Answered step by step

Verified Expert Solution

Question

1 Approved Answer

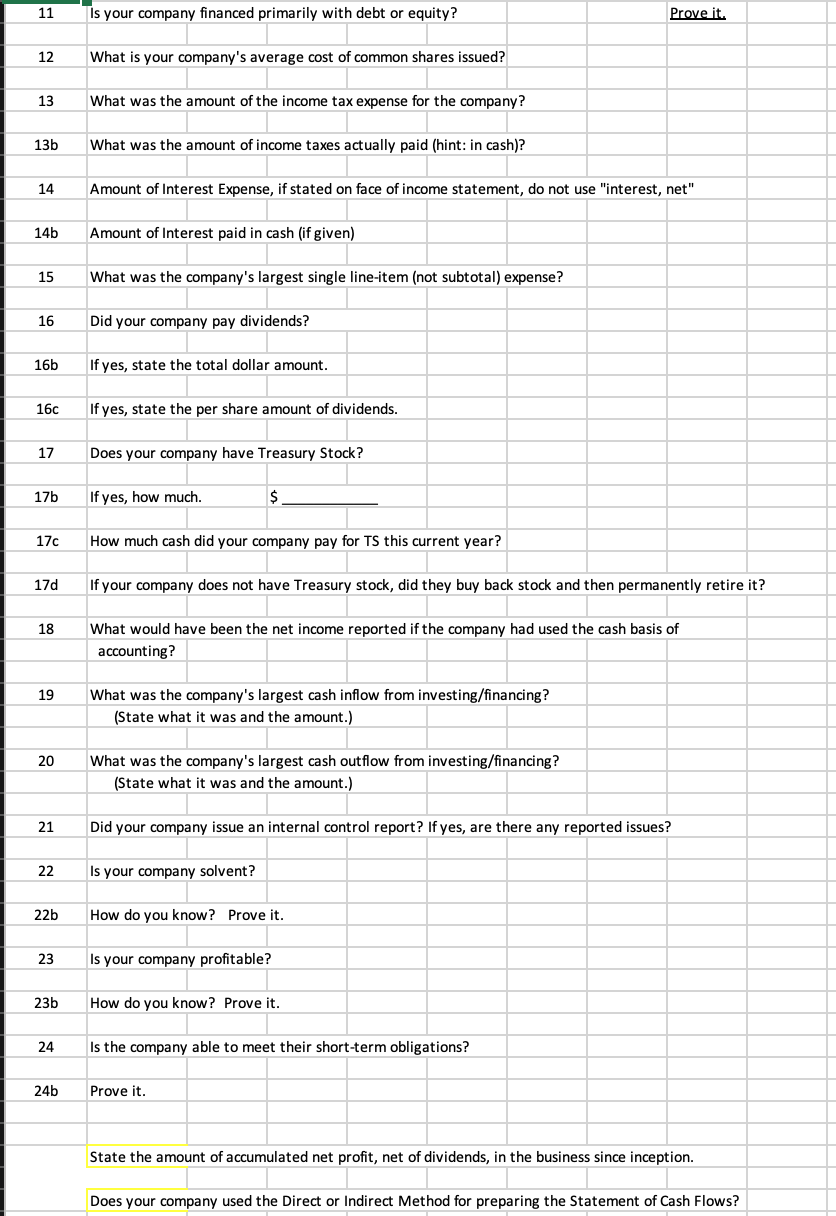

11 Is your company financed primarily with debt or equity? Prove it. 12 What is your company's average cost of common shares issued? 13 What

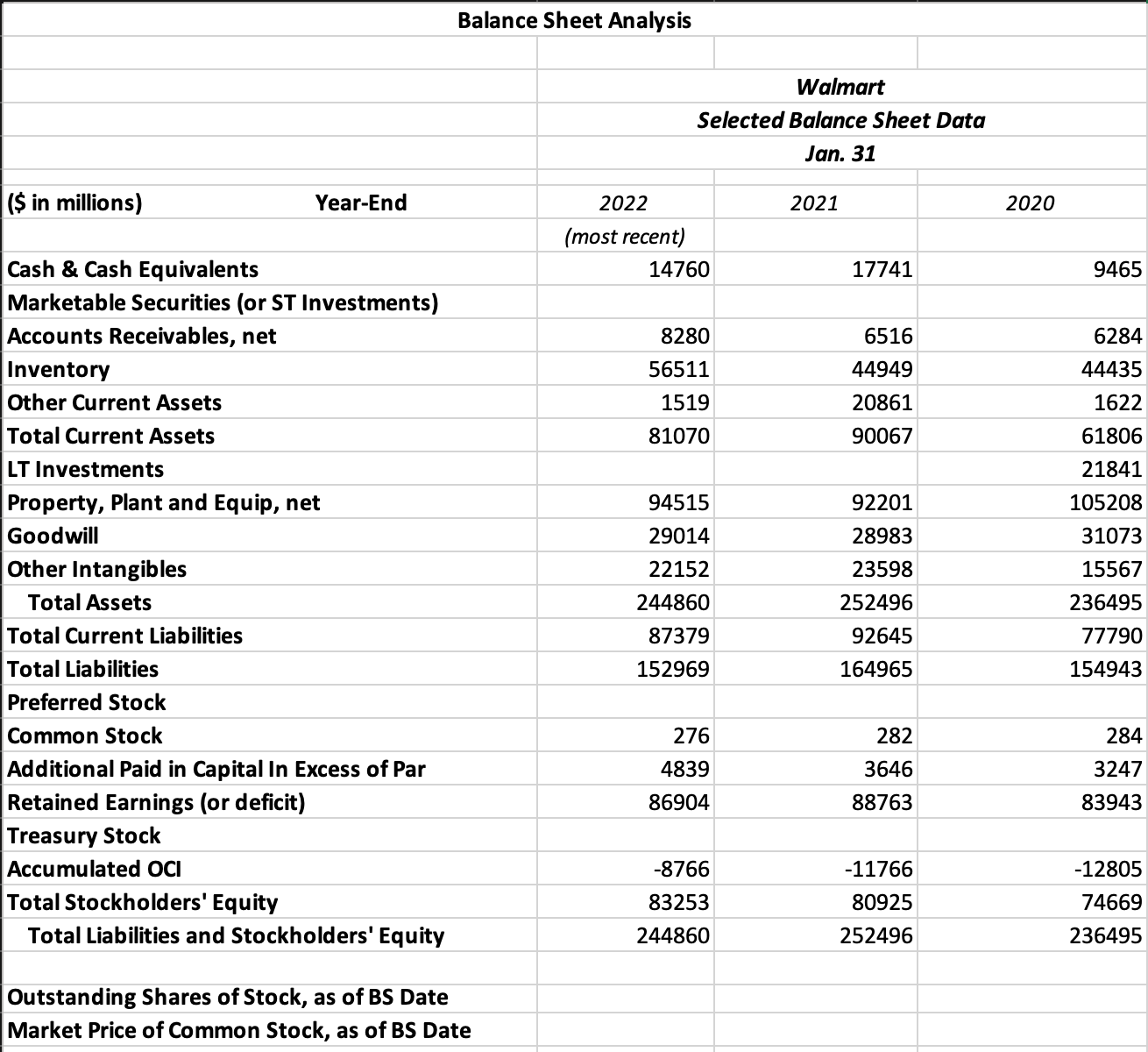

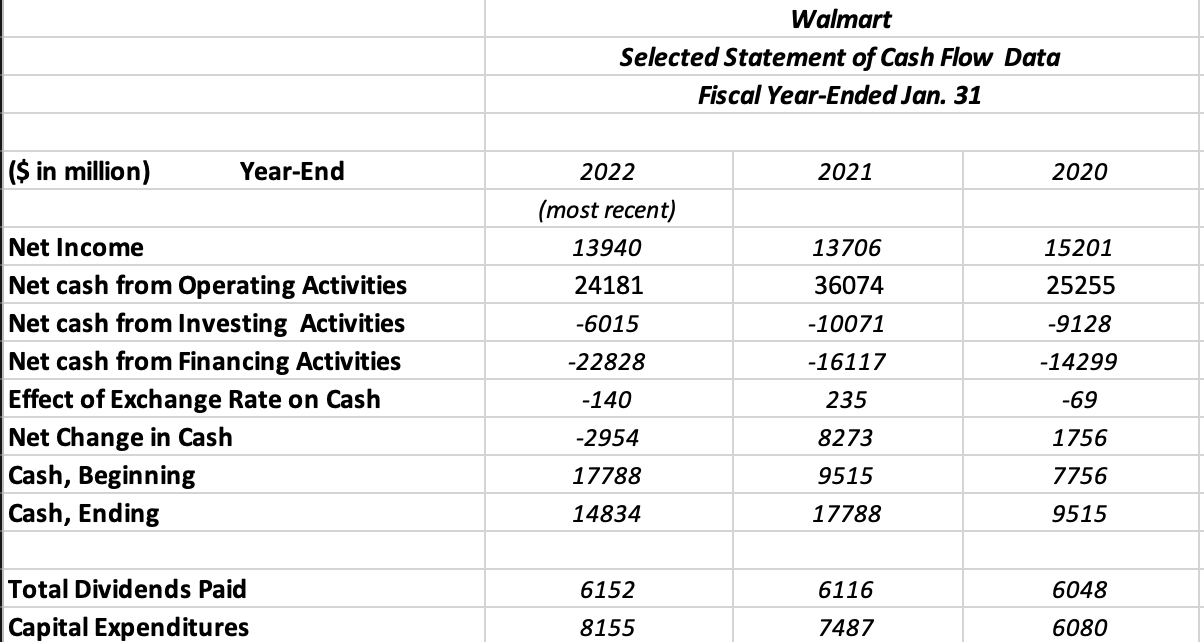

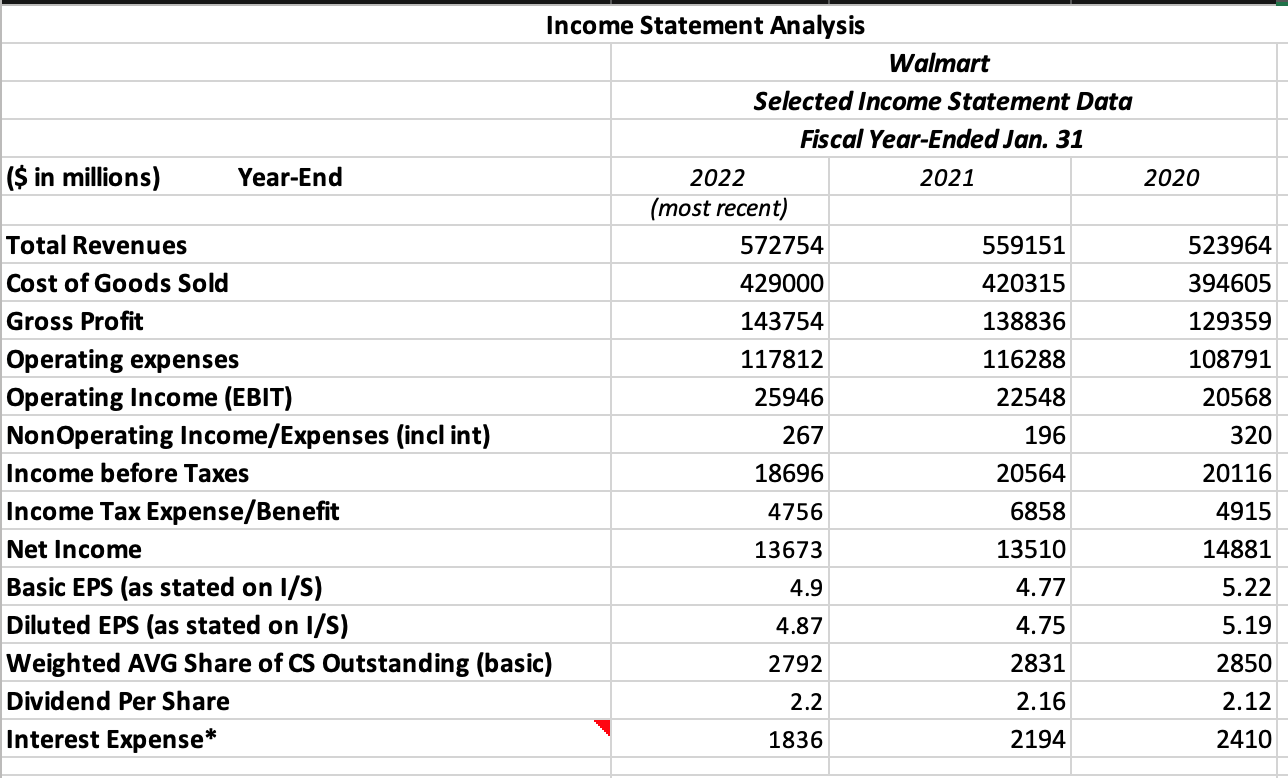

11 Is your company financed primarily with debt or equity? Prove it. 12 What is your company's average cost of common shares issued? 13 What was the amount of the income tax expense for the company? 13b What was the amount of income taxes actually paid (hint: in cash)? 14 Amount of Interest Expense, if stated on face of income statement, do not use "interest, net" 14b Amount of Interest paid in cash (if given) 15 What was the company's largest single line-item (not subtotal) expense? 16 Did your company pay dividends? 16b If yes, state the total dollar amount. 16c If yes, state the per share amount of dividends. 17 Does your company have Treasury Stock? 17b If yes, how much. $ 17c How much cash did your company pay for TS this current year? 17d If your company does not have Treasury stock, did they buy back stock and then permanently retire it? 18 What would have been the net income reported if the company had used the cash basis of accounting? 19 What was the company's largest cash inflow from investing/financing? (State what it was and the amount.) 20 What was the company's largest cash outflow from investing/financing? (State what it was and the amount.) 21 Did your company issue an internal control report? If yes, are there any reported issues? 22 Is your company solvent? 22b How do you know? Prove it. 23 Is your company profitable? 23b How do you know? Prove it. 24 Is the company able to meet their short-term obligations? 24b Prove it. State the amount of accumulated net profit, net of dividends, in the business since inception. Does your company used the Direct or Indirect Method for preparing the Statement of Cash Flows? Balance Sheet Analysis Outstanding Shares of Stock, as of BS Date Market Price of Common Stock, as of BS Date Walmart Selected Statement of Cash Flow Data Fiscal Year-Ended Jan. 31 \begin{tabular}{|l|c|c|c|} \hline (\$ in million) & Year-End & 2022 & 2021 \\ \hline & (most recent) & & \\ \hline Net Income & 13940 & 13706 & 15201 \\ \hline Net cash from Operating Activities & 24181 & 36074 & 25255 \\ \hline Net cash from Investing Activities & -6015 & -10071 & -9128 \\ \hline Net cash from Financing Activities & -22828 & -16117 & -14299 \\ \hline Effect of Exchange Rate on Cash & -140 & 235 & -69 \\ \hline Net Change in Cash & -2954 & 8273 & 1756 \\ \hline Cash, Beginning & 17788 & 9515 & 7756 \\ \hline Cash, Ending & 14834 & 17788 & 9515 \\ \hline & & & \\ \hline Total Dividends Paid & 6152 & 6116 & 6048 \\ \hline Capital Expenditures & 8155 & 7487 & 6080 \\ \hline \end{tabular} Income Statement Analysis Walmart Selected Income Statement Data Fiscal Year-Ended Jan. 31 11 Is your company financed primarily with debt or equity? Prove it. 12 What is your company's average cost of common shares issued? 13 What was the amount of the income tax expense for the company? 13b What was the amount of income taxes actually paid (hint: in cash)? 14 Amount of Interest Expense, if stated on face of income statement, do not use "interest, net" 14b Amount of Interest paid in cash (if given) 15 What was the company's largest single line-item (not subtotal) expense? 16 Did your company pay dividends? 16b If yes, state the total dollar amount. 16c If yes, state the per share amount of dividends. 17 Does your company have Treasury Stock? 17b If yes, how much. $ 17c How much cash did your company pay for TS this current year? 17d If your company does not have Treasury stock, did they buy back stock and then permanently retire it? 18 What would have been the net income reported if the company had used the cash basis of accounting? 19 What was the company's largest cash inflow from investing/financing? (State what it was and the amount.) 20 What was the company's largest cash outflow from investing/financing? (State what it was and the amount.) 21 Did your company issue an internal control report? If yes, are there any reported issues? 22 Is your company solvent? 22b How do you know? Prove it. 23 Is your company profitable? 23b How do you know? Prove it. 24 Is the company able to meet their short-term obligations? 24b Prove it. State the amount of accumulated net profit, net of dividends, in the business since inception. Does your company used the Direct or Indirect Method for preparing the Statement of Cash Flows? Balance Sheet Analysis Outstanding Shares of Stock, as of BS Date Market Price of Common Stock, as of BS Date Walmart Selected Statement of Cash Flow Data Fiscal Year-Ended Jan. 31 \begin{tabular}{|l|c|c|c|} \hline (\$ in million) & Year-End & 2022 & 2021 \\ \hline & (most recent) & & \\ \hline Net Income & 13940 & 13706 & 15201 \\ \hline Net cash from Operating Activities & 24181 & 36074 & 25255 \\ \hline Net cash from Investing Activities & -6015 & -10071 & -9128 \\ \hline Net cash from Financing Activities & -22828 & -16117 & -14299 \\ \hline Effect of Exchange Rate on Cash & -140 & 235 & -69 \\ \hline Net Change in Cash & -2954 & 8273 & 1756 \\ \hline Cash, Beginning & 17788 & 9515 & 7756 \\ \hline Cash, Ending & 14834 & 17788 & 9515 \\ \hline & & & \\ \hline Total Dividends Paid & 6152 & 6116 & 6048 \\ \hline Capital Expenditures & 8155 & 7487 & 6080 \\ \hline \end{tabular} Income Statement Analysis Walmart Selected Income Statement Data Fiscal Year-Ended Jan. 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started