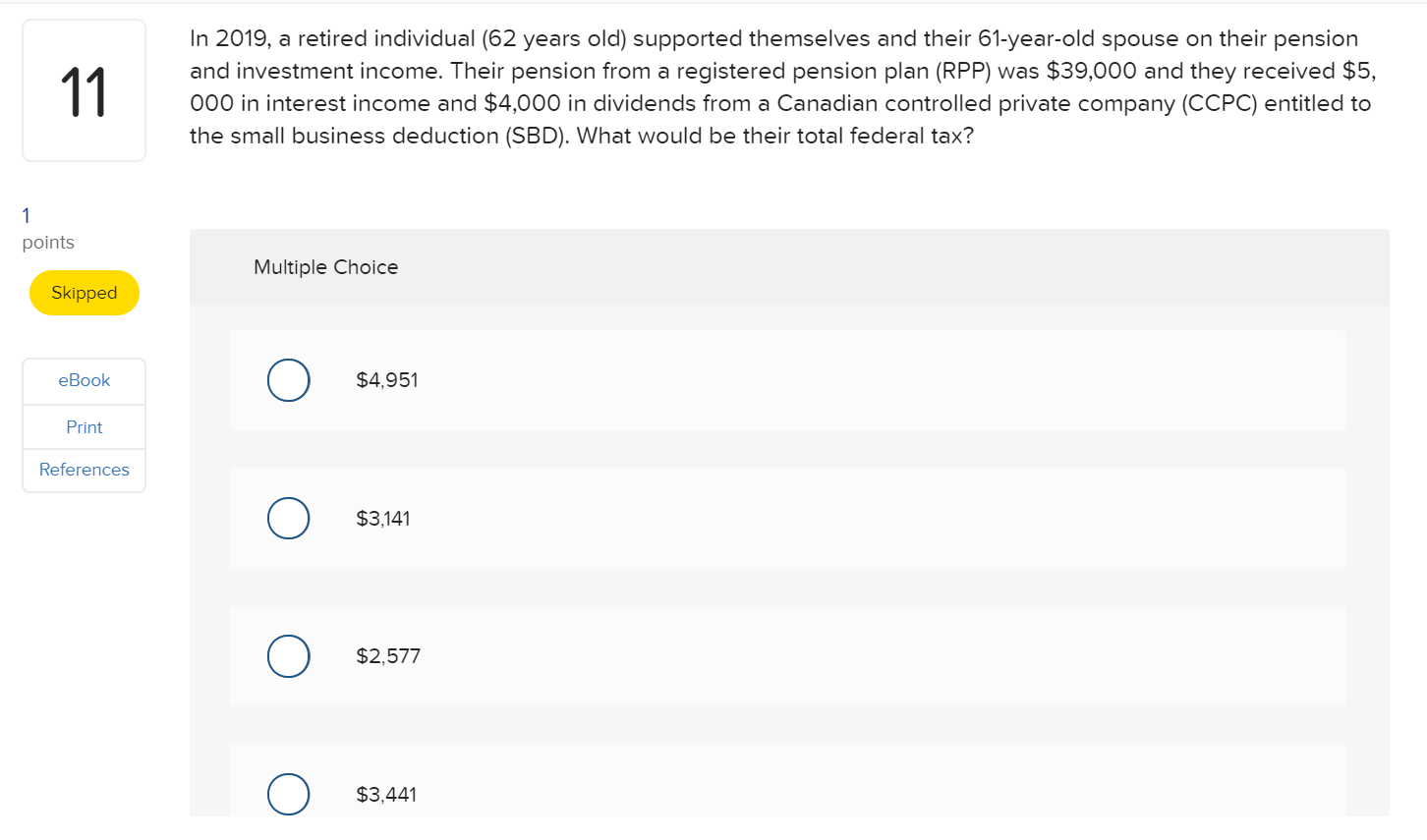

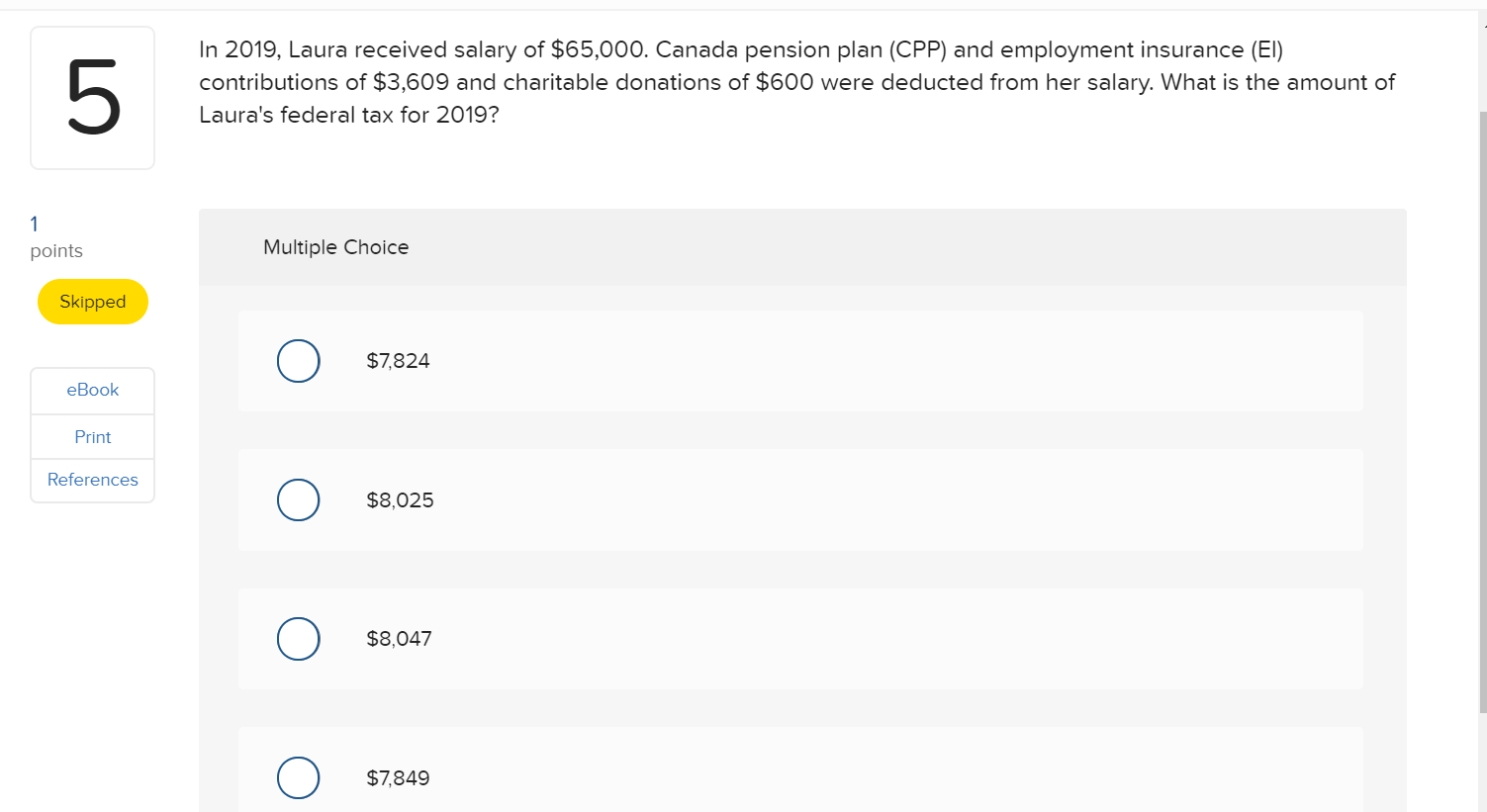

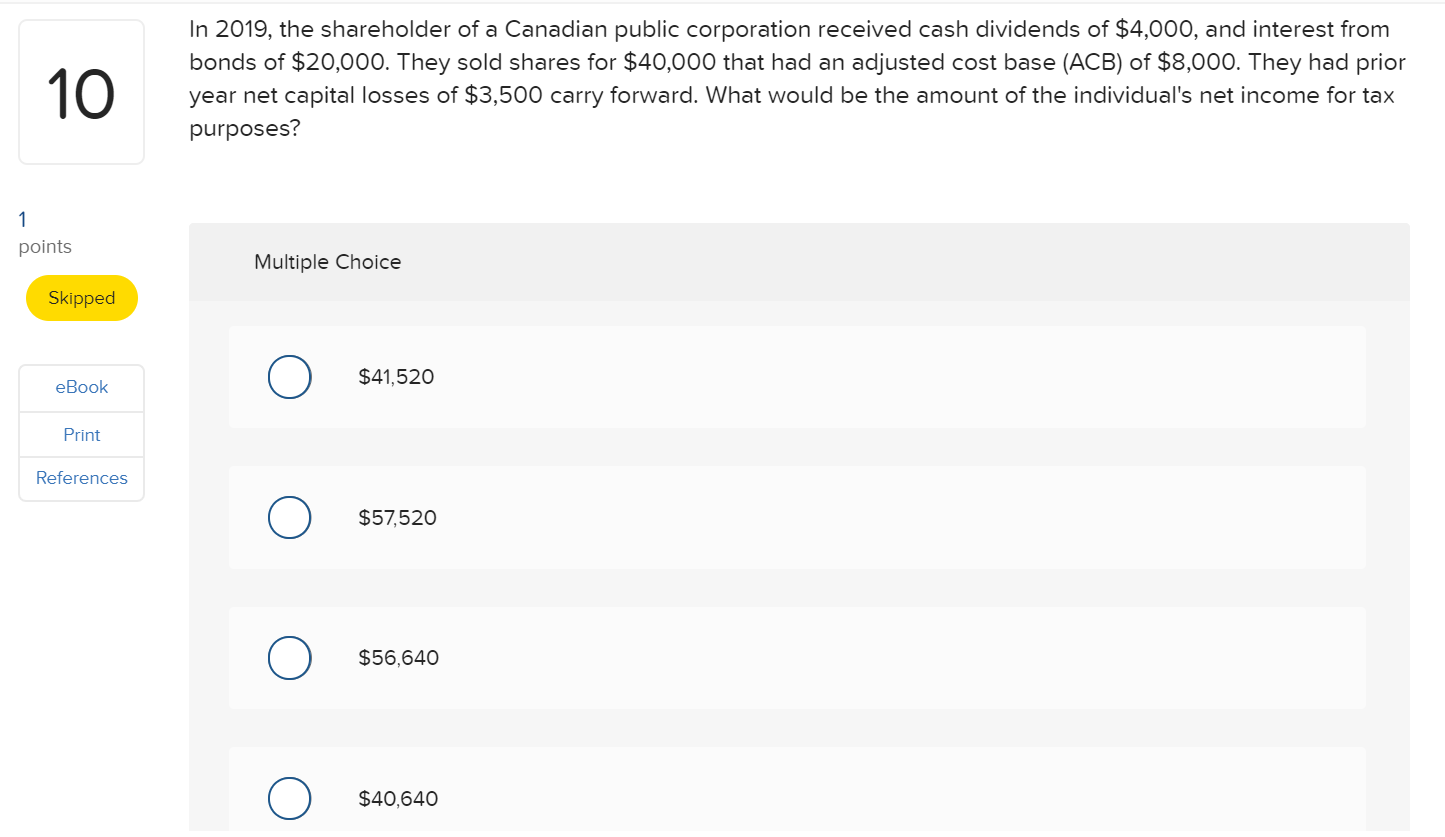

11 In 2019, a retired individual (62 years old) supported themselves and their 61-year-old spouse on their pension and investment income. Their pension from a registered pension plan (RPP) was $39,000 and they received $5, 000 in interest income and $4,000 in dividends from a Canadian controlled private company (CCPC) entitled to the small business deduction (SBD). What would be their total federal tax? 1 points Multiple Choice Skipped eBook o $4,951 Print References $3,141 $2,577 $3,441 LO In 2019, Laura received salary of $65,000. Canada pension plan (CPP) and employment insurance (EI) contributions of $3,609 and charitable donations of $600 were deducted from her salary. What is the amount of Laura's federal tax for 2019? 1 points Multiple Choice Skipped $7,824 eBook Print References $8,025 $8,047 $7,849 10 In 2019, the shareholder of a Canadian public corporation received cash dividends of $4,000, and interest from bonds of $20,000. They sold shares for $40,000 that had an adjusted cost base (ACB) of $8,000. They had prior year net capital losses of $3,500 carry forward. What would be the amount of the individual's net income for tax purposes? 1 points Multiple Choice Skipped $41,520 eBook Print References $57,520 $56,640 $40,640 11 In 2019, a retired individual (62 years old) supported themselves and their 61-year-old spouse on their pension and investment income. Their pension from a registered pension plan (RPP) was $39,000 and they received $5, 000 in interest income and $4,000 in dividends from a Canadian controlled private company (CCPC) entitled to the small business deduction (SBD). What would be their total federal tax? 1 points Multiple Choice Skipped eBook o $4,951 Print References $3,141 $2,577 $3,441 LO In 2019, Laura received salary of $65,000. Canada pension plan (CPP) and employment insurance (EI) contributions of $3,609 and charitable donations of $600 were deducted from her salary. What is the amount of Laura's federal tax for 2019? 1 points Multiple Choice Skipped $7,824 eBook Print References $8,025 $8,047 $7,849 10 In 2019, the shareholder of a Canadian public corporation received cash dividends of $4,000, and interest from bonds of $20,000. They sold shares for $40,000 that had an adjusted cost base (ACB) of $8,000. They had prior year net capital losses of $3,500 carry forward. What would be the amount of the individual's net income for tax purposes? 1 points Multiple Choice Skipped $41,520 eBook Print References $57,520 $56,640 $40,640