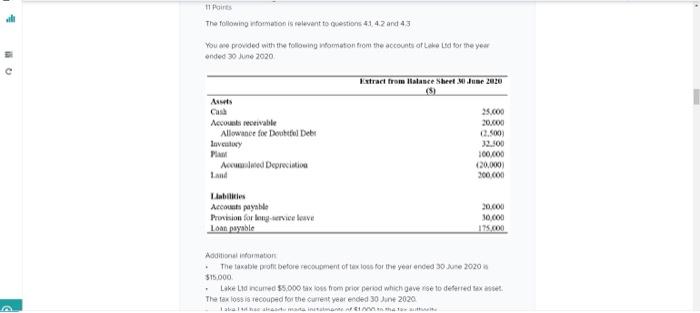

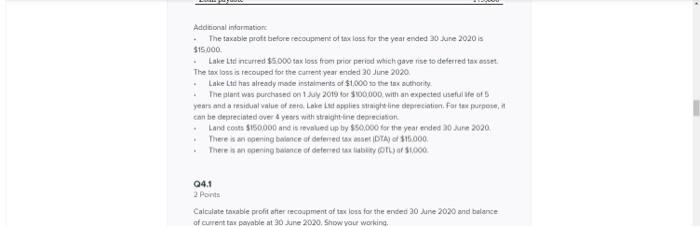

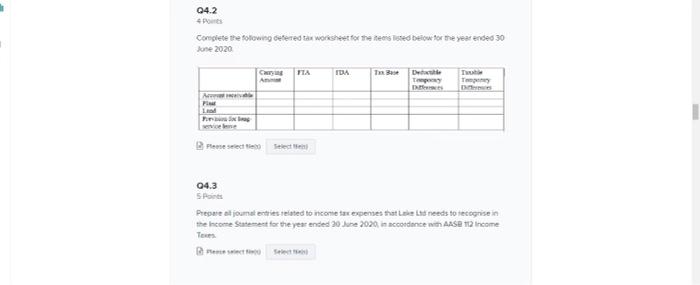

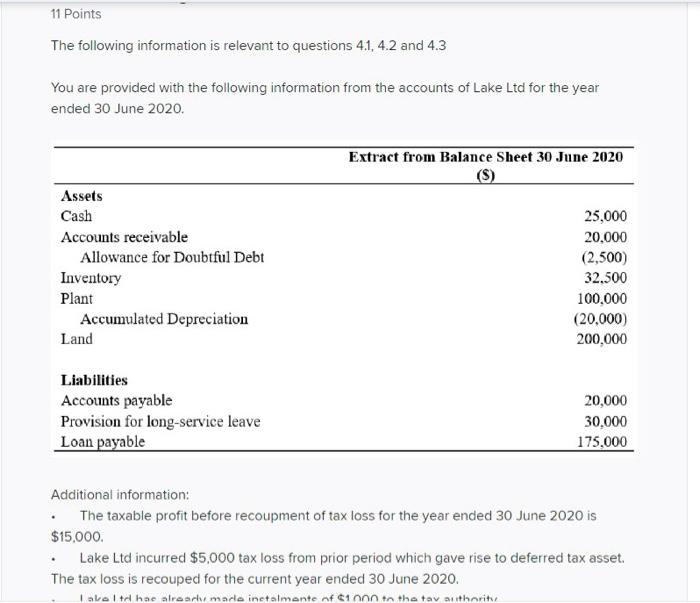

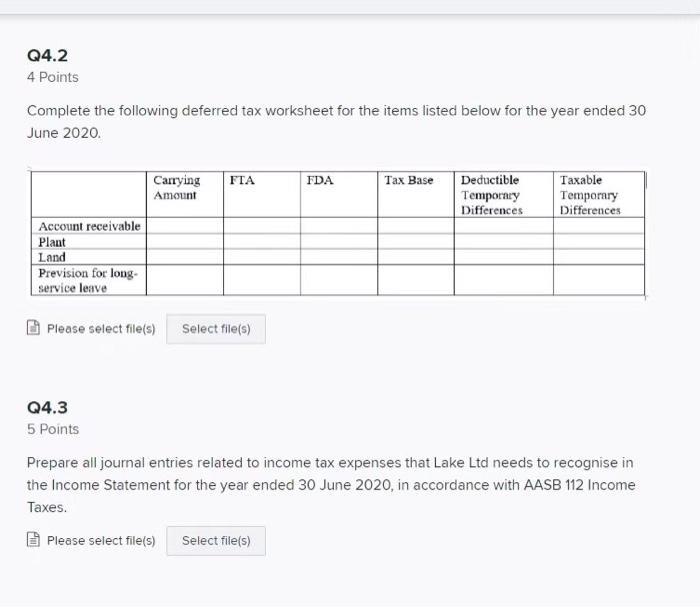

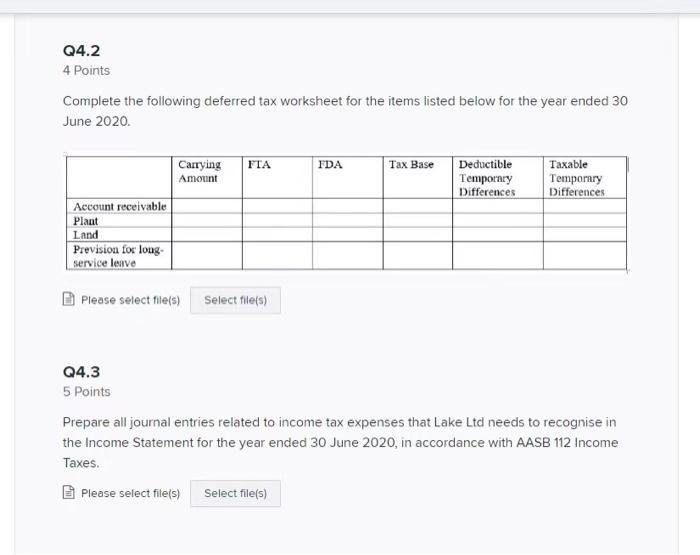

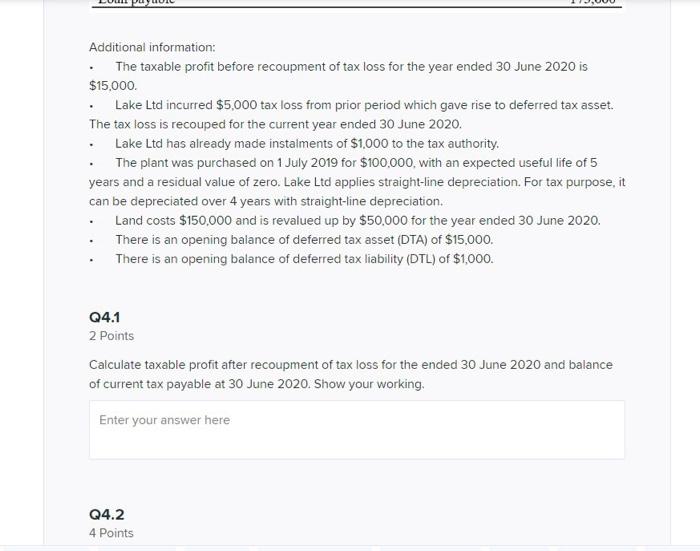

11 Points The following formation is relevant to questions 41, 42 and 43 You we provided with the following tomation from the accounts of the Lid for the year onded 3 June 2020 0 Extract from Halance Sheet 20 June 2010 (8) Cash Accounts receivable Allowance for Dettol Debt lavuty Awaited Depreciation 25.000 20.000 (2.500 32.100 100,00 20.000 300.000 Accounts payable Provision for grove Loan payable 30.000 10.000 175.000 Additional information The taxable profit before recupment of texts for the year endea 30 e 2020 $15.000 Like Lidincurred 55.000 from prior period which gave rise to deferred The foloss is recouped for the current year ended 30 June 2020 Additional information The taxable proft before recoupment of tax loss for the year ended 30 June 2020 is $15.000 Lake Ltd nurred $5.000 ta loss from prior period which gave rise to deferred tax asset The textos is recouped for the current year ended 20 June 2020 Lake Ltd has already made instaliments of $1.000 10 the tax authority The plant was purchased on 1 ay 2019 for $100.000 with an expected sale of years and a situal value of tato Lake Lait applies tighline depreciation. For at purpose, can be deprecinted over 4 years with straight line depreciation Land costs $150,000 and is revalued up by $50,000 for the year ended 20 June 2020 There is an opening bice of deferred taxDTA) of $15.000 There is a coming bace of deferred tax betyr $1.000 Q4.1 2 Ponts Calculate table profiter recopment of the loss for the ended 20 June 2020 and balance of current tax payable at 30 June 2020. Show your working, 04.2 Complete the following defered tax worksheet for the tested below for the year endes 30 June 2020 TTA Am Pores 04.3 5 points Prepare at joumateries related to income tax expenses that needs to recognisen the Income Statement for the year ended 30 June 2020, in accordance with ASB 12 income 11 Points The following information is relevant to questions 4.1, 4.2 and 4.3 You are provided with the following information from the accounts of Lake Ltd for the year ended 30 June 2020. Extract from Balance Sheet 30 June 2020 Assets Cash Accounts receivable Allowance for Doubtful Debt Inventory Plant Accumulated Depreciation Land 25,000 20.000 (2,500) 32.500 100.000 (20,000) 200,000 Liabilities Accounts payable Provision for long-service leave Loan payable 20,000 30,000 175,000 Additional information: The taxable profit before recoupment of tax loss for the year ended 30 June 2020 is $15,000 Lake Ltd incurred $5,000 tax loss from prior period which gave rise to deferred tax asset. The tax loss is recouped for the current year ended 30 June 2020. Lake it hae alreach made instalmente of $1000 to the tav authoritie Q4.2 4 Points Complete the following deferred tax worksheet for the items listed below for the year ended 30 June 2020. FTA FDA Carrying Amount Tax Base Deductible Temporary Differences Taxable Temporary Differences Account receivable Plant Land Prevision for long. service leave Please select file(s) Select file(s) Q4.3 5 Points Prepare all journal entries related to income tax expenses that Lake Ltd needs to recognise in the Income Statement for the year ended 30 June 2020, in accordance with AASB 112 Income Taxes. Please select file(s) Select file(s) Q4.2 4 Points Complete the following deferred tax worksheet for the items listed below for the year ended 30 June 2020. Carrying Amount FTA FDA Tax Base Deductible Temporary Differences Taxable Temporary Differences Account receivable Plant Land Prevision for long- service leave Please select file(s) Select file(s) Q4.3 5 Points Prepare all journal entries related to income tax expenses that Lake Ltd needs to recognise in the Income Statement for the year ended 30 June 2020, in accordance with AASB 112 Income Taxes. Please select file(s) Select file(s) Additional information: The taxable profit before recoupment of tax loss for the year ended 30 June 2020 is $15.000. Lake Ltd incurred $5,000 tax loss from prior period which gave rise to deferred tax asset. The tax loss is recouped for the current year ended 30 June 2020. Lake Ltd has already made instalments of $1,000 to the tax authority. The plant was purchased on 1 July 2019 for $100,000, with an expected useful life of 5 years and a residual value of zero. Lake Ltd applies straight-line depreciation. For tax purpose, it can be depreciated over 4 years with straight-line depreciation. Land costs $150,000 and is revalued up by $50,000 for the year ended 30 June 2020. There is an opening balance of deferred tax asset (DTA) of $15,000. There is an opening balance of deferred tax liability (DTL) of $1,000. Q4.1 2 Points Calculate taxable profit after recoupment of tax loss for the ended 30 June 2020 and balance of current tax payable at 30 June 2020. Show your working, Enter your answer here Q4.2 4 Points 11 Points The following formation is relevant to questions 41, 42 and 43 You we provided with the following tomation from the accounts of the Lid for the year onded 3 June 2020 0 Extract from Halance Sheet 20 June 2010 (8) Cash Accounts receivable Allowance for Dettol Debt lavuty Awaited Depreciation 25.000 20.000 (2.500 32.100 100,00 20.000 300.000 Accounts payable Provision for grove Loan payable 30.000 10.000 175.000 Additional information The taxable profit before recupment of texts for the year endea 30 e 2020 $15.000 Like Lidincurred 55.000 from prior period which gave rise to deferred The foloss is recouped for the current year ended 30 June 2020 Additional information The taxable proft before recoupment of tax loss for the year ended 30 June 2020 is $15.000 Lake Ltd nurred $5.000 ta loss from prior period which gave rise to deferred tax asset The textos is recouped for the current year ended 20 June 2020 Lake Ltd has already made instaliments of $1.000 10 the tax authority The plant was purchased on 1 ay 2019 for $100.000 with an expected sale of years and a situal value of tato Lake Lait applies tighline depreciation. For at purpose, can be deprecinted over 4 years with straight line depreciation Land costs $150,000 and is revalued up by $50,000 for the year ended 20 June 2020 There is an opening bice of deferred taxDTA) of $15.000 There is a coming bace of deferred tax betyr $1.000 Q4.1 2 Ponts Calculate table profiter recopment of the loss for the ended 20 June 2020 and balance of current tax payable at 30 June 2020. Show your working, 04.2 Complete the following defered tax worksheet for the tested below for the year endes 30 June 2020 TTA Am Pores 04.3 5 points Prepare at joumateries related to income tax expenses that needs to recognisen the Income Statement for the year ended 30 June 2020, in accordance with ASB 12 income 11 Points The following information is relevant to questions 4.1, 4.2 and 4.3 You are provided with the following information from the accounts of Lake Ltd for the year ended 30 June 2020. Extract from Balance Sheet 30 June 2020 Assets Cash Accounts receivable Allowance for Doubtful Debt Inventory Plant Accumulated Depreciation Land 25,000 20.000 (2,500) 32.500 100.000 (20,000) 200,000 Liabilities Accounts payable Provision for long-service leave Loan payable 20,000 30,000 175,000 Additional information: The taxable profit before recoupment of tax loss for the year ended 30 June 2020 is $15,000 Lake Ltd incurred $5,000 tax loss from prior period which gave rise to deferred tax asset. The tax loss is recouped for the current year ended 30 June 2020. Lake it hae alreach made instalmente of $1000 to the tav authoritie Q4.2 4 Points Complete the following deferred tax worksheet for the items listed below for the year ended 30 June 2020. FTA FDA Carrying Amount Tax Base Deductible Temporary Differences Taxable Temporary Differences Account receivable Plant Land Prevision for long. service leave Please select file(s) Select file(s) Q4.3 5 Points Prepare all journal entries related to income tax expenses that Lake Ltd needs to recognise in the Income Statement for the year ended 30 June 2020, in accordance with AASB 112 Income Taxes. Please select file(s) Select file(s) Q4.2 4 Points Complete the following deferred tax worksheet for the items listed below for the year ended 30 June 2020. Carrying Amount FTA FDA Tax Base Deductible Temporary Differences Taxable Temporary Differences Account receivable Plant Land Prevision for long- service leave Please select file(s) Select file(s) Q4.3 5 Points Prepare all journal entries related to income tax expenses that Lake Ltd needs to recognise in the Income Statement for the year ended 30 June 2020, in accordance with AASB 112 Income Taxes. Please select file(s) Select file(s) Additional information: The taxable profit before recoupment of tax loss for the year ended 30 June 2020 is $15.000. Lake Ltd incurred $5,000 tax loss from prior period which gave rise to deferred tax asset. The tax loss is recouped for the current year ended 30 June 2020. Lake Ltd has already made instalments of $1,000 to the tax authority. The plant was purchased on 1 July 2019 for $100,000, with an expected useful life of 5 years and a residual value of zero. Lake Ltd applies straight-line depreciation. For tax purpose, it can be depreciated over 4 years with straight-line depreciation. Land costs $150,000 and is revalued up by $50,000 for the year ended 30 June 2020. There is an opening balance of deferred tax asset (DTA) of $15,000. There is an opening balance of deferred tax liability (DTL) of $1,000. Q4.1 2 Points Calculate taxable profit after recoupment of tax loss for the ended 30 June 2020 and balance of current tax payable at 30 June 2020. Show your working, Enter your answer here Q4.2 4 Points