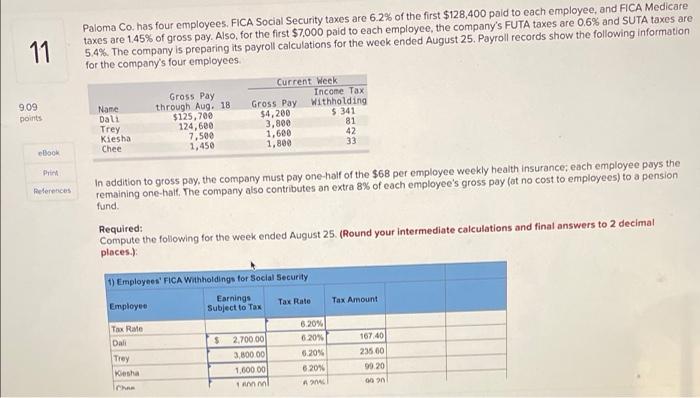

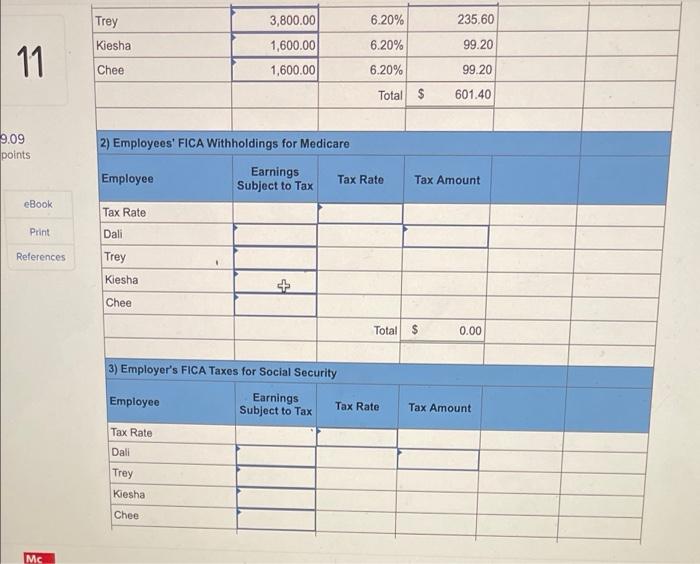

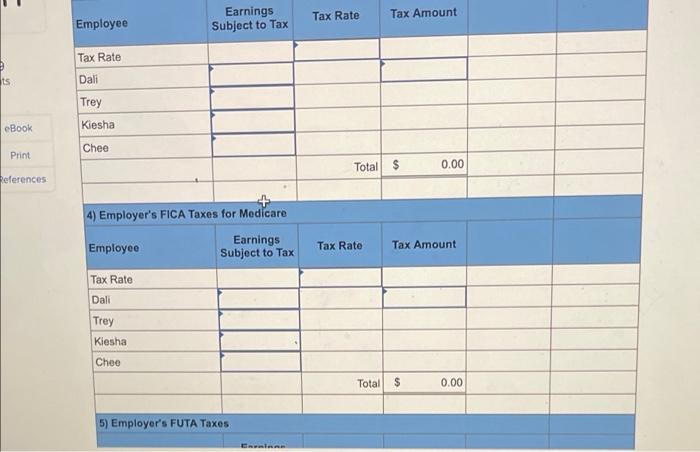

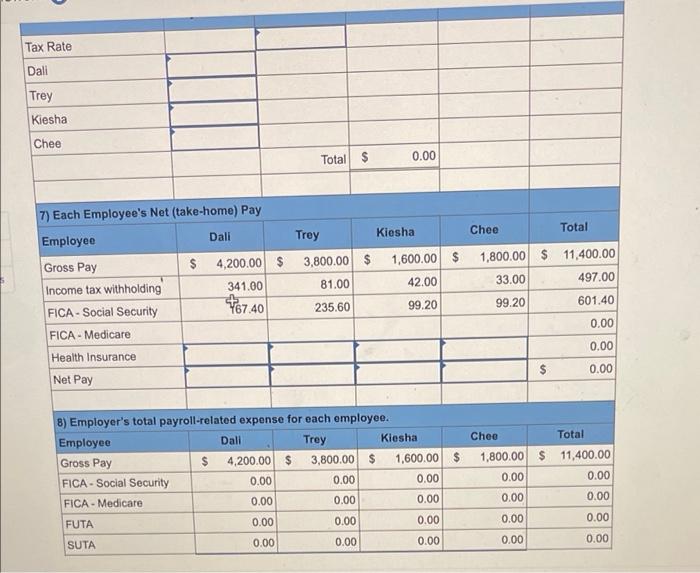

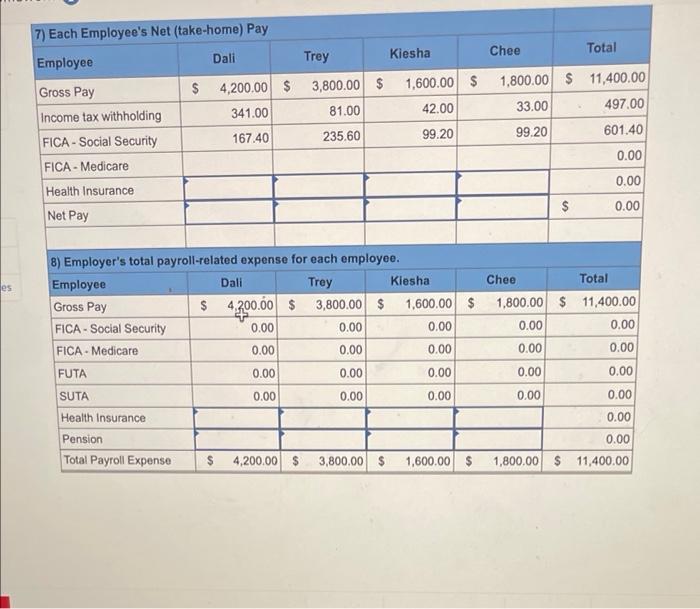

11 Paloma Co. has four employees. FICA Social Security taxes are 6.2% of the first $128,400 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the company's FUTA taxes are 0,6% and SUTA taxes are 5.4%. The company is preparing its payroll calculations for the week ended August 25. Payroll records show the following information for the company's four employees Current Week Gross Pay Income Tax Name through Aug. 18 Gross Pay Withholding Dal $125,700 $4,200 $ 341 124,600 3,800 81 Kiesha 7,500 1,600 Chee 1,450 33 9.09 points Trey 42 1,800 Book Print References In addition to gross pay, the company must pay one half of the $68 per employee weekly health insurance, each employee pays the remaining one-half. The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension fund, Required: Compute the following for the week ended August 25. (Round your intermediate calculations and final answers to 2 decimal places.) Tax Amount 1) Employees' FICA Withholdings for Social Security Earnings Employee Subject to Tax Tax Rate Tax Rate 6.20% Dali $ 2.700.00 6 20% Trey 3,800.00 6.20% Kesha 1,000.00 6.20% Ich am 167.40 235 00 99.20 002 AC 6.20% 235.60 Trey Kiesha 3,800.00 1,600.00 1,600.00 6.20% 99.20 11 Chee 6.20% 99.20 Total $ 601.40 9.09 points Tax Amount 2) Employees' FICA Withholdings for Medicare Employee Earnings Tax Rate Subject to Tax Tax Rate Dali eBook Print References Trey Kiesha + Chee Total $ 0.00 3) Employer's FICA Taxes for Social Security Employee Earnings Tax Rate Subject to Tax Tax Rate Dali Tax Amount Trey Kiesha Chee MC Earnings Subject to Tax Tax Rate Tax Amount Employee Tax Rate ts Dali Trey Kiesha eBook Chee Print Total $ 0.00 References 4) Employer's FICA Taxes for Medicare Employee Earnings Subject to Tax Tax Rate Tax Amount Tax Rate Dali Trey Kiesha Chee Total $ 0.00 5) Employer's FUTA Taxes Tax Rate Dali Trey Kiesha Chee Total $ 0.00 Kiesha Chee Total 7) Each Employee's Net (take-home) Pay Employee Dali Gross Pay $ 4,200.00 $ Income tax withholding 341.00 FICA - Social Security FICA - Medicare Trey 3,800.00 $ 81.00 1,600.00 $ 42.00 99.20 1,800.00 $ 11,400.00 33.00 497.00 $167.40 235.60 99.20 601.40 0.00 0.00 Health Insurance $ 0.00 Net Pay 8) Employer's total payroll-related expense for each employee. Employee Dali Trey Kiesha Gross Pay $ 4,200.00 $ 3,800.00 $ 1,600.00 $ FICA - Social Security 0.00 0.00 0.00 FICA - Medicare 0.00 0.00 0.00 FUTA 0.00 0.00 0.00 SUTA 0.00 0.00 0.00 Chec Total 1,800.00 $ 11,400.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 7) Each Employee's Net (take-home) Pay Dali Trey Kiesha Total Chee $ 1,600.00 $ 4,200.00 $ 341.00 3,800.00 $ 81.00 42.00 Employee Gross Pay Income tax withholding FICA - Social Security FICA - Medicare Health Insurance 1,800.00 $ 11,400.00 33.00 497.00 99.20 601.40 167.40 235.60 99.20 0.00 0.00 $ 0.00 Net Pay es 8) Employer's total payroll-related expense for each employee. Employee Dali Trey Kiesha Gross Pay $ 4,200.00 $ 3,800.00 $ 1,600.00 $ FICA - Social Security 0.00 0.00 0.00 FICA - Medicare 0.00 0.00 0.00 FUTA 0.00 0.00 0.00 SUTA 0.00 0.00 0.00 Health Insurance Pension Total Payroll Expense $ 4,200.00 $ 3,800.00 $ 1,600.00 $ Chee Total 1,800.00 $ 11,400.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 1,800.00 $ 11,400.00