Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(11) Please answer this 2 part question in the exact format shown in The photos Miller Company's contribution format income statement for the most recent

(11) Please answer this 2 part question in the exact format shown in The photos

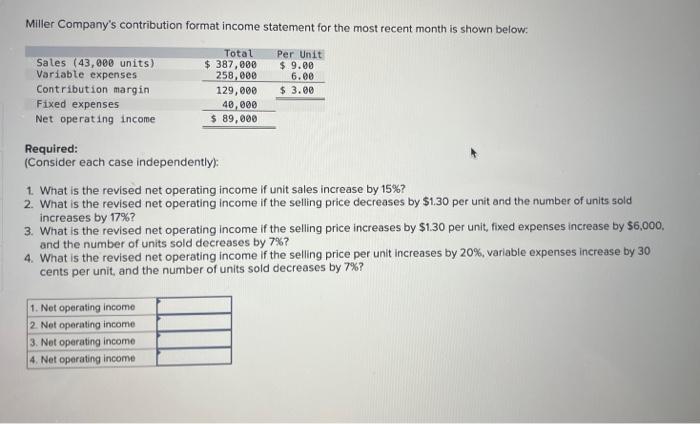

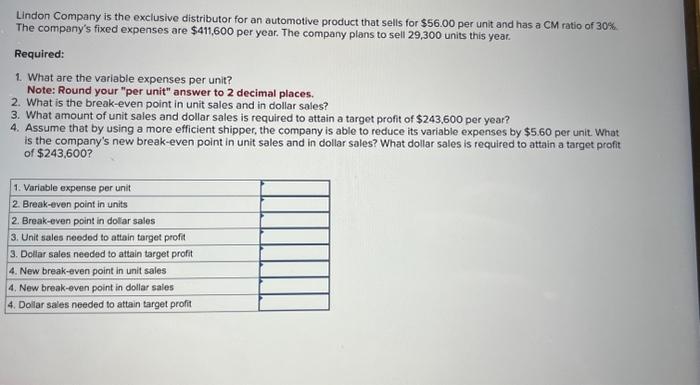

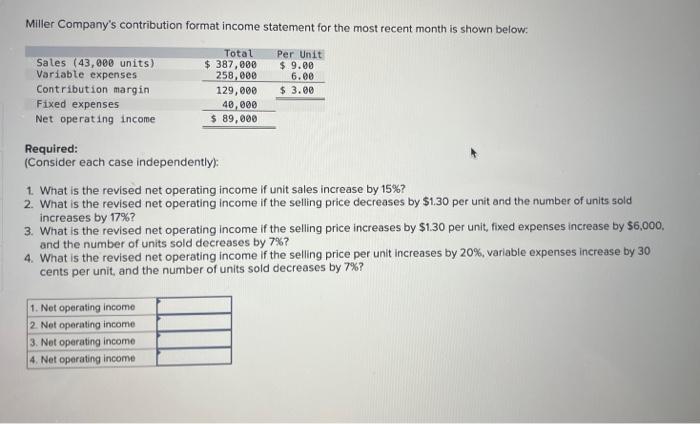

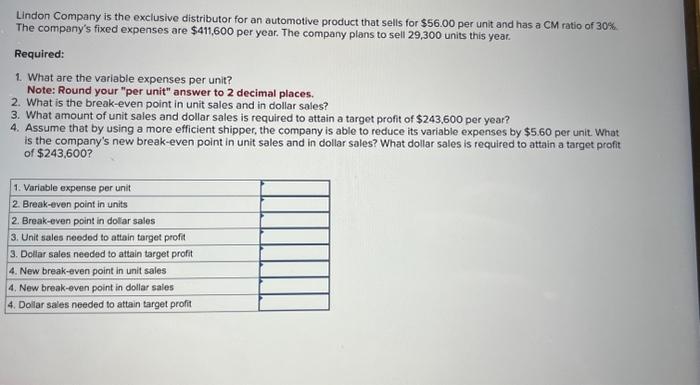

Miller Company's contribution format income statement for the most recent month is shown below: Required: (Consider each case independently): 1. What is the revised net operating income if unit sales increase by 15% ? 2. What is the revised net operating income if the selling price decreases by $1.30 per unit and the number of units sold increases by 17% ? 3. What is the revised net operating income if the selling price increases by $1.30 per unit, fixed expenses increase by $6,000, and the number of units sold decreases by 7% ? 4. What is the revised net operating income if the selling price per unit increases by 20%, variable expenses increase by 30 cents per unit, and the number of units sold decreases by 7% ? Lindon Company is the exclusive distributor for an automotive product that sells for $56.00 per unit and has a CM ratio of 30%. The company's fixed expenses are $411,600 per year. The company plans to sell 29,300 units this year. Required: 1. What are the variable expenses per unit? Note: Round your "per unit" answer to 2 decimal places. 2. What is the break-even point in unit sales and in dollar sales? 3. What amount of unit sales and dollar sales is required to attain a target profit of $243,600 per year? 4. Assume that by using a more efficient shipper, the company is able to reduce its variable expenses by $5.60 per unit. What is the company's new break-even point in unit sales and in dollar sales? What dollar sales is required to attain a target profit of $243,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started