Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11) Instalment notes with fixed principal payments are repayable in; a) equal periodic payments made up of principal and interest. b) equal periodic payments of

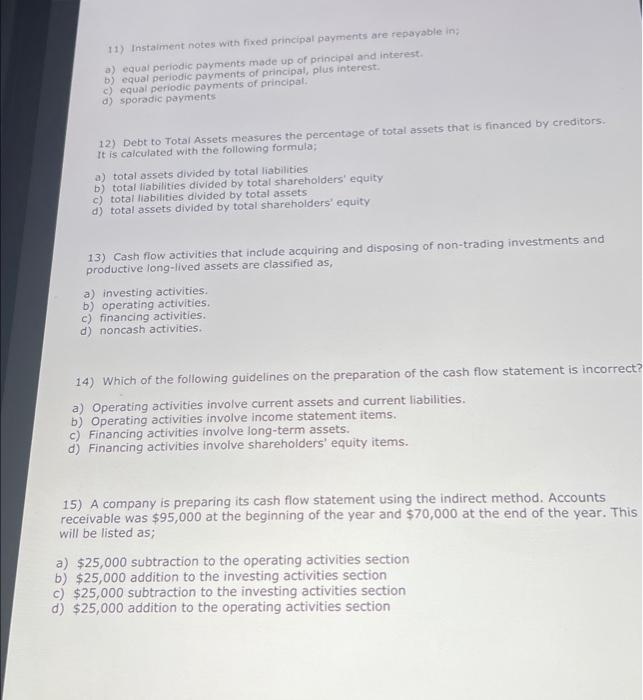

11) Instalment notes with fixed principal payments are repayable in; a) equal periodic payments made up of principal and interest. b) equal periodic payments of principal, plus interest. c) equal periodic payments of principal. d) sporadic payments 12) Debt to Total Assets measures the percentage of total assets that is financed by creditors. It is calculated with the following formula; a) total assets divided by total liabilities b) total liabilities divided by total shareholders' equity c) total liabilities divided by total assets d) total assets divided by total shareholders' equity 13) Cash flow activities that include acquiring and disposing of non-trading investments and productive long-lived assets are classified as, a) investing activities. b) operating activities. c) financing activities. d) noncash activities. 14) Which of the following guidelines on the preparation of the cash flow statement is incorrect? a) Operating activities involve current assets and current liabilities. b) Operating activities involve income statement items. c) Financing activities involve long-term assets. d) Financing activities involve shareholders' equity items. 15) A company is preparing its cash flow statement using the indirect method. Accounts receivable was $95,000 at the beginning of the year and $70,000 at the end of the year. This will be listed as; a) $25,000 subtraction to the operating activities section b) $25,000 addition to the investing activities section c) $25,000 subtraction to the investing activities section d) $25,000 addition to the operating activities section

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started