Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11. The following extracts of Tim's financial statements are available: The gearing (debt to debt plus equity) ratio of Tim will be: A. 15.8% B.

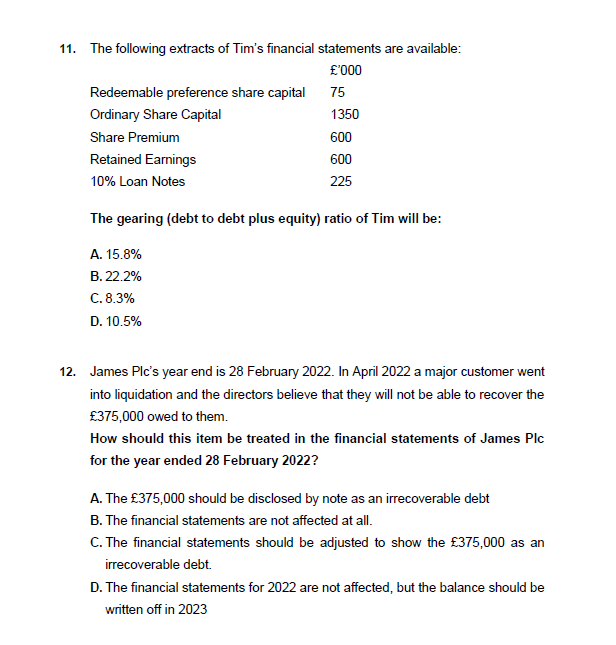

11. The following extracts of Tim's financial statements are available: The gearing (debt to debt plus equity) ratio of Tim will be: A. 15.8% B. 22.2% C. 8.3% D. 10.5% 12. James Plc's year end is 28 February 2022. In April 2022 a major customer went into liquidation and the directors believe that they will not be able to recover the 375,000 owed to them. How should this item be treated in the financial statements of James Plc for the year ended 28 February 2022? A. The 375,000 should be disclosed by note as an irrecoverable debt B. The financial statements are not affected at all. C. The financial statements should be adjusted to show the 375,000 as an irrecoverable debt. D. The financial statements for 2022 are not affected, but the balance should be written off in 2023

11. The following extracts of Tim's financial statements are available: The gearing (debt to debt plus equity) ratio of Tim will be: A. 15.8% B. 22.2% C. 8.3% D. 10.5% 12. James Plc's year end is 28 February 2022. In April 2022 a major customer went into liquidation and the directors believe that they will not be able to recover the 375,000 owed to them. How should this item be treated in the financial statements of James Plc for the year ended 28 February 2022? A. The 375,000 should be disclosed by note as an irrecoverable debt B. The financial statements are not affected at all. C. The financial statements should be adjusted to show the 375,000 as an irrecoverable debt. D. The financial statements for 2022 are not affected, but the balance should be written off in 2023 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started