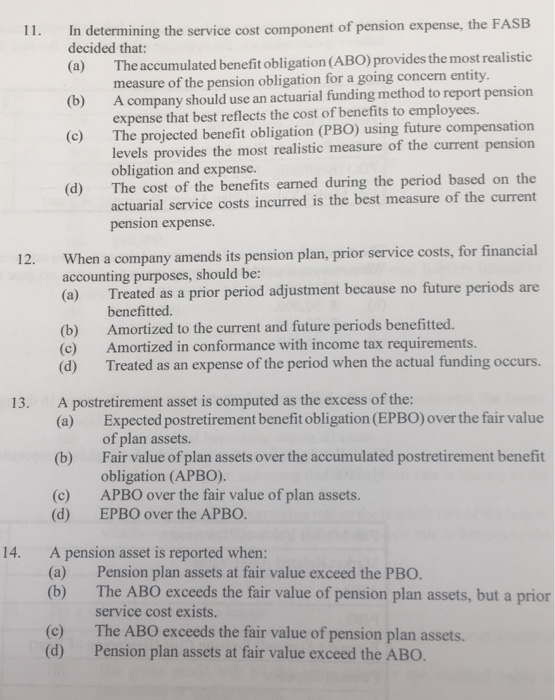

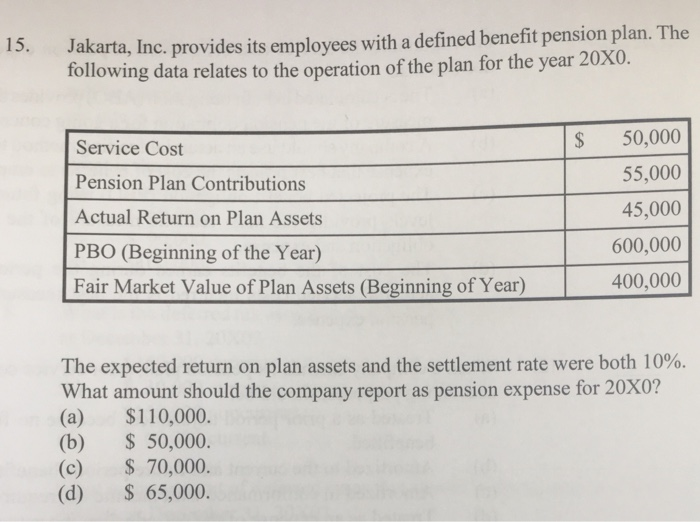

11. In determining the service cost component of pension expense, the FASB decided that: (a) The accumulated benefit obligation (ABO) provides the most realistic (b) A company should use an actuarial funding method to report pension (c) The projected benefit obligation (PBO) using future compensation measure of the pension obligation for a going concern entity. expense that best reflects the cost of benefits to employees. levels provides the most realistic measure of the current pension obligation and expense. The cost of the benefits earned during the period based on the actuarial service costs incurred is the best measure of the current pension expense (d) When a company amends its pension plan, prior service costs, for financial accounting purposes, should be: (a) Treated as a prior period adjustment because no future periods are 12. (b) (c) (d) benefitted. Amortized to the current and future periods benefitted. Amortized in conformance with income tax requirements. Treated as an expense of the period when the actual funding occurs. A postretirement asset is computed as the excess of the: (a) 13. Expected postretirement benefit obligation (EPBO) over the fair value of plan assets. Fair value of plan assets over the accumulated postretirement benefit obligation (APBO). APBO over the fair value of plan assets. EPBO over the APBO. (b) (c) (d) A pension asset is reported when: (a) (b) 14. Pension plan assets at fair value exceed the PBO. The ABO exceeds the fair value of pension plan assets, but a prior service cost exists The ABO exceeds the fair value of pension plan assets. Pension plan assets at fair value exceed the ABO. (c) (d) Jakarta, Inc. provides its employees with a defined benefit pension plan. The following data relates to the operation of the plan for the year 20X0. 15. Service Cost Pension Plan Contributions Actual Return on Plan Assets PBO (Beginning of the Year) Fair Market Value of Plan Assets (Beginning of Year) S 50,000 55,000 45,000 600,000 400,000 The expected return on plan assets and the settlement rate were both 10%. What amount should the company report as pension expense for 20X0? (a) $110,000. (b) 50,000. (c) 70,000 (d) 65,000