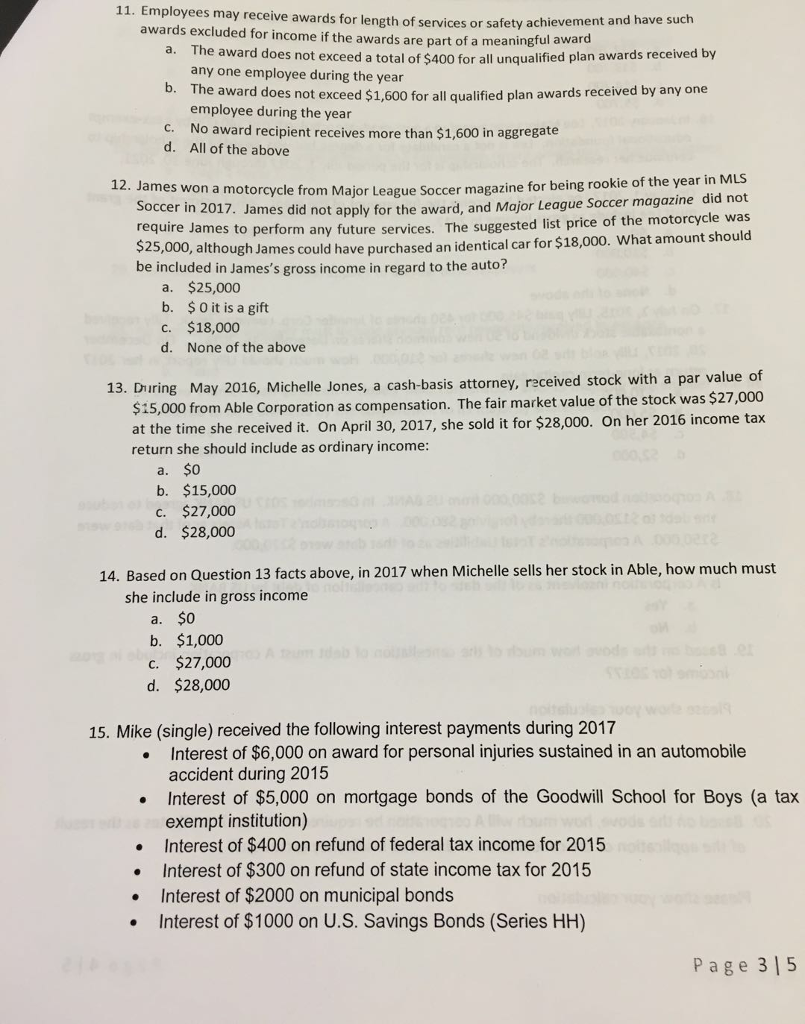

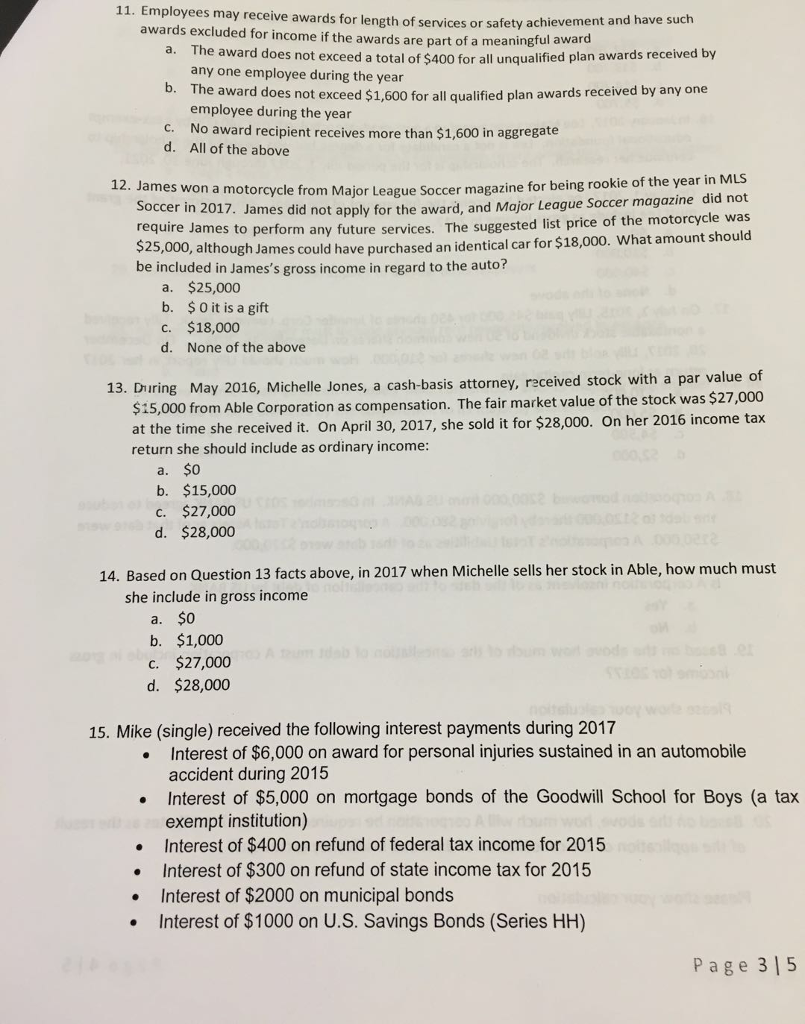

11. Employees may receive awards for length of services or safety achieve ment and have s awards excluded for income if the awards are part of a meani ngful award tal of $400 for all unqualified plan awards received by a. The award does not exceed a tot any one employee during the year b. Th e award does not exceed $1,600 for all qualified plan awards received by any one employee during the year C. d. No award recipient receives more than $1,600 in aggregate All of the above MLS award, and Major League Soccer magazine did not to perform any future services. The suggested list price of the motorcycle was ough James could have purchased an identical car for $18,000. What amount should 12. James won a motorcycle from Major League Soccer magazine f James did not apply for the or being rookie of the year in Soccer in 2017. require Jam $25,000, be included in James's gross income in regard to the auto? es alth a. b. c. d. $25,000 $0 it is a gift $18,000 None of the above h a par value of 13. During May 2016, Michelle Jones, a cash-basis attorney, received stock wit $15,000 at the time she received it. On April 30, 2017, she sold it for return she should include as ordinary income orporation as compensation. The fair market value of the stock was $27,000 $28,000. On her 2016 income tax from Able C b. $15,000 c. $27,000 d. $28,000 14. Based on Question 13 facts above, in 2017 when Michelle sells her stock in Able, how much must she include in gross income b. $1,000 c. $27,000 d. $28,000 15. Mike (single) received the following interest payments during 2017 Interest of $6,000 on award for personal injuries sustained in an automobile accident during 2015 Interest of $5,000 on mortgage bonds of the Goodwill School for Boys (a tax exempt institution) Interest of $400 on refund of federal tax income for 2015 Interest of $300 on refund of state income tax for 2015 Interest of $2000 on municipal bonds . Interest of $1000 on U.S. Savings Bonds (Series HH) Page 315