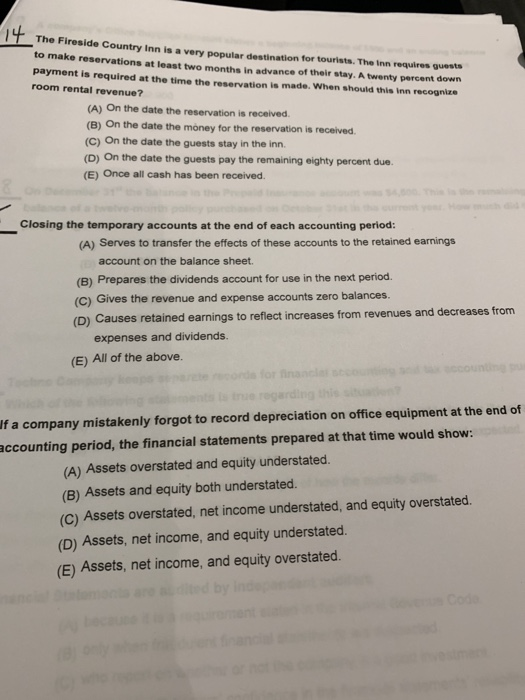

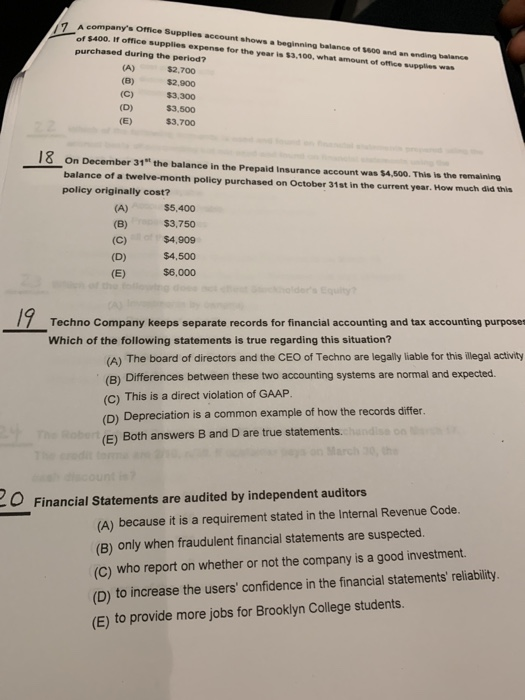

11 The Fireside Country Inn is a very popular destination for tourists. The Inn requires guests to make reservations at least two months in advance of their stay. A twenty percent down payment is required at the time the reservation is made. When should this inn recognize room rental revenue? (A) On the date the reservation is received (B) On the date the money for the reservation is received (C) On the date the guests stay in the inn. (D) On the date the guests pay the remaining eighty percent due. (E) Once all cash has been received. Closing the temporary accounts at the end of each accounting period: (A) Serves to transfer the effects of these accounts to the retained earnings account on the balance sheet. (B) Prepares the dividends account for use in the next period. (C) Gives the revenue and expense accounts zero balances. (D) Causes retained earnings to reflect increases from revenues and decreases from expenses and dividends. (E) All of the above. for financ c ount Wf a company mistakenly forgot to record depreciation on office equipment at the end of accounting period, the financial statements prepared at that time would show: (A) Assets overstated and equity understated. (B) Assets and equity both understated. (C) Assets overstated, net income understated, and equity overstated. (D) Assets, net income, and equity understated. (E) Assets, net income, and equity overstated. (7_A comp A company's Office Supplies account shows a beginning balance of W and an ending balance of $400. If office supplies expense for the year is 13.100, what amount of office supplies was purchased during the period? (A) (B) $2,700 $2,900 $3,300 $3,500 $3.700 10 On December 31" the balance in the Prepaid Insurance account was $4,500. This is the remaining balance of a twelve-month policy purchased on October 31st in the current year. How much did this policy originally cost? (A) $5,400 $3,750 (C) $4.909 $4,500 $6,000 (B) (D) 17 Techno Company keeps separate records for financial accounting and tax accounting purposes Which of the following statements is true regarding this situation? (A) The board of directors and the CEO of Techno are legally liable for this illegal activity (B) Differences between these two accounting systems are normal and expected. (C) This is a direct violation of GAAP. (D) Depreciation is a common example of how the records differ. (E) Both answers B and D are true statements. hunden - Financial Statements are audited by independent auditors (A) because it is a requirement stated in the Internal Revenue Code. (B) only when fraudulent financial statements are suspected. (C) who report on whether or not the company is a good investment. (D) to increase the users' confidence in the financial statements' reliability! (E) to provide more jobs for Brooklyn College students