Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11. How much need to be invested today to result in a Future Value of $60,000 in 8 years time? Assume an annual fixed-rate of

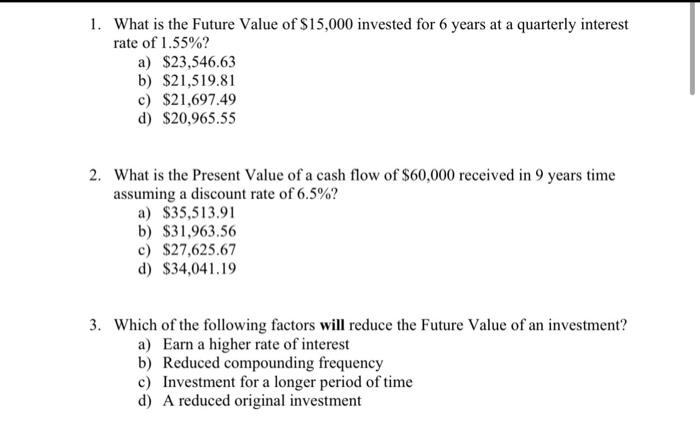

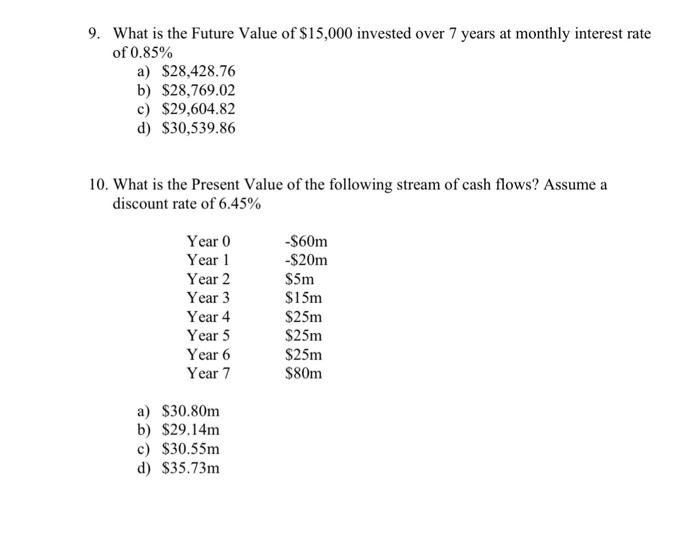

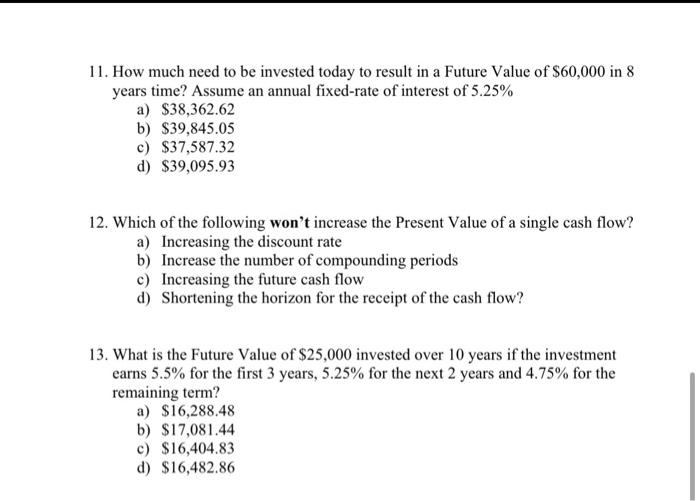

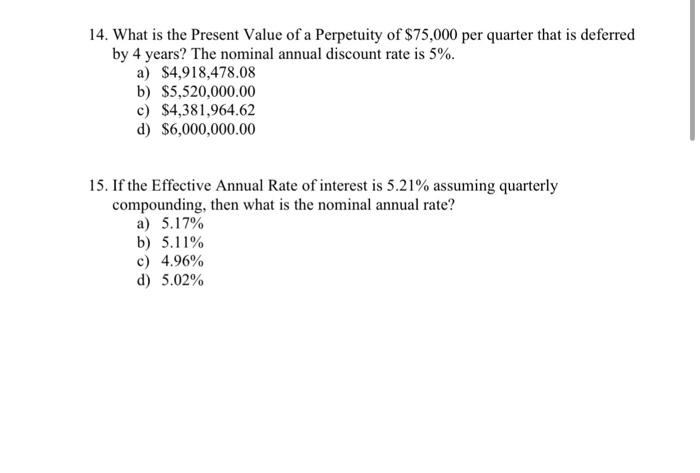

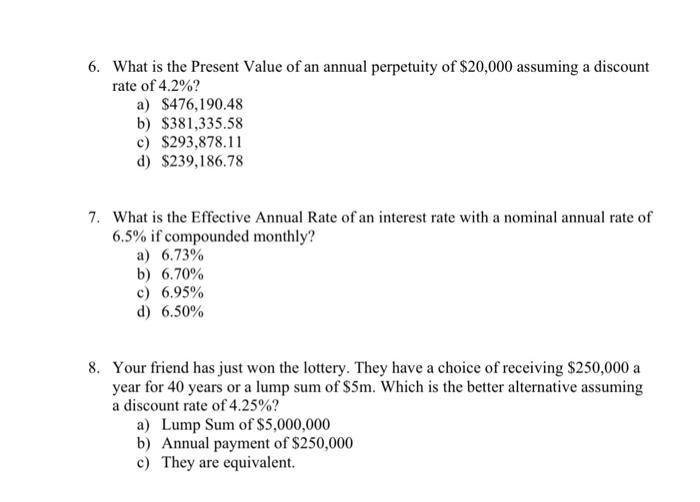

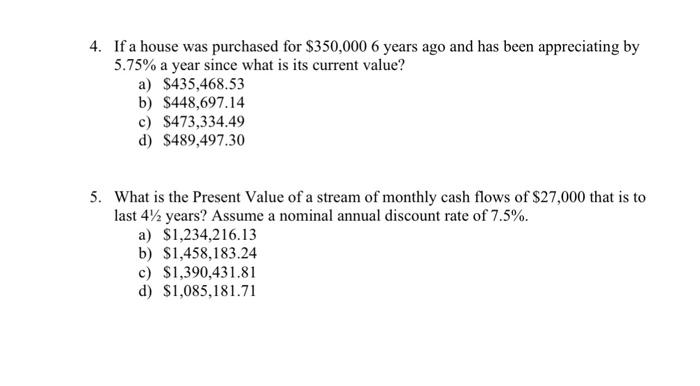

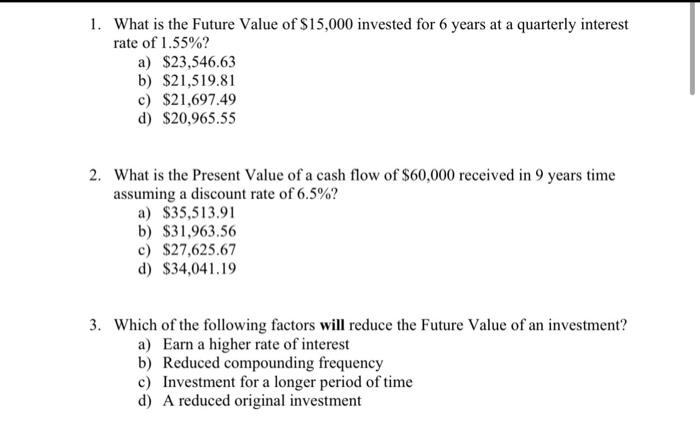

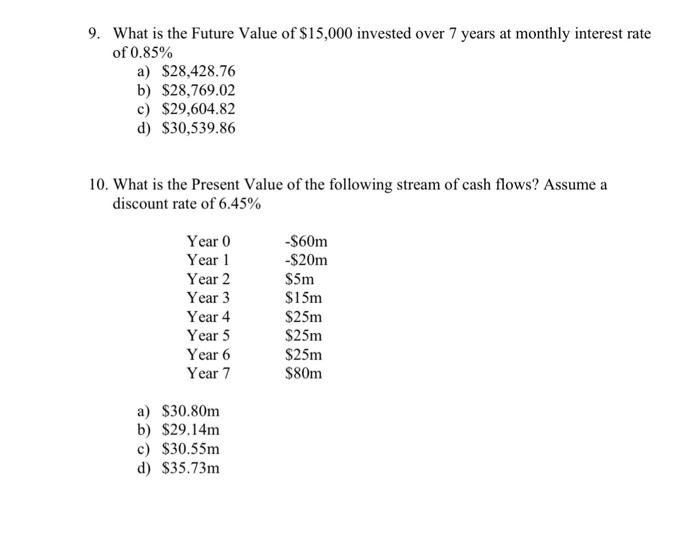

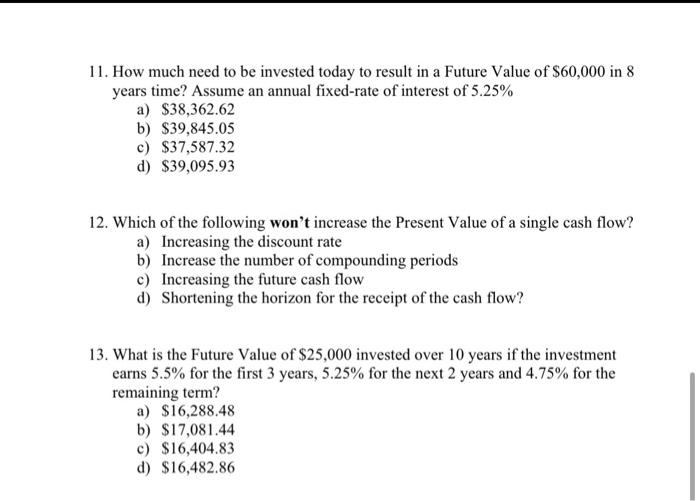

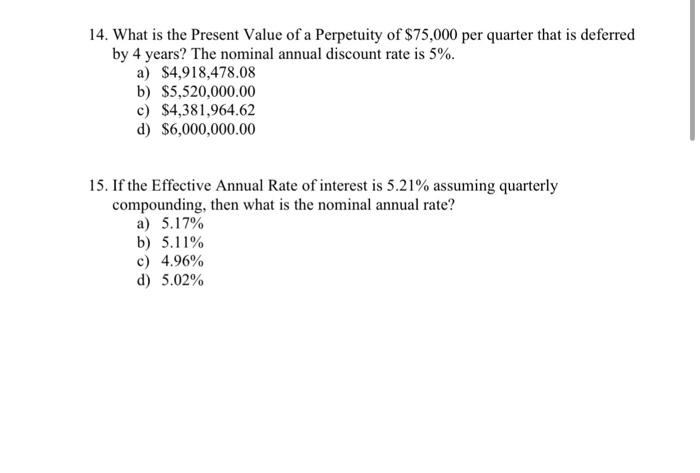

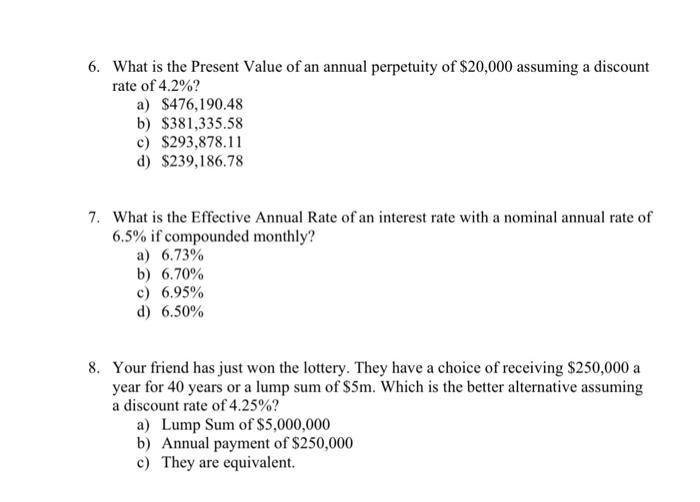

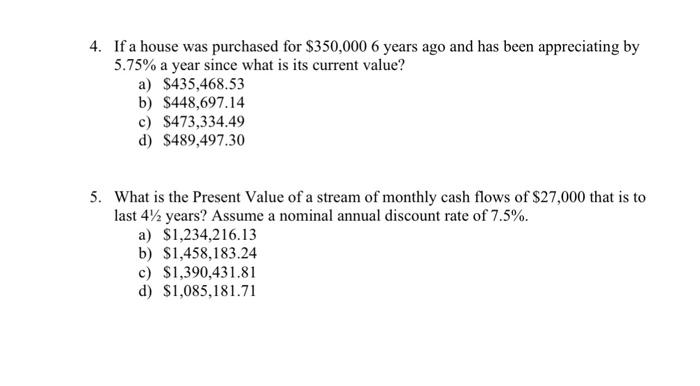

11. How much need to be invested today to result in a Future Value of $60,000 in 8 years time? Assume an annual fixed-rate of interest of 5.25% a) $38,362.62 b) $39,845.05 c) $37,587.32 d) $39,095.93 12. Which of the following won't increase the Present Value of a single cash flow? a) Increasing the discount rate b) Increase the number of compounding periods c) Increasing the future cash flow d) Shortening the horizon for the receipt of the cash flow? 13. What is the Future Value of $25,000 invested over 10 years if the investment earns 5.5% for the first 3 years, 5.25% for the next 2 years and 4.75% for the remaining term? a) $16,288.48 b) $17,081.44 c) $16,404.83 d) $16,482.86 14. What is the Present Value of a Perpetuity of $75,000 per quarter that is deferred by 4 years? The nominal annual discount rate is 5%. a) $4,918,478.08 b) $5,520,000.00 c) $4,381,964.62 d) $6,000,000.00 15. If the Effective Annual Rate of interest is 5.21% assuming quarterly compounding, then what is the nominal annual rate? a) 5.17% b) 5.11% c) 4.96% d) 5.02% 1. What is the Future Value of $15,000 invested for 6 years at a quarterly interest rate of 1.55% ? a) $23,546.63 b) $21,519.81 c) $21,697.49 d) $20,965.55 2. What is the Present Value of a cash flow of $60,000 received in 9 years time assuming a discount rate of 6.5% ? a) $35,513.91 b) $31,963.56 c) $27,625.67 d) $34,041.19 3. Which of the following factors will reduce the Future Value of an investment? a) Earn a higher rate of interest b) Reduced compounding frequency c) Investment for a longer period of time d) A reduced original investment 4. If a house was purchased for $350,0006 years ago and has been appreciating by 5.75% a year since what is its current value? a) $435,468.53 b) $448,697.14 c) $473,334.49 d) $489,497.30 5. What is the Present Value of a stream of monthly cash flows of $27,000 that is to last 421 years? Assume a nominal annual discount rate of 7.5%. a) $1,234,216.13 b) $1,458,183.24 c) $1,390,431.81 d) $1,085,181.71 What is the Future Value of $15,000 invested over 7 years at monthly interest rate of 0.85% a) $28,428,76 b) $28,769.02 c) $29,604.82 d) $30,539.86 10. What is the Present Value of the following stream of cash flows? Assume a discount rate of 6.45% 6. What is the Present Value of an annual perpetuity of $20,000 assuming a discount rate of 4.2% ? a) $476,190.48 b) $381,335.58 c) $293,878.11 d) $239,186.78 7. What is the Effective Annual Rate of an interest rate with a nominal annual rate of 6.5% if compounded monthly? a) 6.73% b) 6.70% c) 6.95% d) 6.50% 8. Your friend has just won the lottery. They have a choice of receiving $250,000 a year for 40 years or a lump sum of $5m. Which is the better alternative assuming a discount rate of 4.25% ? a) Lump Sum of $5,000,000 b) Annual payment of $250,000 c) They are equivalent

11. How much need to be invested today to result in a Future Value of $60,000 in 8 years time? Assume an annual fixed-rate of interest of 5.25% a) $38,362.62 b) $39,845.05 c) $37,587.32 d) $39,095.93 12. Which of the following won't increase the Present Value of a single cash flow? a) Increasing the discount rate b) Increase the number of compounding periods c) Increasing the future cash flow d) Shortening the horizon for the receipt of the cash flow? 13. What is the Future Value of $25,000 invested over 10 years if the investment earns 5.5% for the first 3 years, 5.25% for the next 2 years and 4.75% for the remaining term? a) $16,288.48 b) $17,081.44 c) $16,404.83 d) $16,482.86 14. What is the Present Value of a Perpetuity of $75,000 per quarter that is deferred by 4 years? The nominal annual discount rate is 5%. a) $4,918,478.08 b) $5,520,000.00 c) $4,381,964.62 d) $6,000,000.00 15. If the Effective Annual Rate of interest is 5.21% assuming quarterly compounding, then what is the nominal annual rate? a) 5.17% b) 5.11% c) 4.96% d) 5.02% 1. What is the Future Value of $15,000 invested for 6 years at a quarterly interest rate of 1.55% ? a) $23,546.63 b) $21,519.81 c) $21,697.49 d) $20,965.55 2. What is the Present Value of a cash flow of $60,000 received in 9 years time assuming a discount rate of 6.5% ? a) $35,513.91 b) $31,963.56 c) $27,625.67 d) $34,041.19 3. Which of the following factors will reduce the Future Value of an investment? a) Earn a higher rate of interest b) Reduced compounding frequency c) Investment for a longer period of time d) A reduced original investment 4. If a house was purchased for $350,0006 years ago and has been appreciating by 5.75% a year since what is its current value? a) $435,468.53 b) $448,697.14 c) $473,334.49 d) $489,497.30 5. What is the Present Value of a stream of monthly cash flows of $27,000 that is to last 421 years? Assume a nominal annual discount rate of 7.5%. a) $1,234,216.13 b) $1,458,183.24 c) $1,390,431.81 d) $1,085,181.71 What is the Future Value of $15,000 invested over 7 years at monthly interest rate of 0.85% a) $28,428,76 b) $28,769.02 c) $29,604.82 d) $30,539.86 10. What is the Present Value of the following stream of cash flows? Assume a discount rate of 6.45% 6. What is the Present Value of an annual perpetuity of $20,000 assuming a discount rate of 4.2% ? a) $476,190.48 b) $381,335.58 c) $293,878.11 d) $239,186.78 7. What is the Effective Annual Rate of an interest rate with a nominal annual rate of 6.5% if compounded monthly? a) 6.73% b) 6.70% c) 6.95% d) 6.50% 8. Your friend has just won the lottery. They have a choice of receiving $250,000 a year for 40 years or a lump sum of $5m. Which is the better alternative assuming a discount rate of 4.25% ? a) Lump Sum of $5,000,000 b) Annual payment of $250,000 c) They are equivalent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started