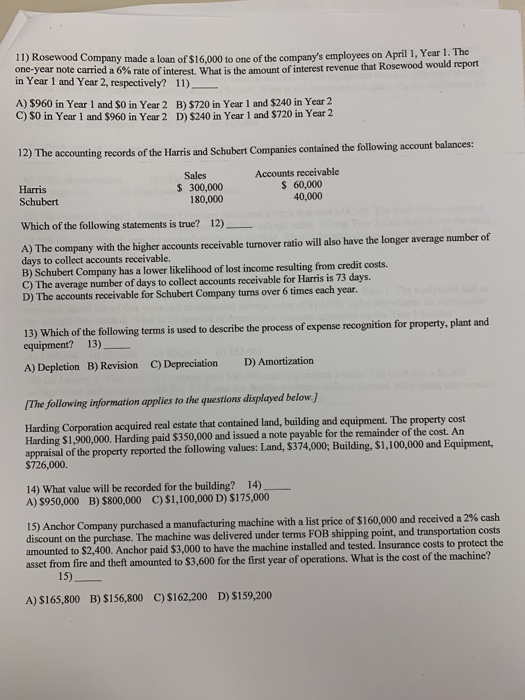

11) Rosewood Company made a loan of $16,000 to one of the company's employees on April 1, Year 1. The one-year note carried a 6% rate of interest what is the amount of interest revenue that Rosewood in Year 1 and Year 2, respectively? 1 1)- would report A) $960 in Year 1 and $0 in Year 2 C) S0 in Year 1 and $960 in Year 2 B) S720 in Year 1 and $240 in Year 2 D) $240 in Year 1 and $720 in Year 2 12) The accounting records of the Harris and Schubert Companies contained the following account bal Sales $ 300,000 Accounts receivable Harris S 60,000 40,000 Schubert Which of the following statements is true? 12) A) The company with the higher accounts receivable turnover ratio will also have the longer average number of 180,000 days to collect accounts receivable. B) Schubert Company has a lower likelibhood of lost income resulting from credit costs. C) The average number of days to collect accounts receivable for Harris is 73 days. D) The accounts receivable for Schubert Company turns over 6 times each year. 13) Which of the following terms is used to describe the process of expense recognition for equipment? 13) A) Depletion B) Revision C) Depreciation D) Amortization The following information applies to the questions displayed below.J Harding Corporation acquired real estate that contained land, building and equipment. The property cost Harding $1,900,000. Harding paid $350,000 and issued a note payable for the remainder of the cost. An appraisal of the property reported the following values: Land, $374,000; Building,$1,100,000 and Equipment, $726,000. 14) What value will be recorded for the building? 14) A) S950,000 B)$800,000 C)$1,100,000 D) $175,000 15) Anchor Company purchased a manufacturing machine with a list price of $160,000 and received a 2% cash discount on the purchase. The machine was delivered under terms FOB shipping point, and transportation costs amounted to $2,400. Anchor paid $3,000 to have the machine installed and tested. Insurance costs to protect the asset from fire and theft amounted to $3,600 for the first year of operations. What is the cost of the machine? 15) A) S165,800 B) S156,800 C)$162,200 D) $159,200