Answered step by step

Verified Expert Solution

Question

1 Approved Answer

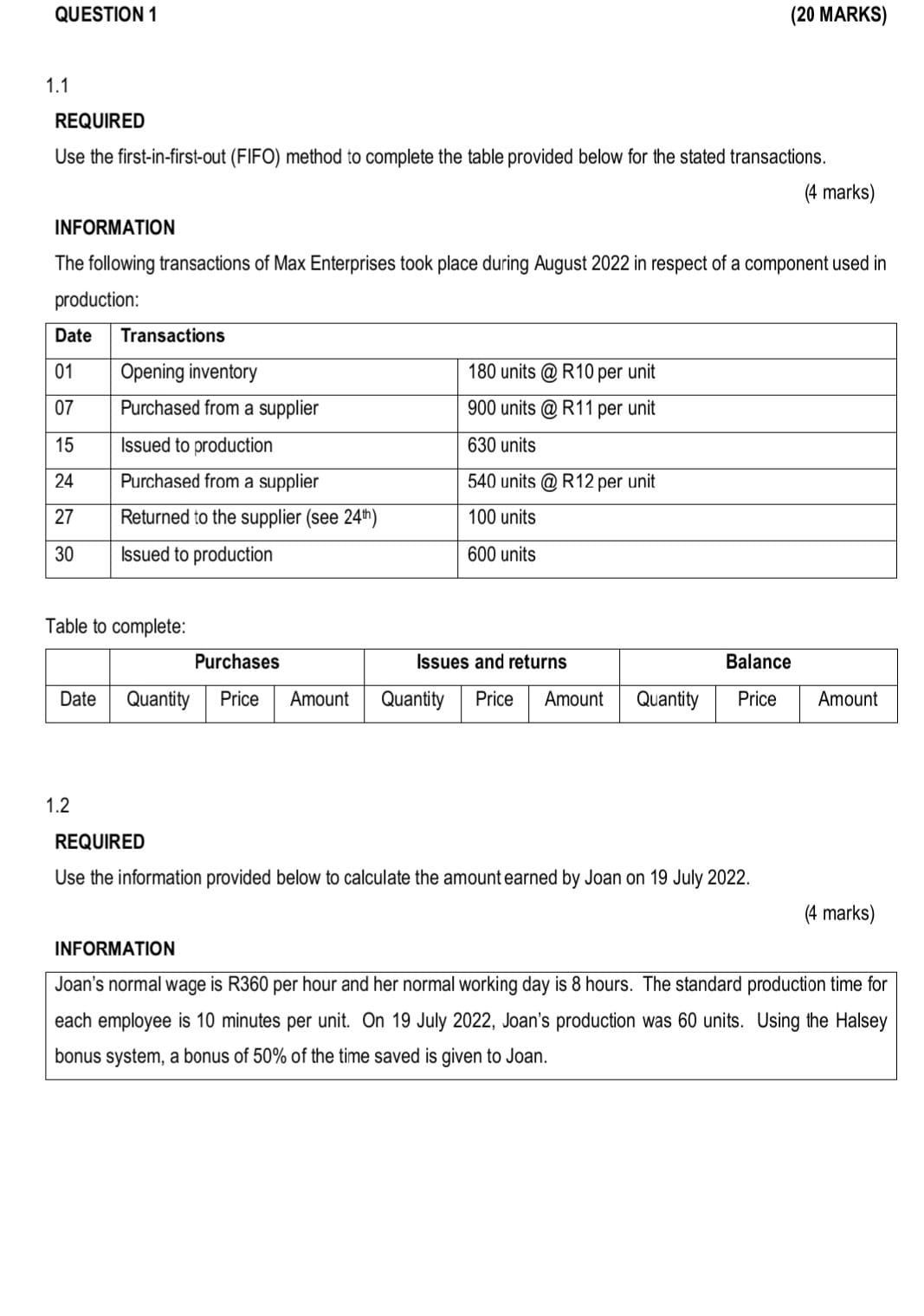

1.1 REQUIRED Use the first-in-first-out (FIFO) method to complete the table provided below for the stated transactions. (4 marks) INFORMATION The following transactions of Max

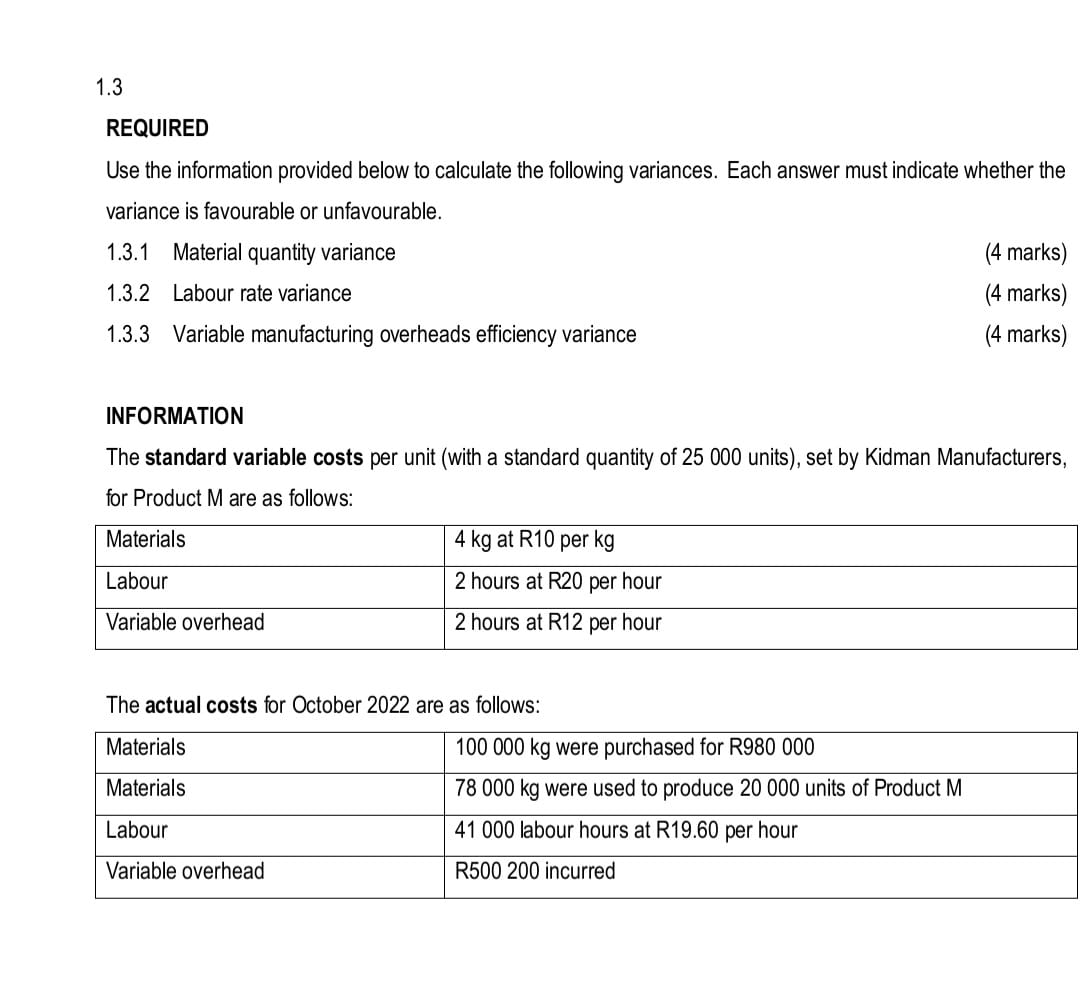

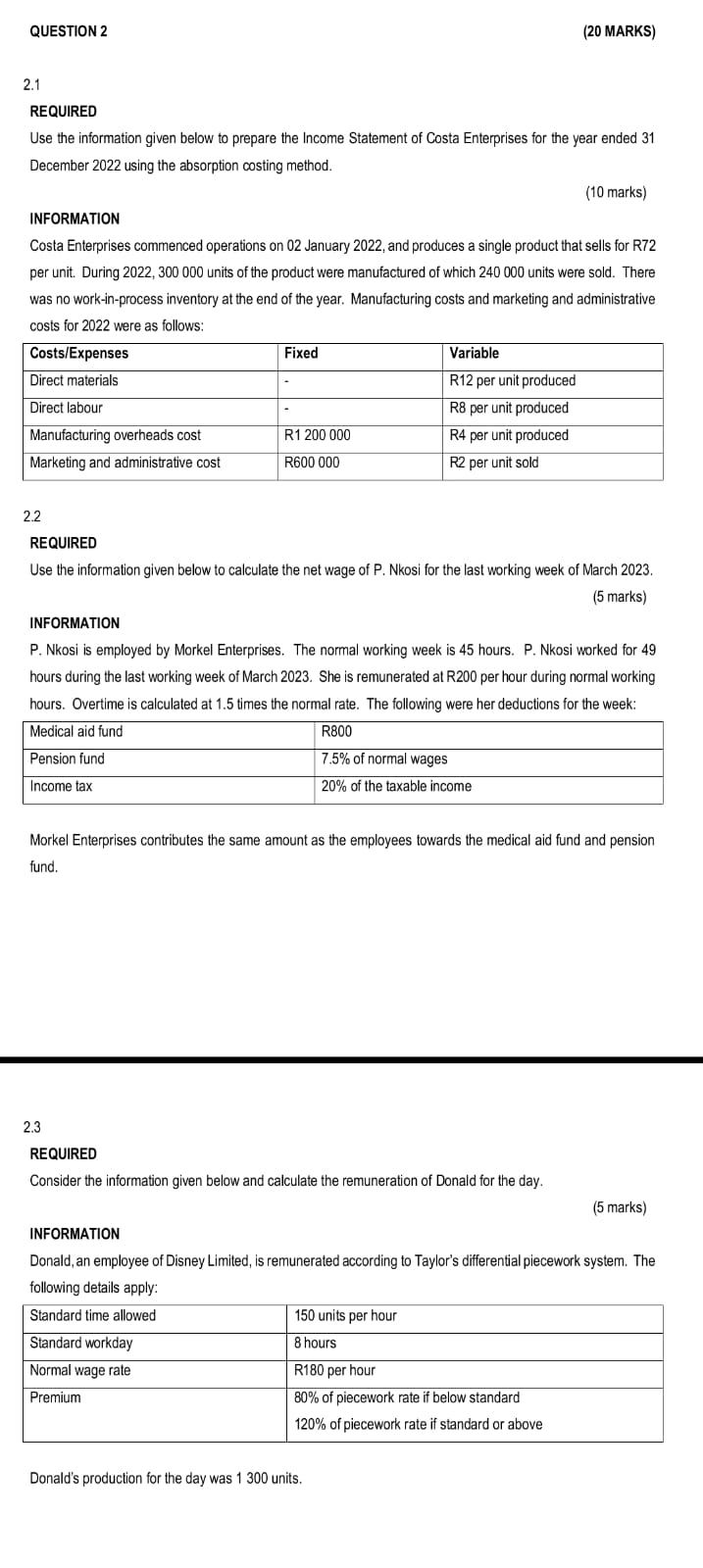

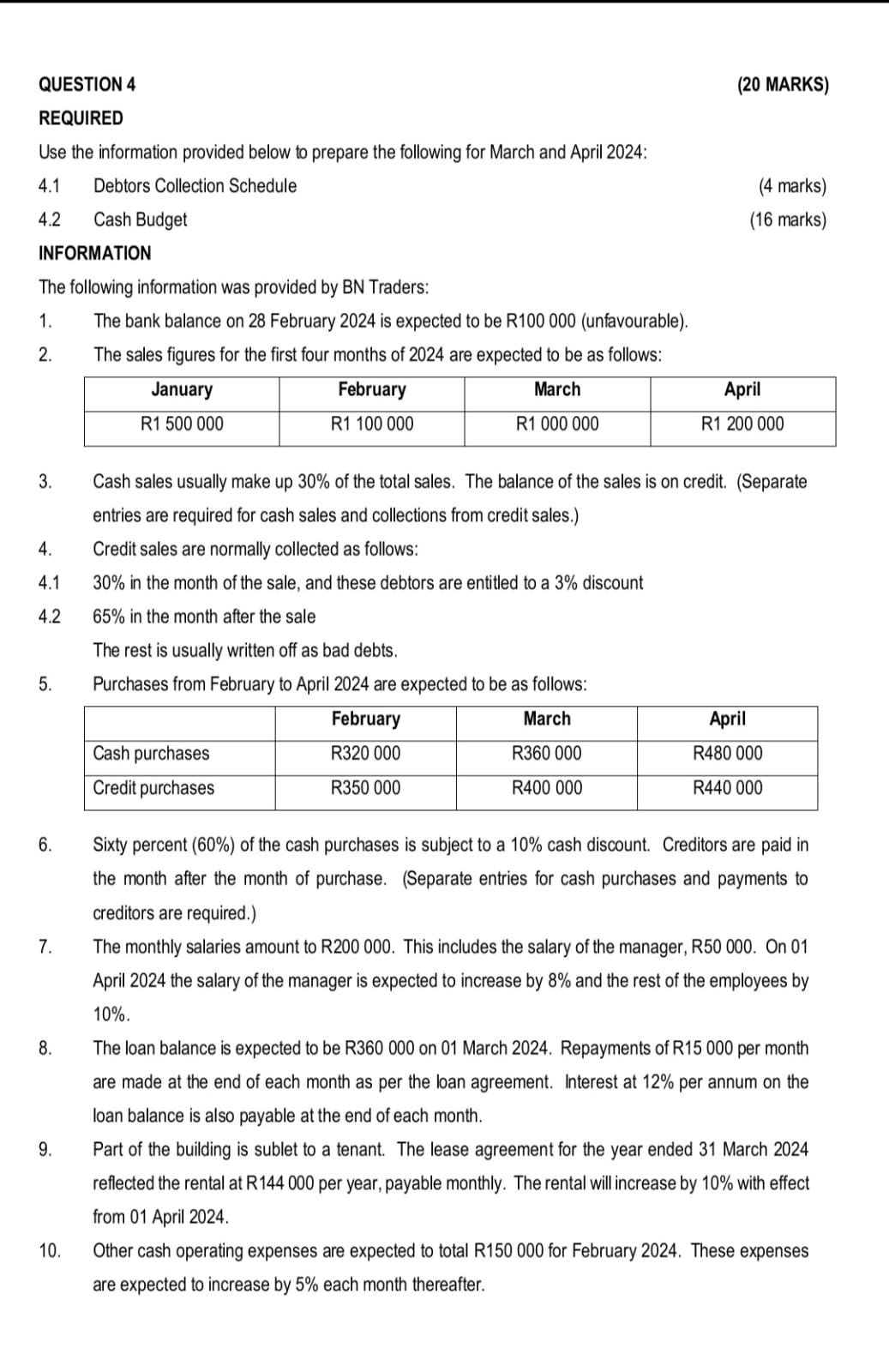

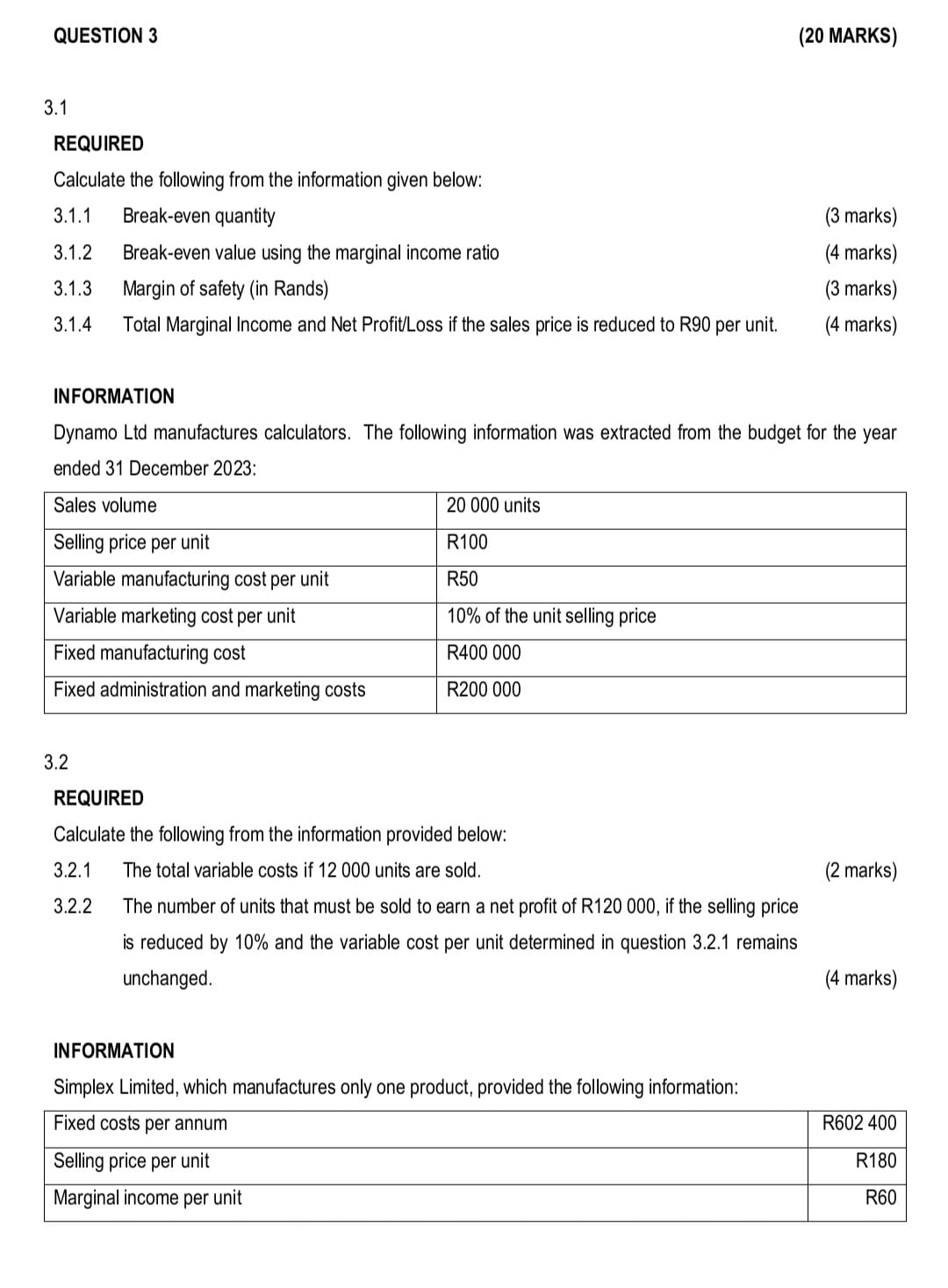

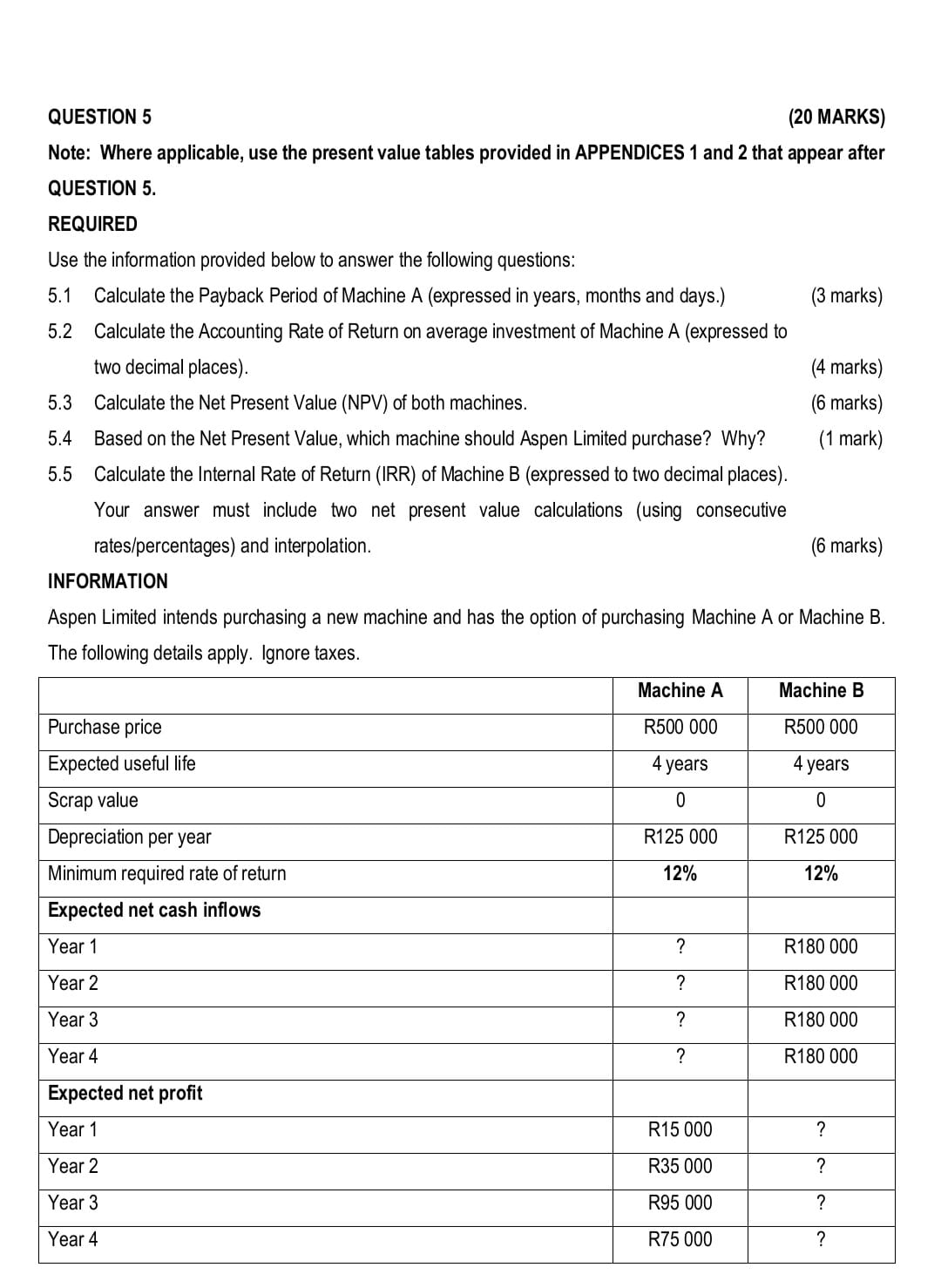

1.1 REQUIRED Use the first-in-first-out (FIFO) method to complete the table provided below for the stated transactions. (4 marks) INFORMATION The following transactions of Max Enterprises took place during August 2022 in respect of a component used in production: Table to complete: 1.2 REQUIRED Use the information provided below to calculate the amount earned by Joan on 19 July 2022. (4 marks) INFORMATION Joan's normal wage is R360 per hour and her normal working day is 8 hours. The standard production time for each employee is 10 minutes per unit. On 19 July 2022, Joan's production was 60 units. Using the Halsey bonus system, a bonus of 50% of the time saved is given to Joan. REQUIRED Use the information provided below to calculate the following variances. Each answer must indicate whether the variance is favourable or unfavourable. 1.3.1 Material quantity variance (4 marks) 1.3.2 Labour rate variance (4 marks) 1.3.3 Variable manufacturing overheads efficiency variance (4 marks) INFORMATION The standard variable costs per unit (with a standard quantity of 25000 units), set by Kidman Manufacturers, for Product M are as follows: The actual costs for October 2022 are as follows: 2.1 REQUIRED Use the information given below to prepare the Income Statement of Costa Enterprises for the year ended 31 December 2022 using the absorption costing method. (10 marks) INFORMATION Costa Enterprises commenced operations on 02 January 2022, and produces a single product that sells for R72 per unit. During 2022, 300000 units of the product were manufactured of which 240000 units were sold. There was no work-in-process inventory at the end of the year. Manufacturing costs and marketing and administrative costs for 2022 were as follows: 2.2 REQUIRED Use the information given below to calculate the net wage of P. Nkosi for the last working week of March 2023. (5 marks) INFORMATION P. Nkosi is employed by Morkel Enterprises. The normal working week is 45 hours. P. Nkosi worked for 49 hours during the last working week of March 2023. She is remunerated at R200 per hour during normal working hours. Overtime is calculated at 1.5 times the normal rate. The following were her deductions for the week: Morkel Enterprises contributes the same amount as the employees towards the medical aid fund and pension fund. 2.3 REQUIRED Consider the information given below and calculate the remuneration of Donald for the day. (5 marks) INFORMATION Donald, an employee of Disney Limited, is remunerated according to Taylor's differential piecework system. The following details apply: Donald's production for the day was 1300 units. QUESTION 4 (20 MARKS) REQUIRED Use the information provided below to prepare the following for March and April 2024: 4.1 Debtors Collection Schedule (4 marks) 4.2 Cash Budget (16 marks) INFORMATION The following information was provided by BN Traders: 1. The bank balance on 28 February 2024 is expected to be R100 000 (unfavourable). 2. The sales figures for the first four months of 2024 are expected to be as follows: 3. Cash sales usually make up 30% of the total sales. The balance of the sales is on credit. (Separate entries are required for cash sales and collections from credit sales.) 4. Credit sales are normally collected as follows: 4.130% in the month of the sale, and these debtors are entitled to a 3% discount 4.265% in the month after the sale The rest is usually written off as bad debts. 5. Purchases from February to April 2024 are expected to be as follows: 6. Sixty percent (60%) of the cash purchases is subject to a 10% cash discount. Creditors are paid in the month after the month of purchase. (Separate entries for cash purchases and payments to creditors are required.) 7. The monthly salaries amount to R200 000. This includes the salary of the manager, R50 000 . On 01 April 2024 the salary of the manager is expected to increase by 8% and the rest of the employees by 10%. 8. The loan balance is expected to be R360 000 on 01 March 2024. Repayments of R15000 per month are made at the end of each month as per the loan agreement. Interest at 12% per annum on the loan balance is also payable at the end of each month. 9. Part of the building is sublet to a tenant. The lease agreement for the year ended 31 March 2024 reflected the rental at R144 000 per year, payable monthly. The rental will increase by 10% with effect from 01 April 2024. 10. Other cash operating expenses are expected to total R150 000 for February 2024. These expenses are expected to increase by 5% each month thereafter. INFORMATION Dynamo Ltd manufactures calculators. The following information was extracted from the budget for the year ended 31 December 2023: 3.2 REQUIRED Calculate the following from the information provided below: 3.2.1 The total variable costs if 12000 units are sold. ( 2 marks) 3.2.2 The number of units that must be sold to earn a net profit of R120 000 , if the selling price is reduced by 10% and the variable cost per unit determined in question 3.2.1 remains unchanged. (4 marks) QUESTION 5 (20 MARKS) Note: Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. REQUIRED Use the information provided below to answer the following questions: 5.1 Calculate the Payback Period of Machine A (expressed in years, months and days.) (3 marks) 5.2 Calculate the Accounting Rate of Return on average investment of Machine A (expressed to two decimal places). (4 marks) 5.3 Calculate the Net Present Value (NPV) of both machines. (6 marks) 5.4 Based on the Net Present Value, which machine should Aspen Limited purchase? Why? (1 mark) 5.5 Calculate the Internal Rate of Return (IRR) of Machine B (expressed to two decimal places). Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. (6 marks) INFORMATION Aspen Limited intends purchasing a new machine and has the option of purchasing Machine A or Machine B

1.1 REQUIRED Use the first-in-first-out (FIFO) method to complete the table provided below for the stated transactions. (4 marks) INFORMATION The following transactions of Max Enterprises took place during August 2022 in respect of a component used in production: Table to complete: 1.2 REQUIRED Use the information provided below to calculate the amount earned by Joan on 19 July 2022. (4 marks) INFORMATION Joan's normal wage is R360 per hour and her normal working day is 8 hours. The standard production time for each employee is 10 minutes per unit. On 19 July 2022, Joan's production was 60 units. Using the Halsey bonus system, a bonus of 50% of the time saved is given to Joan. REQUIRED Use the information provided below to calculate the following variances. Each answer must indicate whether the variance is favourable or unfavourable. 1.3.1 Material quantity variance (4 marks) 1.3.2 Labour rate variance (4 marks) 1.3.3 Variable manufacturing overheads efficiency variance (4 marks) INFORMATION The standard variable costs per unit (with a standard quantity of 25000 units), set by Kidman Manufacturers, for Product M are as follows: The actual costs for October 2022 are as follows: 2.1 REQUIRED Use the information given below to prepare the Income Statement of Costa Enterprises for the year ended 31 December 2022 using the absorption costing method. (10 marks) INFORMATION Costa Enterprises commenced operations on 02 January 2022, and produces a single product that sells for R72 per unit. During 2022, 300000 units of the product were manufactured of which 240000 units were sold. There was no work-in-process inventory at the end of the year. Manufacturing costs and marketing and administrative costs for 2022 were as follows: 2.2 REQUIRED Use the information given below to calculate the net wage of P. Nkosi for the last working week of March 2023. (5 marks) INFORMATION P. Nkosi is employed by Morkel Enterprises. The normal working week is 45 hours. P. Nkosi worked for 49 hours during the last working week of March 2023. She is remunerated at R200 per hour during normal working hours. Overtime is calculated at 1.5 times the normal rate. The following were her deductions for the week: Morkel Enterprises contributes the same amount as the employees towards the medical aid fund and pension fund. 2.3 REQUIRED Consider the information given below and calculate the remuneration of Donald for the day. (5 marks) INFORMATION Donald, an employee of Disney Limited, is remunerated according to Taylor's differential piecework system. The following details apply: Donald's production for the day was 1300 units. QUESTION 4 (20 MARKS) REQUIRED Use the information provided below to prepare the following for March and April 2024: 4.1 Debtors Collection Schedule (4 marks) 4.2 Cash Budget (16 marks) INFORMATION The following information was provided by BN Traders: 1. The bank balance on 28 February 2024 is expected to be R100 000 (unfavourable). 2. The sales figures for the first four months of 2024 are expected to be as follows: 3. Cash sales usually make up 30% of the total sales. The balance of the sales is on credit. (Separate entries are required for cash sales and collections from credit sales.) 4. Credit sales are normally collected as follows: 4.130% in the month of the sale, and these debtors are entitled to a 3% discount 4.265% in the month after the sale The rest is usually written off as bad debts. 5. Purchases from February to April 2024 are expected to be as follows: 6. Sixty percent (60%) of the cash purchases is subject to a 10% cash discount. Creditors are paid in the month after the month of purchase. (Separate entries for cash purchases and payments to creditors are required.) 7. The monthly salaries amount to R200 000. This includes the salary of the manager, R50 000 . On 01 April 2024 the salary of the manager is expected to increase by 8% and the rest of the employees by 10%. 8. The loan balance is expected to be R360 000 on 01 March 2024. Repayments of R15000 per month are made at the end of each month as per the loan agreement. Interest at 12% per annum on the loan balance is also payable at the end of each month. 9. Part of the building is sublet to a tenant. The lease agreement for the year ended 31 March 2024 reflected the rental at R144 000 per year, payable monthly. The rental will increase by 10% with effect from 01 April 2024. 10. Other cash operating expenses are expected to total R150 000 for February 2024. These expenses are expected to increase by 5% each month thereafter. INFORMATION Dynamo Ltd manufactures calculators. The following information was extracted from the budget for the year ended 31 December 2023: 3.2 REQUIRED Calculate the following from the information provided below: 3.2.1 The total variable costs if 12000 units are sold. ( 2 marks) 3.2.2 The number of units that must be sold to earn a net profit of R120 000 , if the selling price is reduced by 10% and the variable cost per unit determined in question 3.2.1 remains unchanged. (4 marks) QUESTION 5 (20 MARKS) Note: Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. REQUIRED Use the information provided below to answer the following questions: 5.1 Calculate the Payback Period of Machine A (expressed in years, months and days.) (3 marks) 5.2 Calculate the Accounting Rate of Return on average investment of Machine A (expressed to two decimal places). (4 marks) 5.3 Calculate the Net Present Value (NPV) of both machines. (6 marks) 5.4 Based on the Net Present Value, which machine should Aspen Limited purchase? Why? (1 mark) 5.5 Calculate the Internal Rate of Return (IRR) of Machine B (expressed to two decimal places). Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. (6 marks) INFORMATION Aspen Limited intends purchasing a new machine and has the option of purchasing Machine A or Machine B Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started