Answered step by step

Verified Expert Solution

Question

1 Approved Answer

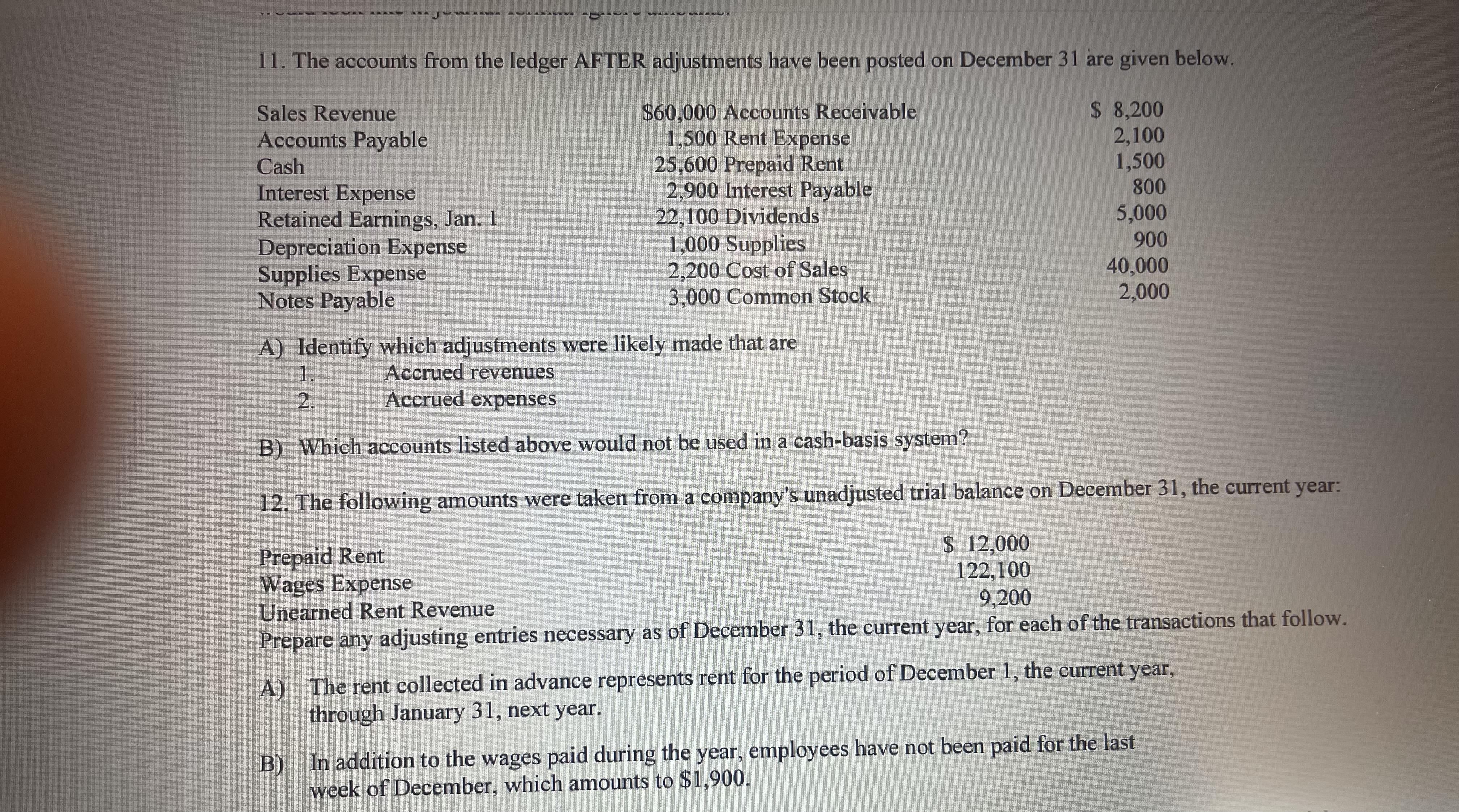

11. The accounts from the ledger AFTER adjustments have been posted on December 31 are given below. Sales Revenue Accounts Payable Cash Interest Expense

11. The accounts from the ledger AFTER adjustments have been posted on December 31 are given below. Sales Revenue Accounts Payable Cash Interest Expense $60,000 Accounts Receivable 1,500 Rent Expense $ 8,200 2,100 1,500 800 Retained Earnings, Jan. 1 Depreciation Expense Supplies Expense Notes Payable 25,600 Prepaid Rent 2,900 Interest Payable 22,100 Dividends 5,000 1,000 Supplies 2,200 Cost of Sales 3,000 Common Stock 900 40,000 2,000 A) Identify which adjustments were likely made that are 1. 2. Accrued revenues Accrued expenses B) Which accounts listed above would not be used in a cash-basis system? 12. The following amounts were taken from a company's unadjusted trial balance on December 31, the current year: Prepaid Rent Wages Expense Unearned Rent Revenue $ 12,000 122,100 9,200 Prepare any adjusting entries necessary as of December 31, the current year, for each of the transactions that follow. A) The rent collected in advance represents rent for the period of December 1, the current year, through January 31, next year. B) In addition to the wages paid during the year, employees have not been paid for the last week of December, which amounts to $1,900.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 For the first question it seems like you are given a list of accounts from the ledger after ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started