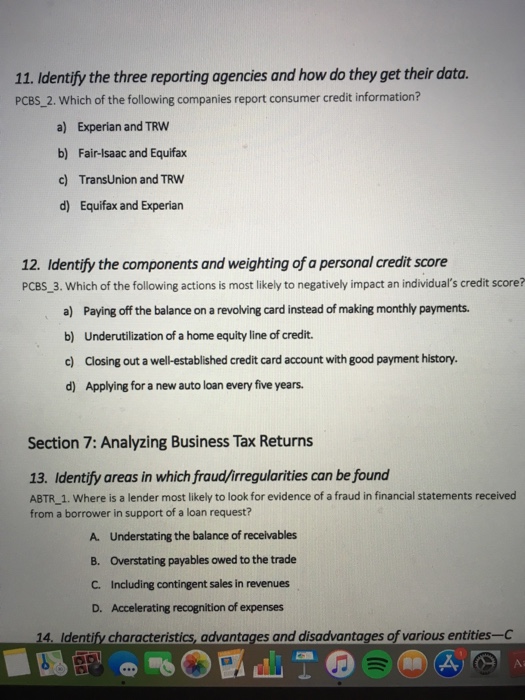

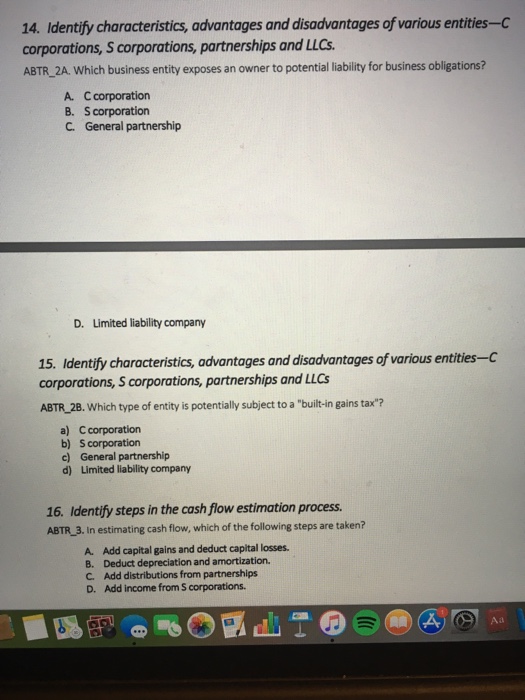

11. Identify the three reporting agencies and how do they get their data. PCBS 2. Which of the following companies report consumer credit information? a) Experian and TRW b) Fair-Isaac and Equifax c) TransUnion and TRVW d) Equifax and Experian 12. Identify the components and weighting of a personal credit score PCBS 3. Which of the following actions is most likely to negatively impact an individual's credit score? a) Paying off the balance on a revolving card instead of making monthly payments. b) Underutilization of a home equity line of credit. c) Closing out a well-established credit card account with good payment history d) Applying for a new auto loan every five years. Section 7: Analyzing Business Tax Returns 13. Identify areas in which fraud/irregularities can be found ABTR_1. Where is a lender most likely to look for evidence of a fraud in financial statements received from a borrower in support of a loan request? A Understating the balance of receivables B. Overstating payables owed to the trade C. Including contingent sales in revenues D. Accelerating recognition of expenses 14. Identify characteristics, advantages and disadvantages of various entities-C 11. Identify the three reporting agencies and how do they get their data. PCBS 2. Which of the following companies report consumer credit information? a) Experian and TRW b) Fair-Isaac and Equifax c) TransUnion and TRVW d) Equifax and Experian 12. Identify the components and weighting of a personal credit score PCBS 3. Which of the following actions is most likely to negatively impact an individual's credit score? a) Paying off the balance on a revolving card instead of making monthly payments. b) Underutilization of a home equity line of credit. c) Closing out a well-established credit card account with good payment history d) Applying for a new auto loan every five years. Section 7: Analyzing Business Tax Returns 13. Identify areas in which fraud/irregularities can be found ABTR_1. Where is a lender most likely to look for evidence of a fraud in financial statements received from a borrower in support of a loan request? A Understating the balance of receivables B. Overstating payables owed to the trade C. Including contingent sales in revenues D. Accelerating recognition of expenses 14. Identify characteristics, advantages and disadvantages of various entities-C