Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.1 Khorab Ltd manufactures chocolate candy. The company's management accounts are drawn up an a monthly basis as per the financial manager's (FM) recommendation. Ms

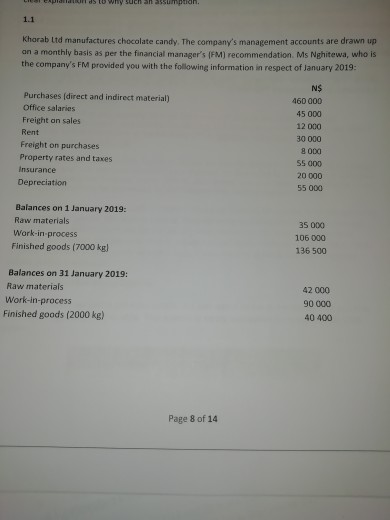

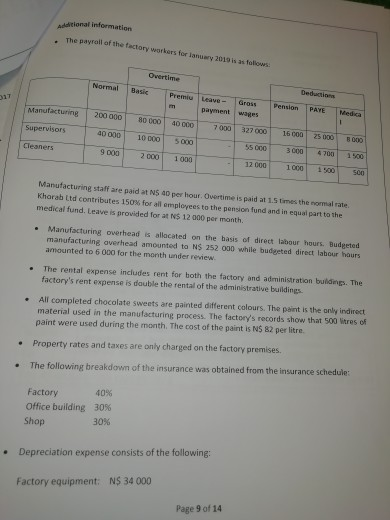

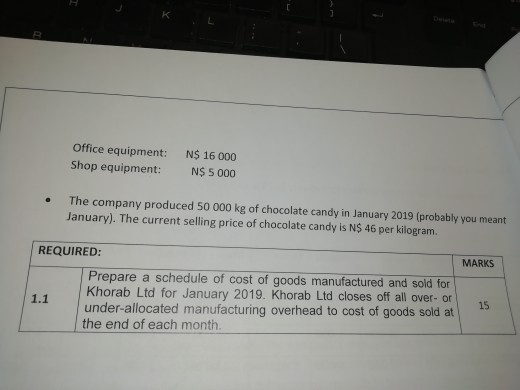

1.1 Khorab Ltd manufactures chocolate candy. The company's management accounts are drawn up an a monthly basis as per the financial manager's (FM) recommendation. Ms Nghitewa, who is the company's FM provided you with the following infarmation in respect of January 2019: Purchases (direct and indirect material) Office salaries Freight on sales Rent Freight on purchases Property rates and taxes Insurance Depreciation N$ 460 000 45 000 12 000 30 000 8 000 55 000 20 000 55 000 Balances on 1 January 2019: Raw materials Work-in process Finished goods (7000 kg 35 000 106 000 136 500 Balances on 31 January 2019: Raw materials Work-in-process 42 000 90 000 40 400 Finished goods (2000 kg) Page 8 of 14 ional information yrall of the factory workers for Januery 2019 is as 1 Overtime Normal|Basic Premiu Leave Gross Pension PAYEMedca payment wages Manufacturing 200 000 80 000 40 000 7000 327 00060025 0008000 Supervisors 40 000 10 000 5000 55 000 3 00047001500 Cleaners 9 000 2 0001000 12 000 1000 1 500500 Manufacturing staf are paid at NS 40 per hour. Owertime is paid at 1.5 times the normal rate Kharab Ltd contributes 150% for all employees to the pension fund and in equal part to th medical fund. Leave is provided for at N$ 12000 per month. Manufacturing overhead is allacated on the basis of direct labour hours. Budgeted manufacturing averhead amounted to N$ 252 000 while budgeted direct labour hours mounted to 6 000 for the month under review. The rental expense includes rent for both the factory and administration buldings. The factory's rent expense is dauble the rental of the administrative buildings . All completed chocolate sweets are painted different colours. The paint is the only indirect material used in the manufacturing process. The factory's records show that 500 itres of paint were used during the month. The cost of the paint is NS 82 per litre. Property rates and taxes are only charged on the factory premises. The following breakdown of the insurance was obtained from the insurance schedule . Factory Office building Shop 40% 30% 30% . Depreciation expense consists of the following: N$ 34 000 Factory equipment: Page 9 of 14 Office equipment: Shop equipment: N$ 16 000 N$ 5 000 . The company produced 50 000 kg of chocolate candy in January 2019 (probably you meant January). The current selling price of chocolate candy is N$ 46 per kilogram. REQUIRED: MARKS Prepare a schedule of cost of goods manufactured and sold for Khorab Ltd for January 2019. Khorab Ltd closes off all over- or under-allocated manufacturing overhead to cost of goods sold at the end of each month 1.1 15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started