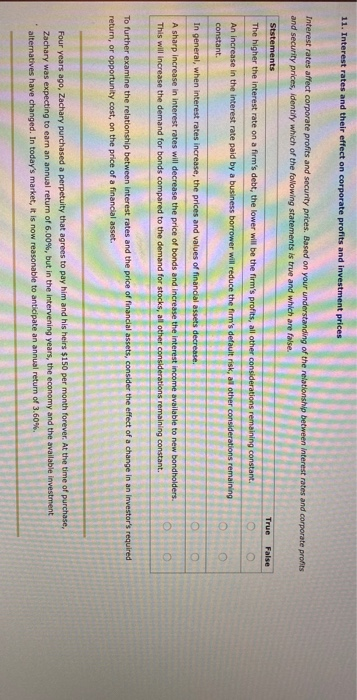

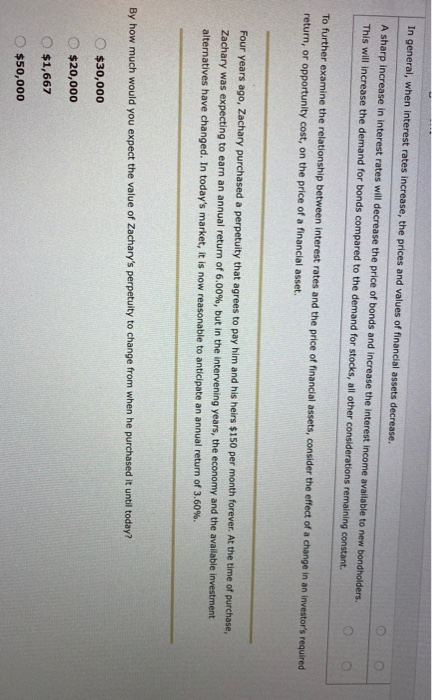

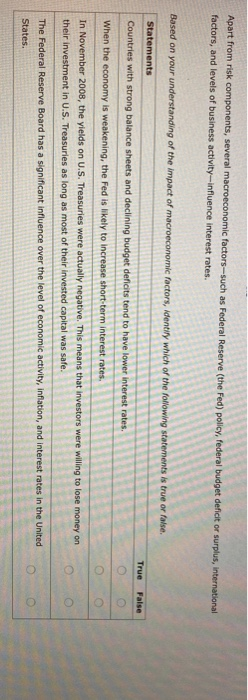

11. Interest rates and their effect on corporate profits and investment prices Interest rates affect corporate profits and security prices. Based on your understanding of the relationship between interest rates and corporate profits and security prices, identify which of the following statements is true and which are false True False Ststements The higher the interest rate on a firm's debt, the lower will be the firm's profits, all other considerations remaining constant. An increase in the interest rate paid by a business borrower will reduce the firm's default risk, all other considerations remaining constant. In general, when interest rates increase, the prices and values of financial assets decrease A sharp increase in interest rates will decrease the price of bonds and increase the interest income available to new bondholders. This will increase the demand for bonds compared to the demand for stocks, all other considerations remaining constant. To further examine the relationship between interest rates and the price of financial assets, consider the effect of a change in an investor's required return, or opportunity cost, on the price of a financial asset. Four years ago, Zachary purchased a perpetuity that agrees to pay him and his heirs $150 per month forever. At the time of purchase, Zachary was expecting to earn an annual return of 6.00%, but in the intervening years, the economy and the available investment alternatives have changed. In today's market, it is now reasonable to anticipate an annual return of 3.60%. In general, when interest rates increase, the prices and values of financial assets decrease. A sharp increase in interest rates will decrease the price of bonds and increase the interest income available to new bondholders. This will increase the demand for bonds compared to the demand for stocks, all other considerations remaining constant. To further examine the relationship between interest rates and the price of financial assets, consider the effect of a change in an investor's required return, or opportunity cost, on the price of a financial asset. Four years ago, Zachary purchased a perpetuity that agrees to pay him and his heirs $150 per month forever. At the time of purchase, Zachary was expecting to earn an annual return of 6.00%, but in the intervening years, the economy and the available investment alternatives have changed. In today's market, it is now reasonable to anticipate an annual return of 3.60%. By how much would you expect the value of Zachary's perpetuity to change from when he purchased it until today? $30,000 $20,000 $1,667 $50,000 Apart from risk components, several macroeconomic factors such as Federal Reserve (the Fed) policy, federal budget deficit or surplus, international factors, and levels of business activity-influence interest rates. Based on your understanding of the impact of macroeconomic factors, Identity which of the following statements is true or false. Statements True False Countries with strong balance sheets and declining budget deficits tend to have lower interest rates. When the economy is weakening, the Fed is likely to increase short-term interest rates, . In November 2008, the yields on U.S. Treasures were actually negative. This means that investors were willing to lose money on their investment in U.S. Treasuries as long as most of their invested capital was safe. The Federal Reserve Board has a significant influence over the level of economic activity, inflation, and interest rates in the United States. o