Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11. Sales A) taxes collected by a retailer are recorded by crediting Sales Taxes Payable. ) crediting Sales Tax Revenue C) D) debiting Sales Tax

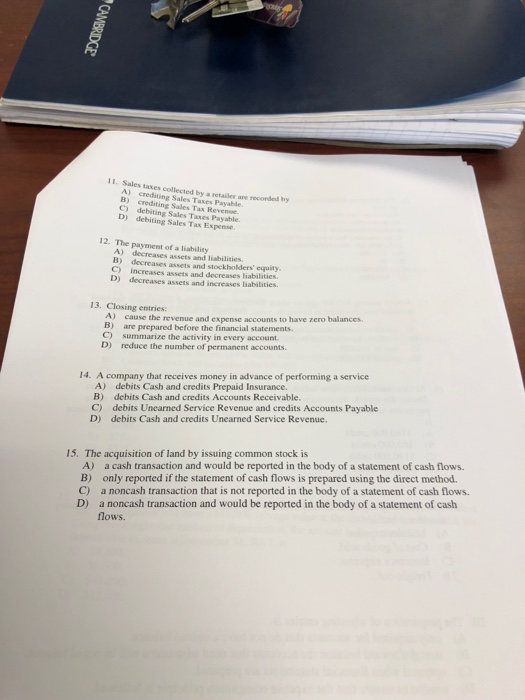

11. Sales A) taxes collected by a retailer are recorded by crediting Sales Taxes Payable. ) crediting Sales Tax Revenue C) D) debiting Sales Tax Expense 12. The payment of a liability A) decreases assets and liabilities. C) increases assets and decreases liabilities D) decreases assets and increases liabilities 13. Closing entries: A) cause the revenue and expense accounts to have zero balances B) are prepared before the financial statements. C) summarize the activity in every account D) reduce the number of permanent accounts 14. A company that receives money in advance of performing a service A) debits Cash and credits Prepaid Insurance. B) debits Cash and credits Accounts Receivable. C) debits Uncarned Service Revenue and credits Accounts Payable D) debits Cash and credits Unearned Service Revenue. 15. The acquisition of land by issuing common stock is A) a cash transaction and would be reported in the body of a statement of cash flows. B) only reported if the statement of cash flows is prepared using the direct method. C) a noncash transaction that is not reported in the body of a statement of cash flows. D) a noncash transaction and would be reported in the body of a statement of cash flows

11. Sales A) taxes collected by a retailer are recorded by crediting Sales Taxes Payable. ) crediting Sales Tax Revenue C) D) debiting Sales Tax Expense 12. The payment of a liability A) decreases assets and liabilities. C) increases assets and decreases liabilities D) decreases assets and increases liabilities 13. Closing entries: A) cause the revenue and expense accounts to have zero balances B) are prepared before the financial statements. C) summarize the activity in every account D) reduce the number of permanent accounts 14. A company that receives money in advance of performing a service A) debits Cash and credits Prepaid Insurance. B) debits Cash and credits Accounts Receivable. C) debits Uncarned Service Revenue and credits Accounts Payable D) debits Cash and credits Unearned Service Revenue. 15. The acquisition of land by issuing common stock is A) a cash transaction and would be reported in the body of a statement of cash flows. B) only reported if the statement of cash flows is prepared using the direct method. C) a noncash transaction that is not reported in the body of a statement of cash flows. D) a noncash transaction and would be reported in the body of a statement of cash flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started