs) allow shareholders to reinvest their dividends in the company itself by purchasing additional shares rather than being

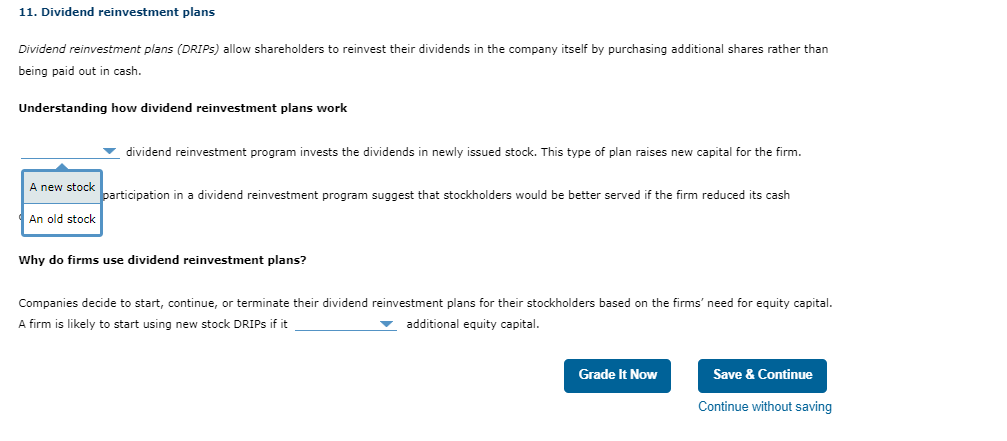

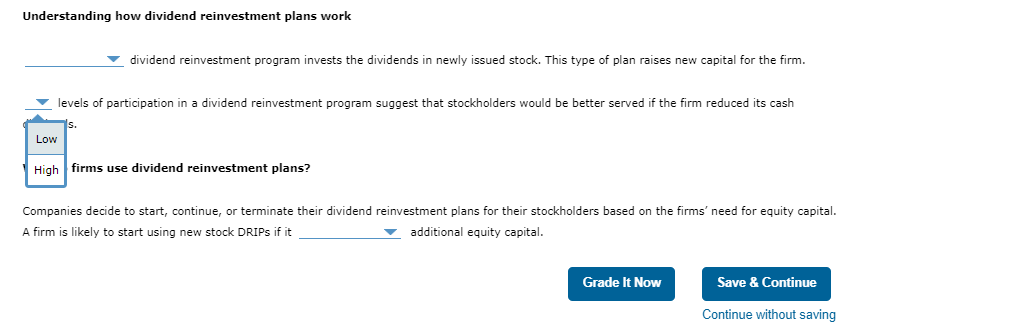

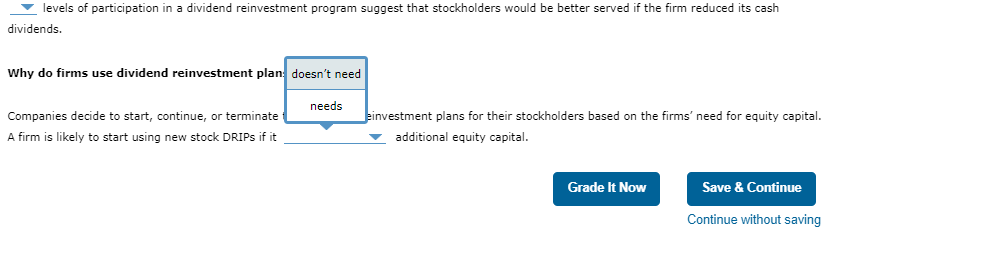

11. Dividend reinvestment plans Dividend reinvestment plans (DRIPs) allow shareholders to reinvest their dividends in the company itself by purchasing additional shares rather than being paid out in cash. Understanding how dividend reinvestment plans work dividend reinvestment program invests the dividends in newly issued stock. This type of plan raises new capital for the firm. A new stock participation in a dividend reinvestment program suggest that stockholders would be better served if the firm reduced its cash An old stock Why do firms use dividend reinvestment plans? Companies decide to start, continue, or terminate their dividend reinvestment plans for their stockholders based on the firms' need for equity capital. A firm is likely to start using new stock DRIPs if it additional equity capital. Continue without saving Understanding how dividend reinvestment plans work [- dividend reinvestment program invests the dividends in newly issued stock. This type of plan raises new capital for the firm. levels of participation in a dividend reinvestment program suggest that stockholders would be better served if the firm reduced its cash s. Low High firms use dividend reinvestment plans? Companies decide to start, continue, or terminate their dividend reinvestment plans for their stockholders based on the firms' need for equity capital. A firm is likely to start using new stock DRIPs if it additional equity capital. Continue without saving levels of participation in a dividend reinvestment program suggest that stockholders would be better served if the firm reduced its cash dividends. Why do firms use dividend reinvestment plan doesn't need Companies decide to start, continue, or terminate einvestment plans for their stockholders based on the firms' need for equity capital. A firm is likely to start using new stock DRIPs if it _ additional equity capital. Continue without saving

11. Dividend reinvestment plans Dividend reinvestment plans (DRIPs) allow shareholders to reinvest their dividends in the company itself by purchasing additional shares rather than being paid out in cash. Understanding how dividend reinvestment plans work dividend reinvestment program invests the dividends in newly issued stock. This type of plan raises new capital for the firm. A new stock participation in a dividend reinvestment program suggest that stockholders would be better served if the firm reduced its cash An old stock Why do firms use dividend reinvestment plans? Companies decide to start, continue, or terminate their dividend reinvestment plans for their stockholders based on the firms' need for equity capital. A firm is likely to start using new stock DRIPs if it additional equity capital. Continue without saving Understanding how dividend reinvestment plans work [- dividend reinvestment program invests the dividends in newly issued stock. This type of plan raises new capital for the firm. levels of participation in a dividend reinvestment program suggest that stockholders would be better served if the firm reduced its cash s. Low High firms use dividend reinvestment plans? Companies decide to start, continue, or terminate their dividend reinvestment plans for their stockholders based on the firms' need for equity capital. A firm is likely to start using new stock DRIPs if it additional equity capital. Continue without saving levels of participation in a dividend reinvestment program suggest that stockholders would be better served if the firm reduced its cash dividends. Why do firms use dividend reinvestment plan doesn't need Companies decide to start, continue, or terminate einvestment plans for their stockholders based on the firms' need for equity capital. A firm is likely to start using new stock DRIPs if it _ additional equity capital. Continue without saving Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started