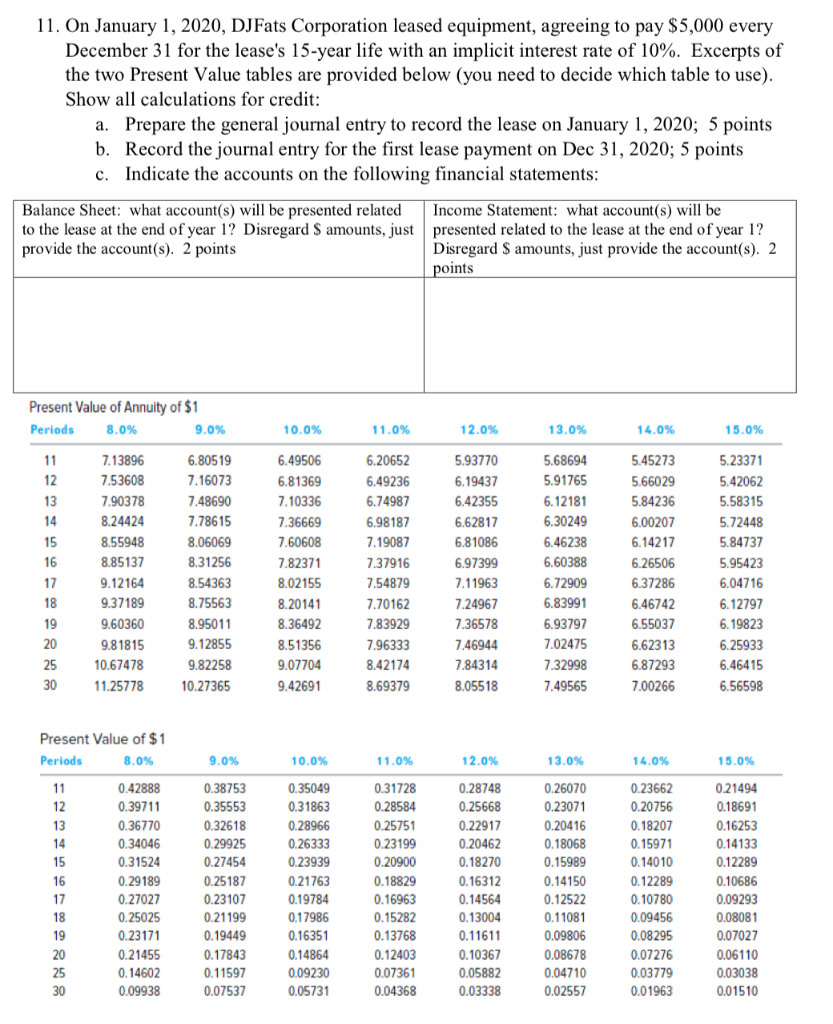

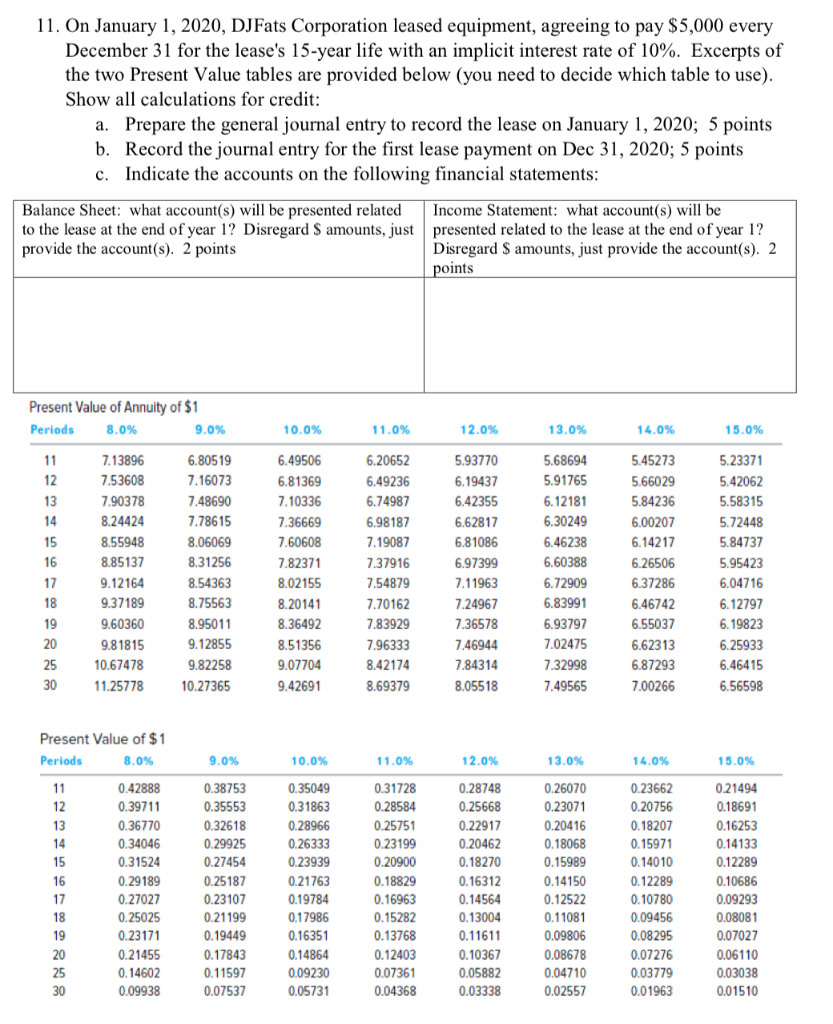

11. On January 1, 2020, DJFats Corporation leased equipment, agreeing to pay $5,000 every December 31 for the lease's 15-year life with an implicit interest rate of 10%. Excerpts of the two Present Value tables are provided below (you need to decide which table to use). Show all calculations for credit: a. Prepare the general journal entry to record the lease on January 1, 2020; 5 points b. Record the journal entry for the first lease payment on Dec 31, 2020; 5 points c. Indicate the accounts on the following financial statements: Balance Sheet: what account(s) will be presented related to the lease at the end of year 1? Disregard $ amounts, just provide the account(s). 2 points Income Statement: what account(s) will be presented related to the lease at the end of year 1? Disregard $ amounts, just provide the account(s). 2 points Present Value of Annuity of $1 Periods 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% 7.13896 7.53608 7.90378 8.24424 8.55948 8.85137 9.12164 9.37189 9.60360 9.81815 10.67478 11.25778 6.80519 7.16073 7.48690 7.78615 8.06069 8.31256 8.54363 8.75563 8.95011 9.12855 9.82258 10.27365 6.49506 6.81369 7.10336 7.36669 7.60608 7.82371 8.02155 8.20141 8.36492 8.51356 9.07704 9.42691 6.20652 6.49236 6.74987 6.98187 7.19087 7.37916 7.54879 7.70162 7.83929 7.96333 8.42174 8.69379 5.93770 6.19437 6.42355 6.62817 6.81086 6.97399 7.11963 7.24967 7.36578 7.46944 7.84314 8.05518 5.68694 5.91765 6.12181 6.30249 6.46238 6.60388 6.72909 6.83991 6.93797 7.02475 7.32998 7.49565 5.45273 5.66029 5.84236 6.00207 6.14217 6.26506 6.37286 6.46742 6.55037 6.62313 6.87293 7.00266 5.23371 5.42062 5.58315 5.72448 5.84737 5.95423 6.04716 6.12797 6.19823 6.25933 6.46415 6.56598 30 Present Value of $1 Periods 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% 0.42888 0.39711 0.36770 0.34046 0.31524 0.29189 0.27027 0.25025 0.23171 0.21455 0.14602 0.09938 0.38753 0.35553 0.32618 0.29925 0.27454 0.25187 0.23107 0.21199 0.19449 0.17843 0.11597 0.07537 0.35049 0.31863 0.28966 0.26333 0.23939 0.21763 0.19784 0.17986 0.16351 0.14864 0.09230 0.05731 0.31728 0.28584 0.25751 0.23199 0.20900 0.18829 0.16963 0.15282 0.13768 0.12403 0.07361 0.04368 0.28748 0.25668 0.22917 0.20462 0.18270 0.16312 0.14564 0.13004 0.11611 0.10367 0.05882 0.03338 0.26070 0.23071 0.20416 0.18068 0.15989 0.14150 0.12522 0.11081 0.09806 0.08678 0.04710 0.02557 0.23662 0.20756 0.18207 0.15971 0.14010 0.12289 0.10780 0.09456 0.08295 0.07276 0.03779 0.01963 0.21494 0.18691 0.16253 0.14133 0.12289 0.10686 0.09293 0.08081 0.07027 0.06110 0.03038 0.01510