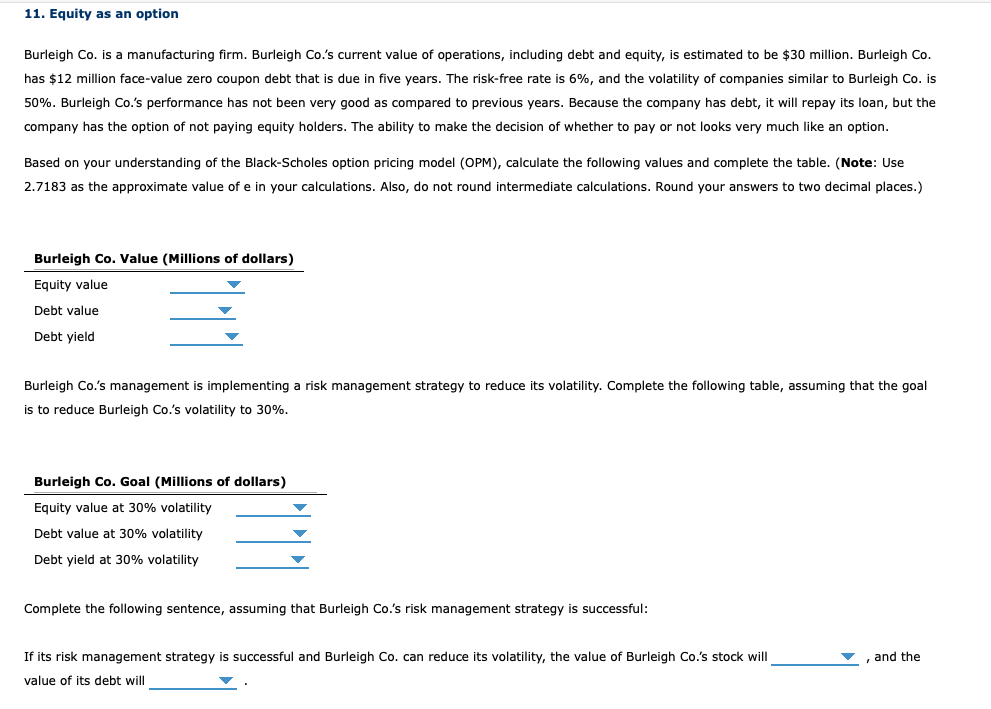

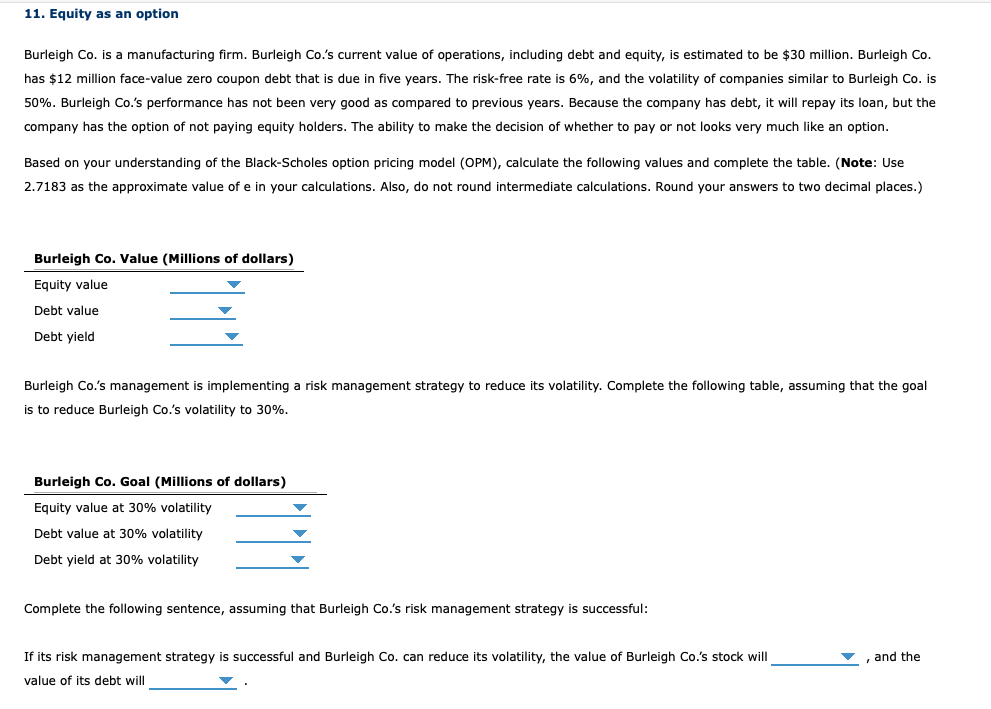

11. Equity as an option Burleigh Co. is a manufacturing firm. Burleigh Co.'s current value of operations, including debt and equity, is estimated to be $30 million. Burleigh Co. has $12 million face-value zero coupon debt that is due in five years. The risk-free rate is 6%, and the volatility of companies similar to Burleigh Co. is 50%. Burleigh Co.'s performance has not been very good as compared to previous years. Because the company has debt, it will repay its loan, but the company has the option of not paying equity holders. The ability to make the decision of whether to pay or not looks very much like an option. Based on your understanding of the Black-Scholes option pricing model (OPM), calculate the following values and complete the table. (Note: Use 2.7183 as the approximate value of e in your calculations. Also, do not round intermediate calculations. Round your answers to two decimal places.) Burleigh Co. Value (Millions of dollars) Equity value Debt value Debt yield Burleigh Co.'s management is implementing a risk management strategy to reduce its volatility. Complete the following table, assuming that the goal is to reduce Burleigh Co.'s volatility to 30%. Burleigh Co. Goal (Millions of dollars) Equity value at 30% volatility Debt value at 30% volatility Debt yield at 30% volatility Complete the following sentence, assuming that Burleigh Co.'s risk management strategy is successful: , and the If its risk management strategy is successful and Burleigh Co. can reduce its volatility, the value of Burleigh Co.'s stock will value of its debt will 11. Equity as an option Burleigh Co. is a manufacturing firm. Burleigh Co.'s current value of operations, including debt and equity, is estimated to be $30 million. Burleigh Co. has $12 million face-value zero coupon debt that is due in five years. The risk-free rate is 6%, and the volatility of companies similar to Burleigh Co. is 50%. Burleigh Co.'s performance has not been very good as compared to previous years. Because the company has debt, it will repay its loan, but the company has the option of not paying equity holders. The ability to make the decision of whether to pay or not looks very much like an option. Based on your understanding of the Black-Scholes option pricing model (OPM), calculate the following values and complete the table. (Note: Use 2.7183 as the approximate value of e in your calculations. Also, do not round intermediate calculations. Round your answers to two decimal places.) Burleigh Co. Value (Millions of dollars) Equity value Debt value Debt yield Burleigh Co.'s management is implementing a risk management strategy to reduce its volatility. Complete the following table, assuming that the goal is to reduce Burleigh Co.'s volatility to 30%. Burleigh Co. Goal (Millions of dollars) Equity value at 30% volatility Debt value at 30% volatility Debt yield at 30% volatility Complete the following sentence, assuming that Burleigh Co.'s risk management strategy is successful: , and the If its risk management strategy is successful and Burleigh Co. can reduce its volatility, the value of Burleigh Co.'s stock will value of its debt will