Question

11. Red Flag, Inc. currently produces Kids Scooters for sales under its own logo. They are also making the wheels that are the part of

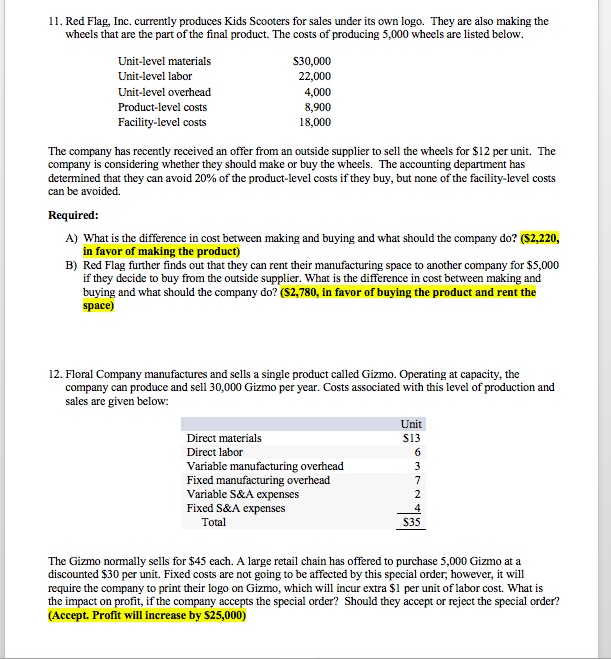

11. Red Flag, Inc. currently produces Kids Scooters for sales under its own logo. They are also making the wheels that are the part of the final product. The costs of producing 5,000 wheels are listed below. Unit-level materials $30,000 Unit-level labor 22,000 Unit-level overhead 4,000 Product-level costs 8,900 Facility-level costs 18,000 The company has recently received an offer from an outside supplier to sell the wheels for $12 per unit. The company is considering whether they should make or buy the wheels. The accounting department has determined that they can avoid 20% of the product-level costs if they buy, but none of the facility-level costs can be avoided. Required: A) What is the difference in cost between making and buying and what should the company do?

11. Red Flag, Inc. currently produces Kids Scooters for sales under its own logo. They are also making the wheels that are the part of the final product. The costs of producing 5,000 wheels are listed below. Unit-level materials $30,000 Unit-level labor 22,000 Unit-level overhead 4,000 Product-level costs 8,900 Facility-level costs 18,000 The company has recently received an offer from an outside supplier to sell the wheels for $12 per unit. The company is considering whether they should make or buy the wheels. The accounting department has determined that they can avoid 20% of the product-level costs if they buy, but none of the facility-level costs can be avoided. Required: A) What is the difference in cost between making and buying and what should the company do?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started