Question

1.1 Draw up a memorandum in which you evaluate the companys results for GEMs board of directors. The analysis should include the calculation of ratios

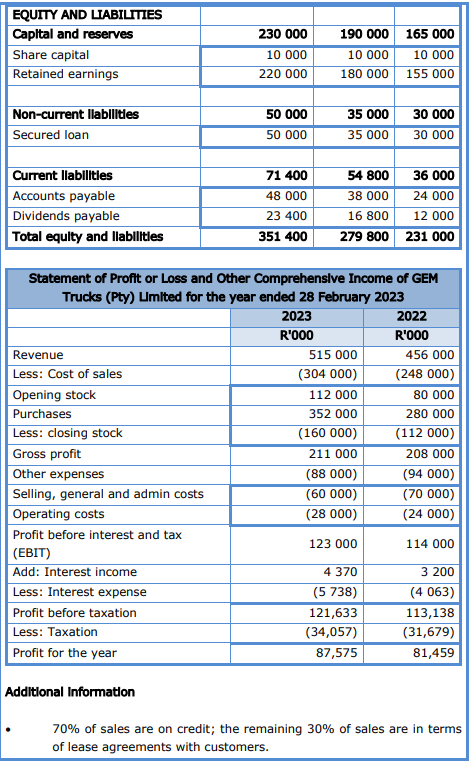

1.1 Draw up a memorandum in which you evaluate the companys results for GEMs board of directors. The analysis should include the calculation of ratios and comprehensive commentary on the following essential elements for 2022 and 2023: Efficiency of the working capital cycle (three ratios) Debt/gearing (two ratios based on book values) Profitability (three ratios). Note: with the efficiency ratios do work with average debtors, stock and creditors figures. (25)

1.2 Assume it is decided to raise additional equity capital via the issue of new shares (to fund the purchase of three new machines) rather than debt. Using the dividend valuation method, determine the current price per GEM share that would be used as a base to determine the issue price of new shares and how many new shares would need to be issued. Note: work to 2 decimal places. (7)

Also, suggest practical ways in which this new capital could be raised and relevant considerations in the process. (6)

1.3 Assuming the debt was chosen, explain the considerations relating to raising debt to fund the three new machines. rework the solvency ratios in your response. Also, be sure to apply your response specifically to the case with examples and references to workings you have done or chose to do herein. (14)

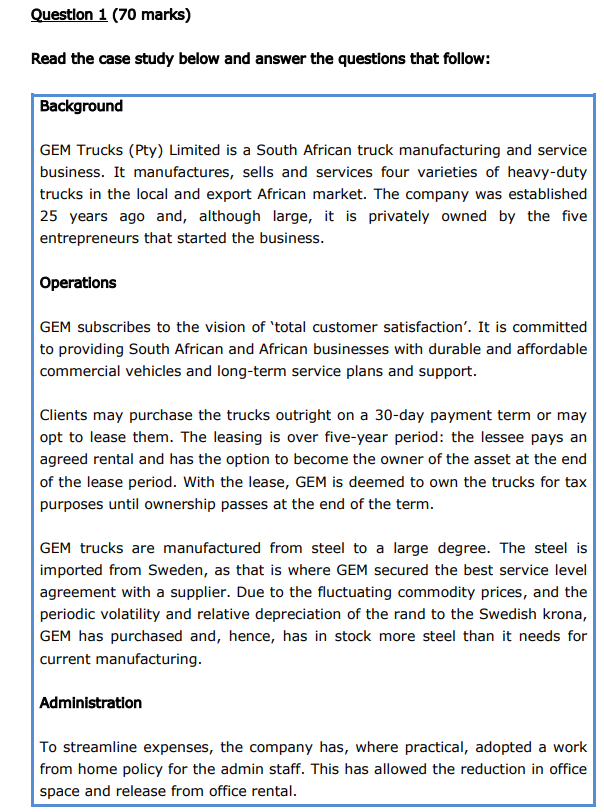

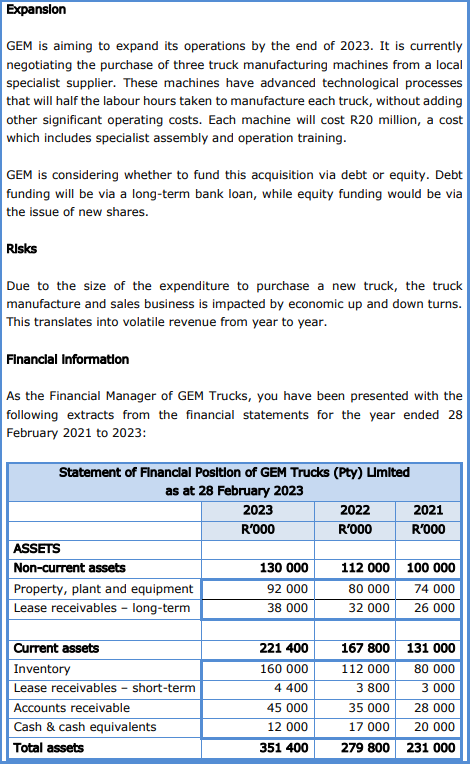

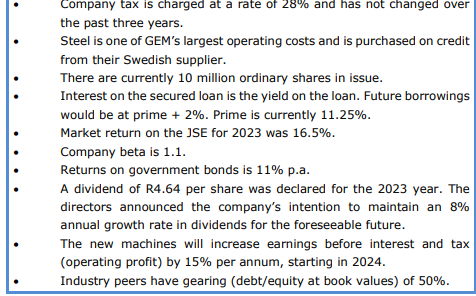

Additional Information - \quad70 of sales are on credit; the remaining \30 of sales are in terms of lease agreements with customers. Read the case study below and answer the questions that follow: Background GEM Trucks (Pty) Limited is a South African truck manufacturing and service business. It manufactures, sells and services four varieties of heavy-duty trucks in the local and export African market. The company was established 25 years ago and, although large, it is privately owned by the five entrepreneurs that started the business. Operations GEM subscribes to the vision of 'total customer satisfaction'. It is committed to providing South African and African businesses with durable and affordable commercial vehicles and long-term service plans and support. Clients may purchase the trucks outright on a 30-day payment term or may opt to lease them. The leasing is over five-year period: the lessee pays an agreed rental and has the option to become the owner of the asset at the end of the lease period. With the lease, GEM is deemed to own the trucks for tax purposes until ownership passes at the end of the term. GEM trucks are manufactured from steel to a large degree. The steel is imported from Sweden, as that is where GEM secured the best service level agreement with a supplier. Due to the fluctuating commodity prices, and the periodic volatility and relative depreciation of the rand to the Swedish krona, GEM has purchased and, hence, has in stock more steel than it needs for current manufacturing. Administration To streamline expenses, the company has, where practical, adopted a work from home policy for the admin staff. This has allowed the reduction in office space and release from office rental. GEM is aiming to expand its operations by the end of 2023 . It is currently negotiating the purchase of three truck manufacturing machines from a local specialist supplier. These machines have advanced technological processes that will half the labour hours taken to manufacture each truck, without adding other significant operating costs. Each machine will cost R20 million, a cost which includes specialist assembly and operation training. GEM is considering whether to fund this acquisition via debt or equity. Debt funding will be via a long-term bank loan, while equity funding would be via the issue of new shares. Risks Due to the size of the expenditure to purchase a new truck, the truck manufacture and sales business is impacted by economic up and down turns. This translates into volatile revenue from year to year. Financial Information As the Financial Manager of GEM Trucks, you have been presented with the following extracts from the financial statements for the year ended 28 February 2021 to 2023 : Company tax is charged at a rate of \28 and has not changed over the past three years. Steel is one of GEM's largest operating costs and is purchased on credit from their Swedish supplier. There are currently 10 million ordinary shares in issue. Interest on the secured loan is the yield on the loan. Future borrowings would be at prime \+2. Prime is currently \11.25. Market return on the JSE for 2023 was \16.5. Company beta is 1.1 . Returns on government bonds is \11 p.a. A dividend of R4.64 per share was declared for the 2023 year. The directors announced the company's intention to maintain an \8 annual growth rate in dividends for the foreseeable future. The new machines will increase earnings before interest and tax (operating profit) by \15 per annum, starting in 2024. Industry peers have gearing (debt/equity at book values) of \50Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started