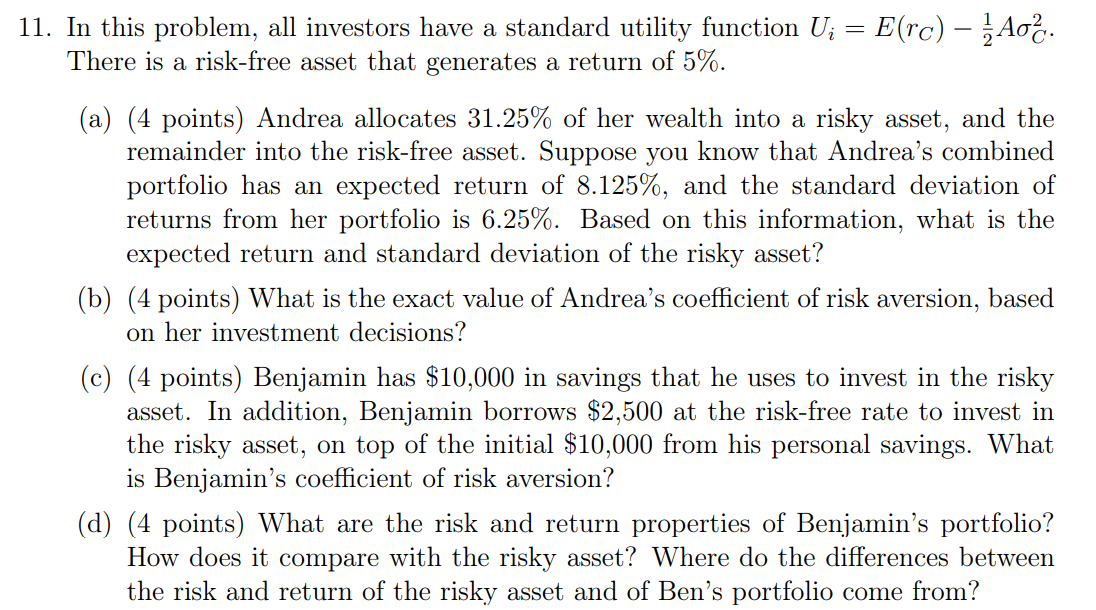

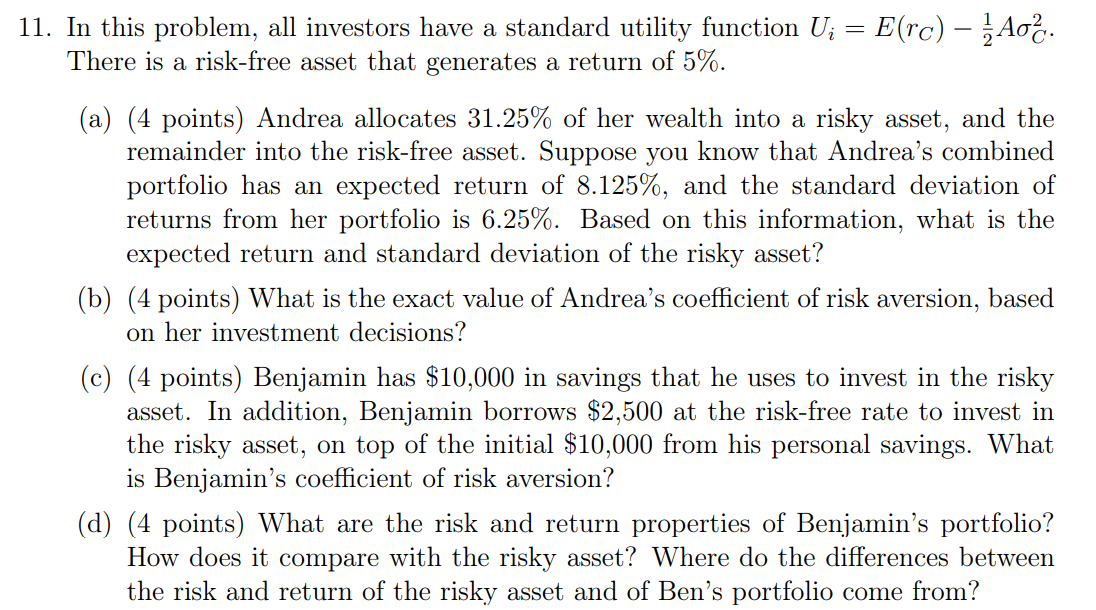

11. In this problem, all investors have a standard utility function U; = E(rc) Ao. There is a risk-free asset that generates a return of 5%. (a) (4 points) Andrea allocates 31.25% of her wealth into a risky asset, and the remainder into the risk-free asset. Suppose you know that Andrea's combined portfolio has an expected return of 8.125%, and the standard deviation of returns from her portfolio is 6.25%. Based on this information, what is the expected return and standard deviation of the risky asset? (b) (4 points) What is the exact value of Andrea's coefficient of risk aversion, based on her investment decisions? (c) (4 points) Benjamin has $10,000 in savings that he uses to invest in the risky asset. In addition, Benjamin borrows $2,500 at the risk-free rate to invest in the risky asset, on top of the initial $10,000 from his personal savings. What is Benjamin's coefficient of risk aversion? (d) (4 points) What are the risk and return properties of Benjamin's portfolio? How does it compare with the risky asset? Where do the differences between the risk and return of the risky asset and of Ben's portfolio come from? 11. In this problem, all investors have a standard utility function U; = E(rc) Ao. There is a risk-free asset that generates a return of 5%. (a) (4 points) Andrea allocates 31.25% of her wealth into a risky asset, and the remainder into the risk-free asset. Suppose you know that Andrea's combined portfolio has an expected return of 8.125%, and the standard deviation of returns from her portfolio is 6.25%. Based on this information, what is the expected return and standard deviation of the risky asset? (b) (4 points) What is the exact value of Andrea's coefficient of risk aversion, based on her investment decisions? (c) (4 points) Benjamin has $10,000 in savings that he uses to invest in the risky asset. In addition, Benjamin borrows $2,500 at the risk-free rate to invest in the risky asset, on top of the initial $10,000 from his personal savings. What is Benjamin's coefficient of risk aversion? (d) (4 points) What are the risk and return properties of Benjamin's portfolio? How does it compare with the risky asset? Where do the differences between the risk and return of the risky asset and of Ben's portfolio come from