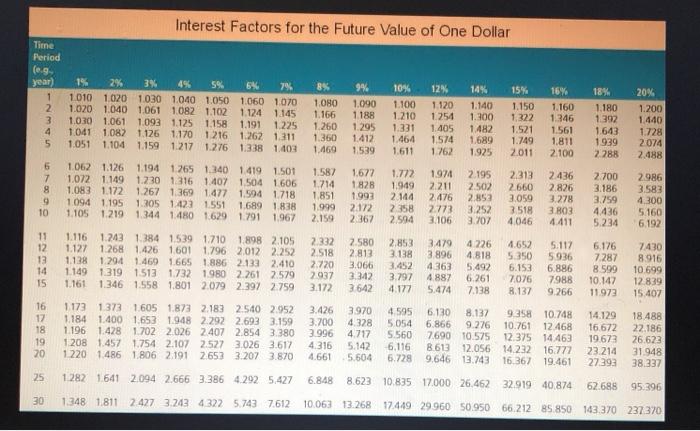

11. Problem 7-11 eBook Problem 7 11 You purchase a stock for $15 and expect its price to grow annually at a rate of percent Us Appendix A to answer the questions. Round your answers to the nearest cent What orice are you expecting after seven years? + h. If the rate of increase in the price doubled from percent to 14 percent would that double the news in the price Doubling the growth rate the price appreciation. The increase in the price at is and at 14% Interest Factors for the Future Value of One Dollar Time Period (e.g year) 1 2 3 4 5 15 2% 3% 5% 6% 7% 1010 1020 1030 1040 1.050 1060 1070 1.020 1.040 1.061 1.082 1.102 1.124 1.145 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1041 1.082 1126 1.170 1216 1.262 1.311 1.051 1.104 1159 1217 1.276 1338 1403 8% 1.080 1.166 1.260 1.360 1.469 9% 1.090 1188 1.295 1.412 1539 10% 1.100 1.210 1.331 1.464 1.611 12% 1.120 1.254 1.405 1574 1762 14% 1.140 1.300 1.482 1.689 1925 15% 1.150 1.322 1.521 1.749 2011 16% 1.160 1346 1.561 1.811 2100 18% 1.180 1392 1.643 1939 2288 20% 1.200 1.440 1.728 2074 2.488 6 7 8 9 10 1062 1.126 1.194 1.265 1.340 1.419 1.501 1.587 1.072 1149 1.230 1316 1407 1504 1606 1714 1.083 1.172 1.267 1.369 1477 1.594 1718 1851 1094 1195 1.305 1423 1551 1.689 1838 1999 1.105 1.219 1344 1.480 1629 1791 1967 2.159 2700 3.186 1.677 1828 1.993 2.172 2.367 1.772 1.949 2.144 2358 2.594 1.974 2.211 2.476 2773 3.106 2.195 2.502 2.852 3.252 3.707 2.313 2660 3.059 3.518 4046 2436 2.826 3.278 3803 4.411 3.759 2986 3.583 4300 5.160 6.192 4436 5.234 11 12 13 14 15 1.116 1.243 1.384 1.539 1710 1.898 2.105 1.127 1.268 1426 1601 1796 2012 2.252 1.138 1.294 1460 1665 1886 2133 2.410 1.149 1319 15131732 1980 2.261 2.579 1.161 1.346 1.558 1.801 2.079 2.397 2.759 2332 2.518 2.720 2937 3.172 7.580 2.813 3.066 3.342 3.642 2.853 3.138 3.452 3.797 4.177 3.479 3.896 4363 4.887 5.474 4.226 4.818 5.492 6.261 7.138 4.652 5.350 6.153 7076 8.137 5.117 5936 6.886 7988 9,266 6.176 7.287 8.599 10.147 11.973 7430 8.916 10.699 12.839 15 407 16 17 18 19 20 1.173 1373 1.605 1.873 2.183 2540 2.952 1.184 1.400 1.653 1.948 2.292 2.693 3.159 1.196 1.428 1702 2026 2407 2.854 3.380 1208 1.457 1.754 2.107 2.527 3.026 3.617 1220 1.486 1.806 2.191 2653 3.207 3.870 3.426 3.700 3.996 4316 4.661 3.970 4,328 4717 5.142 5.604 4.595 5.054 5 560 6.116 6.728 6.130 8.137 9358 10.748 6.866 9.276 10.761 12.468 7690 10.575 12.375 14.463 8.613 12.056 14.232 16.777 9.646 13.743 16.367 19.461 14.129 16,672 19.673 23.214 27.393 18.488 22.186 26.623 31 948 38.337 25 1 282 1641 2.094 2.666 3.386 4.292 5.427 68.48 8.623 10.83517.000 26.462 32.919 40 874 62.688 95.396 30 1348 1.811 2.427 3.243 4322 5.743 7612 10.063 13.268 1744929960 50.950 66.212 85.850 143,370 237370