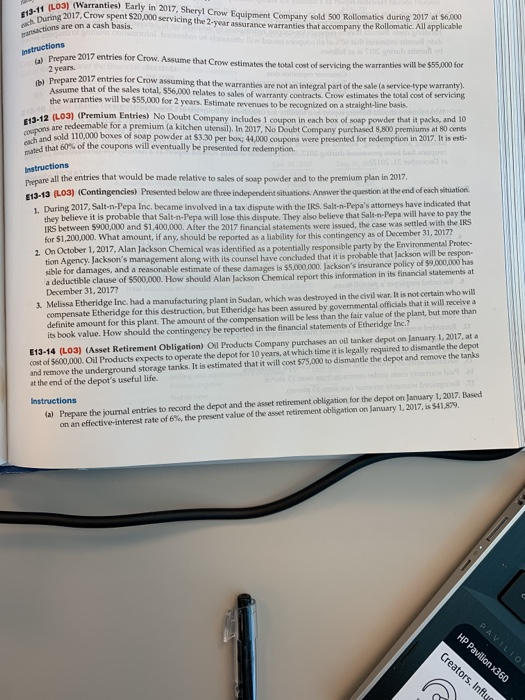

11 (LO3) (Warranties) Early ctions are on a cash basis. et3ring 2017, Crow spent $20,000 servicing the 2-year assurance warranties that accompany the Rollomatic Alf Crow Equipment Company sold 500 Rollomatics during 2017 at $6,000 assurance warranties that accompany the Rollomatic. All applicable Instructions Prepare 2017 entries for Crow. Assume that Crow estimates the total cost of servicing the 2 years. Prepare 2017 entries for Crow assuming that the warranties are not an integral part of the sale (a Assume t e 2017 entries for Crow. Assume that Crow estimates the tota warranties will be $55,000 for that of the sales total, $56,000 relates to sales of warranty contracts service-type warranty). tracts. Crow estimates the total cost of servicing the warranties will be $,000 for 2 years. Estimate revenues to be rescognized on a straight on a straight-line basis. 03) (Premium Entries) No Doubt Company includes 1 coupon in each box of soap powder that it packs, and 10 are redeemable for a premium (a kitchen utensil). In 2017, No Doubt Coempany parchased 8,800 premiums at 80 cents that 60% of the coupons will eventually be presented for redemption. oach and sold 110,000 boof soup powder at $3.30 per box: 44,000 coupons were presented for redemption in 2017. It is esti- nstruetions Prepare all the entries that would be made relative to sales of soup powder and to the premium plan in 2017 E13-13 (L03) (Contingencies) Presented below ane three independent situations. Answer the question at the end of each situation 1. During 2017, Salen-Pepa Inc. became involved in a tax dispute with the IRS, Salt-n-Pepa's attormeys have indicated that they believe it is probable that Salt-n-Pepa will lose this dispute. They also believe that Salt-n-Pepa will have to pay the IRS between $900,000 and $1,400,000. After the 2017 financial statements were issued, the case was settled with the IRS for $1.200,000. What amount, if any, should be reported as a liability for this contingency as of December 31, 20172 ty by the Environmental Protec- luded that it is probable that Jackson will be respon- 2. On October 1, 2017, Alan Jackson Chemical was identified as a potentially responsible par of $9,000,000 has How should Alan Jackson Chemical report this information in its financial statements at . Melissa Etheridge Inc. had a manufacturing plant in Sudan, which was destroyed in the civil war. lt is not certain who will is $5,000,000. Jackson's insu sible for damages, and a reasonable estimate of a deductible clause of $500,000. Ala December 31, 2017? these damages is compensate Etheridge for this destruction, but Etheridge has been assured by governmental officials that it will receive a definite amount for this plant. The amount of the compensation will be less than the fair value of the plant, but more than its book value. How should the contingency be reported in the financial statements of Etheridge Inc E13-14 (LO3) (Asset Retirement Obligation) Oil Products Company purchases an oil tanker depot on January 1, 2017, at a cost of $600,000. Oil Products expects to operate the depot for 10 years, at which time it is legally required to dismantle the depot and remove the underground storage tanks. It is estimated that it will cost $75,000 to dismantle the depot and remove the tanks at the end of the depot's useful life. Instructions la) Prepare the journal entries to record the depot and the asset retinement obligation for the depot on January 1, 2017. Baserd on an effective-interest rate of 6%, the present value of the asset Tetirement obligation on January 1.2017 ssss