Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#11 Hank started a new business, Hank's Donut World (HW for short), in June of lost year. He has requested your advice on the following

#11

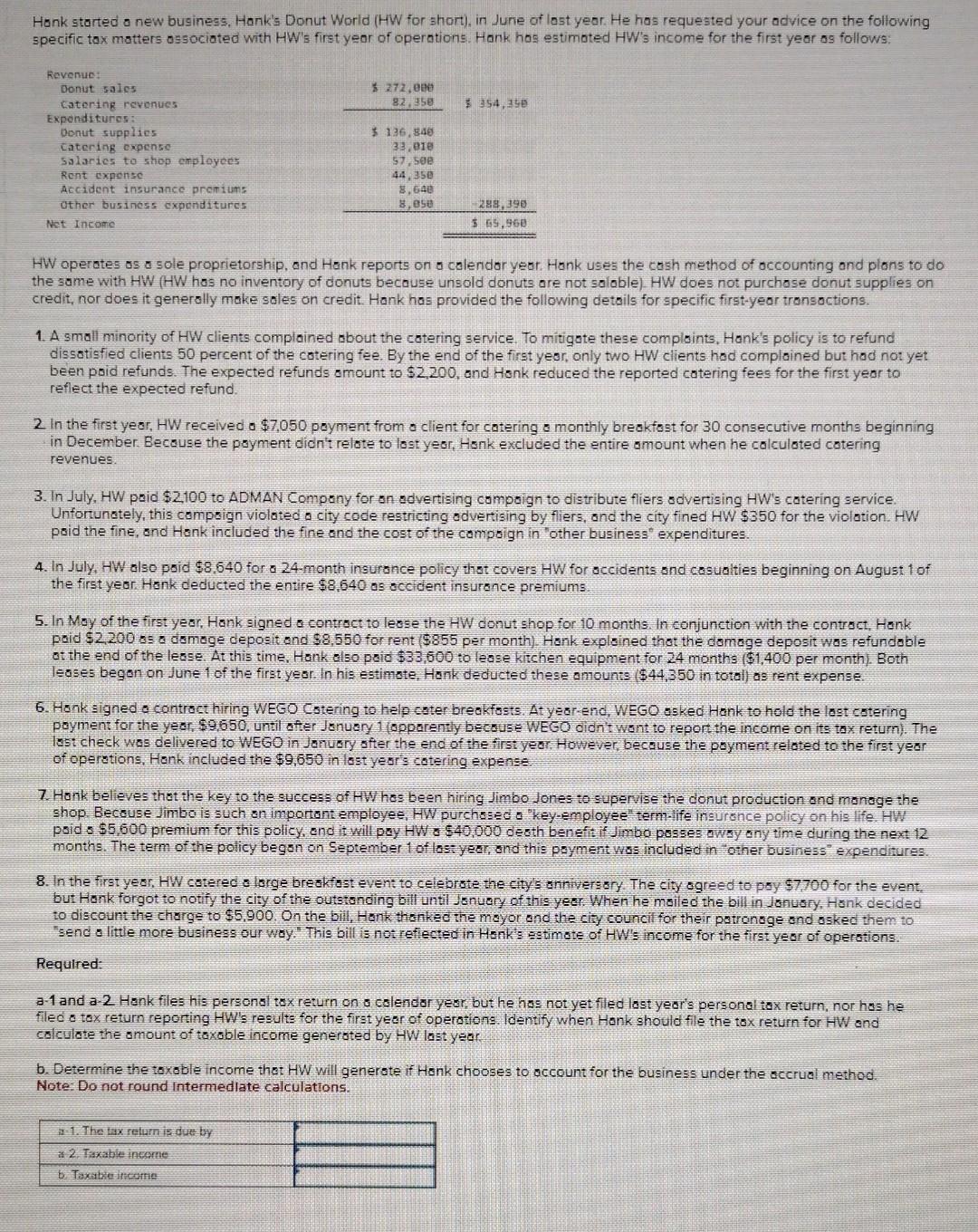

Hank started a new business, Hank's Donut World (HW for short), in June of lost year. He has requested your advice on the following specific tox matters ossociated with HW's first year of operotions. Hank hos estimoted HW's income for the first year as follows: HW operates as a sole proprietorship, and Hank reports on o calendor year. Hank uses the cash method of accounting and plons to do the same with HW (HW hos no inventory of donuts because unsold donuts are not solable). HW does not purchase donut supplies on credit, nor does it generolly make soles on credit. Hank has provided the following details for specific first-year tronsoctions. 1. A small minority of HW clients complained obout the cotering service. To mitigate these complaints, Hank's policy is to refund dissotisfied clients 50 percent of the catering fee. By the end of the first yeor, anly two HW clients hod complained but had not yet been poid refunds. The expected refunds omount to $2,200, and Honk reduced the reported catering fees for the first yeor to reflect the expected refund. 2 In the first year, HW received o $7,050 poyment from o client for catering o monthly breakfost for 30 consecutive months beginning in December. Becouse the poyment didn't relate to lost yeor. Honk excluced the entire amount when he colculated catering revenues. 3. In July. HW paid $2,100 to ADMAN Company for on odvertising campoign to distribute fliers odvertising HW's catering service. Unfortunately, this compoign violated o city code restricting odvertising by fliers, and the city fined HW $350 for the violation. HW poid the fine, and Hank included the fine and the cost of the campoign in "other business" expenditures. 4. In July, HW also psid $8,640 for a 24 -month insurance policy that covers HW for accidents ond casualies beginning on August 1 of the first yeor. Honk deducted the entire $8,640 os occident insuronce premiums. 5. In Moy of the first year. Hank signed o contract to lesse the HW donut shop for 10 months. In conjunction with the controct, Hank paid $2,200 os a demege deposit ond $8,550 for rent (\$855 per month). Hank explained thot the domage deposit was refundable ot the end of the lease. At this time, Honk also paid $33,600 to lease kitchen equipment for 24 months (\$1,400 per month). Both lesses begon on June 1 of the first yeor. In his estimate, Honk deducted these amounts ($44,350 in total) as rent expense. 6. Honk signed e controct hiring WEGO Cotering to help coter breakfasts. At year-end, WEGO asked Hank to hold the last catering payment for the year, $9,650, until efter Jenuery 1 (opparently becouse WEGO didnt went to report the income on its tax retum). The lest check was delivered to WEGO in Jenuery ofter the end of the first year. However, becouse the peyment related to the first year of operations. Hank included the $9,650 in lost yest's cotering expense. 7. Hank believes that the key to the success of HW hos been hiring limbo lones to supervise the donut procuction and manage the shop. Becouse Jimbo is such an importont employee. HW purchosed o ' key-employee term-life ineurrace policy on his life. HW poid os $5,600 premium for this policy, and it will pay HW s $40,000 deoth benefit if Jimbo posses owsy eny time during the next 12 months. The term of the policy began on September l of last year, snd this poyment was included in "other business" expenditures. 8. In the first yesr, HW catered o lorge breakfast event to celebrote the city s anniversory. The city ogreed to psy $7,700 for the event, but Henk forgot to notify the city of the outstonding bill until jenuary of this yeer. When he moiled the bill in Jonusry. Hernk decided to discount the charge to $5,900. On the bili. Henk thenked the moyor end the city council for their potronsge ond osked them to "send a little more business our way." This bill is not refiected in Hanks estimate of HW's income for the first year of operations. Required: a-1 and a-2. Henk files his personsl tax return on o colendar year, but he hos not yet filed last year's personal tax return, nor has he filed o tox return reporting HW's results for the first yeer of operotions. Identify when Hank should file the tox return for HW and calculate the amount of taxoble income generated by HW last year. b. Determine the toxable income that HW will generate if Honk chooses to account for the business under the accrual method. Note: Do not round intermedlate calculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started