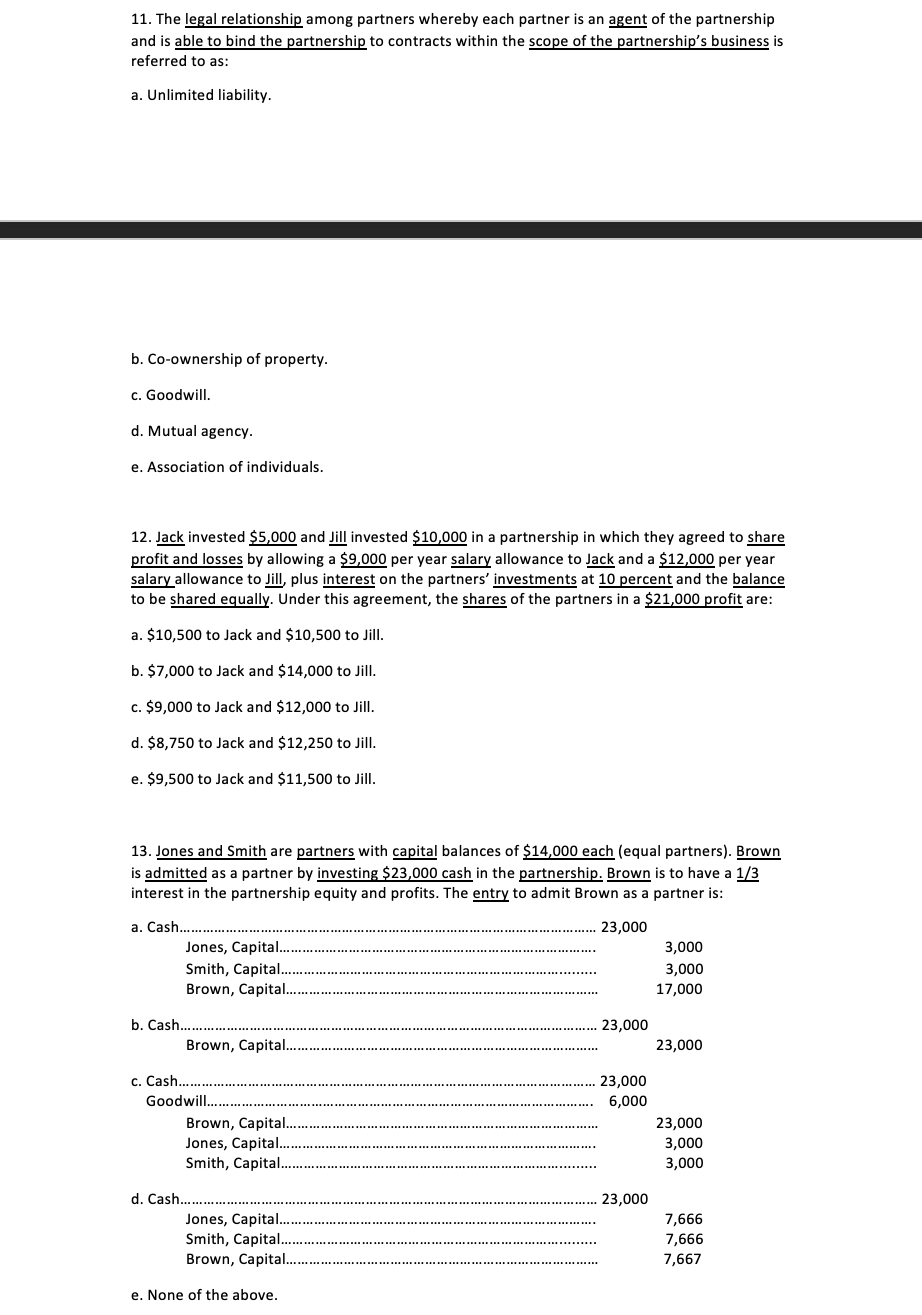

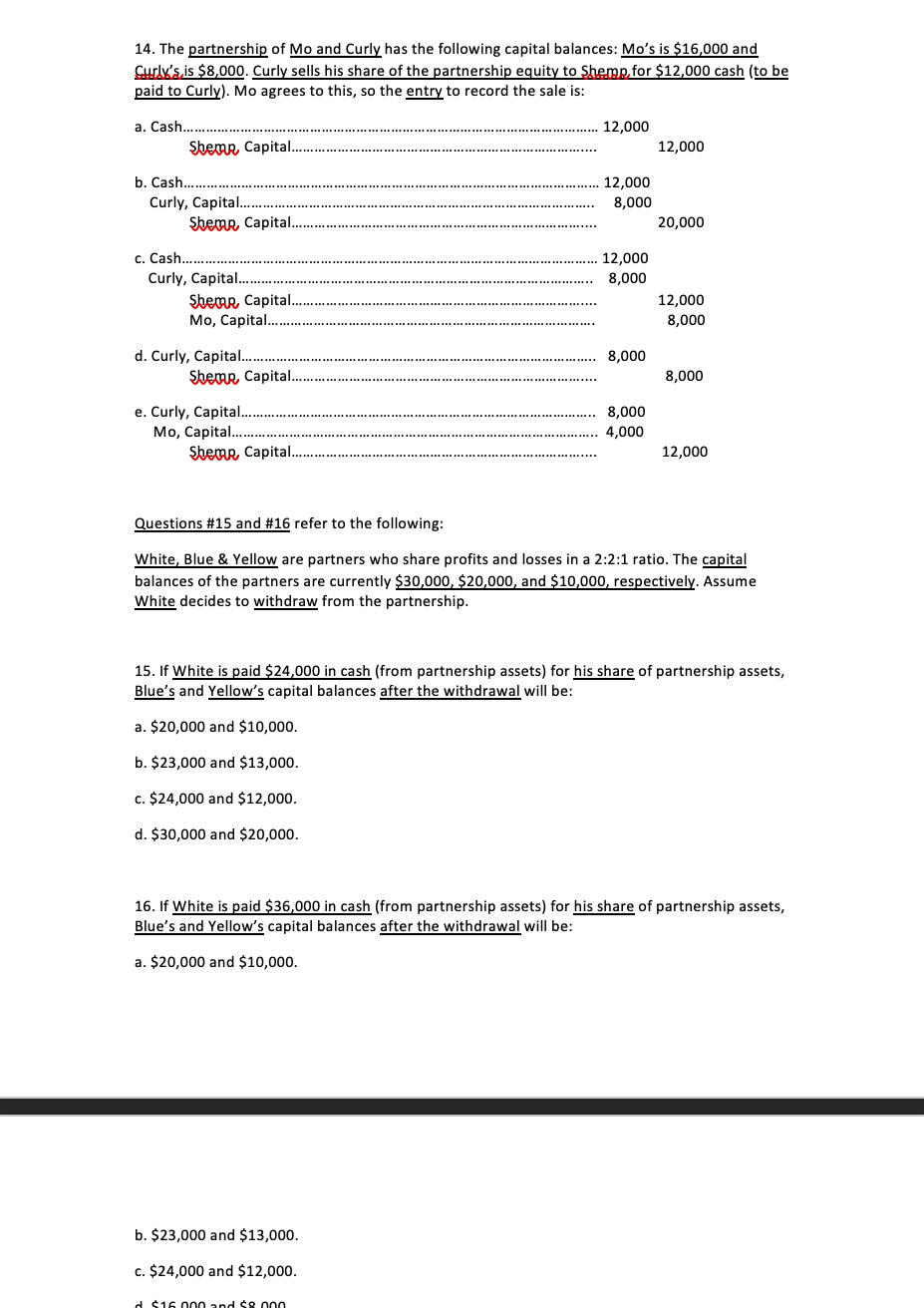

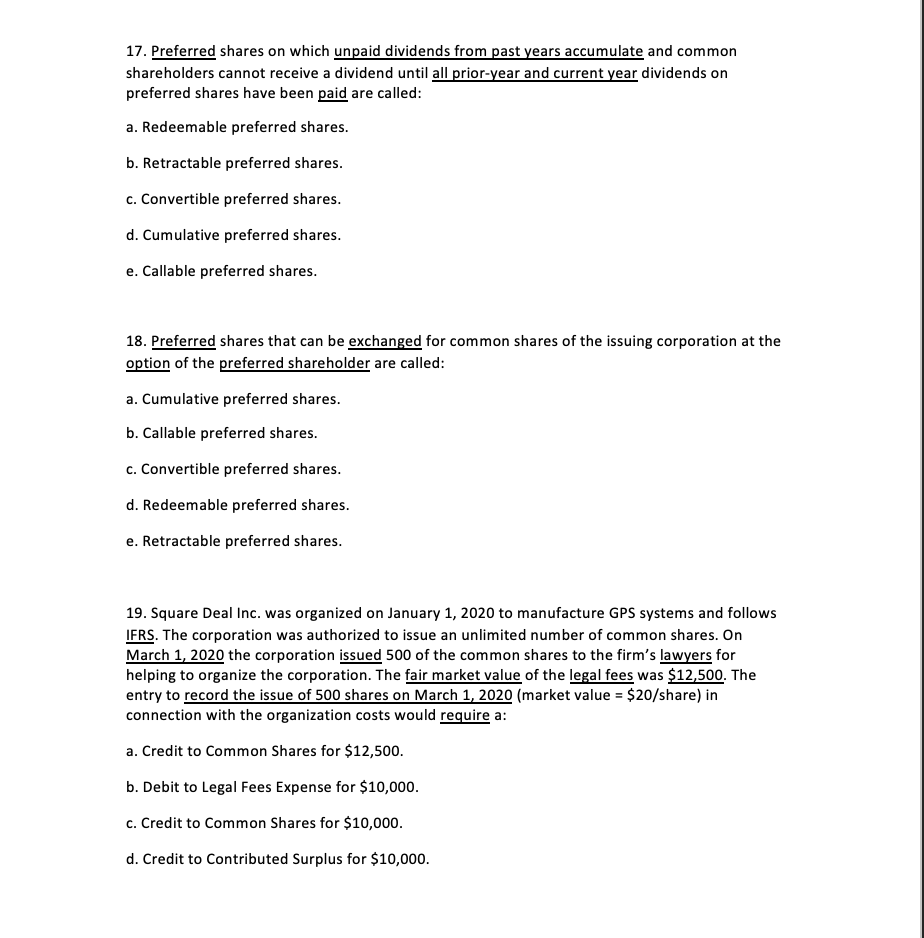

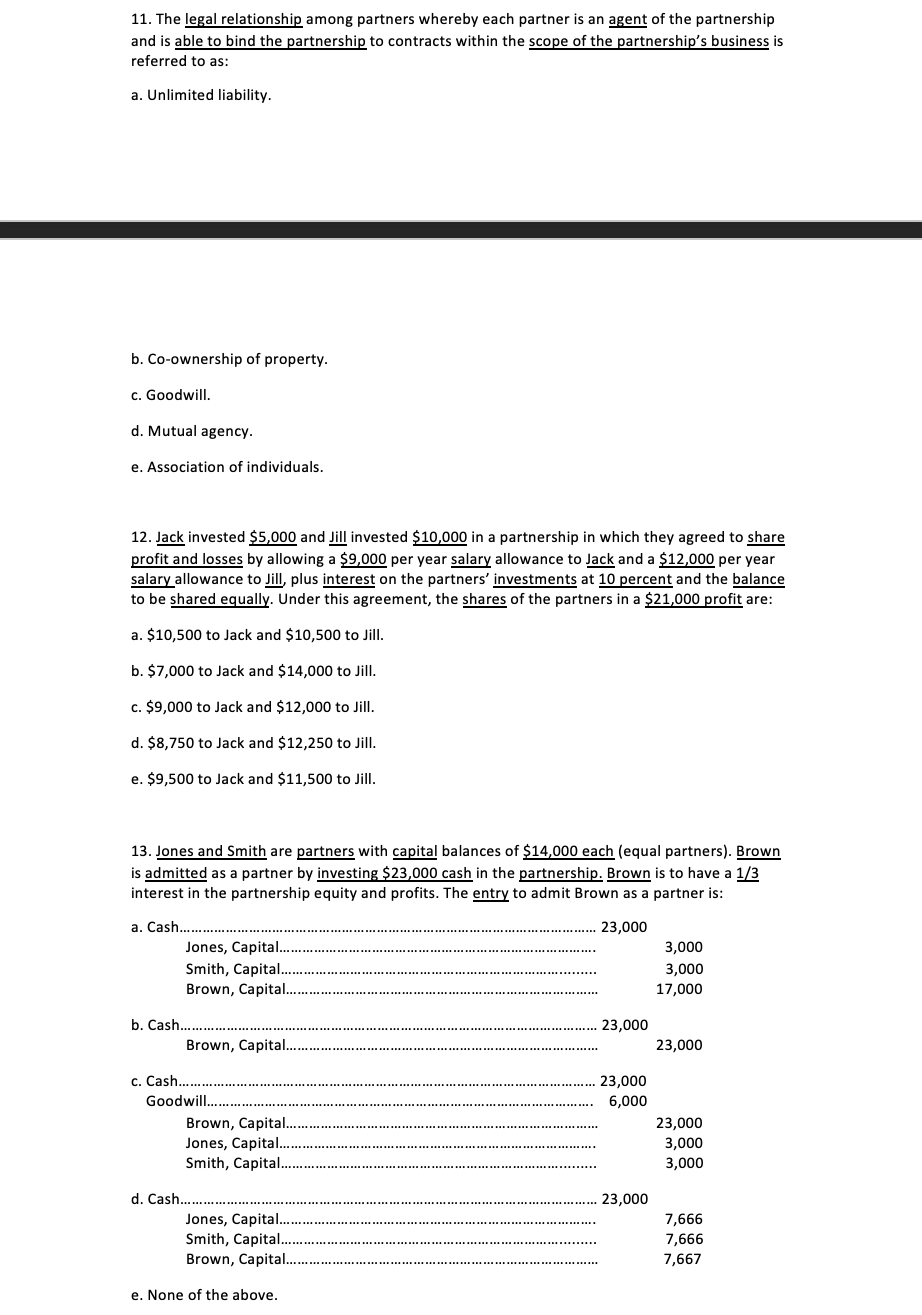

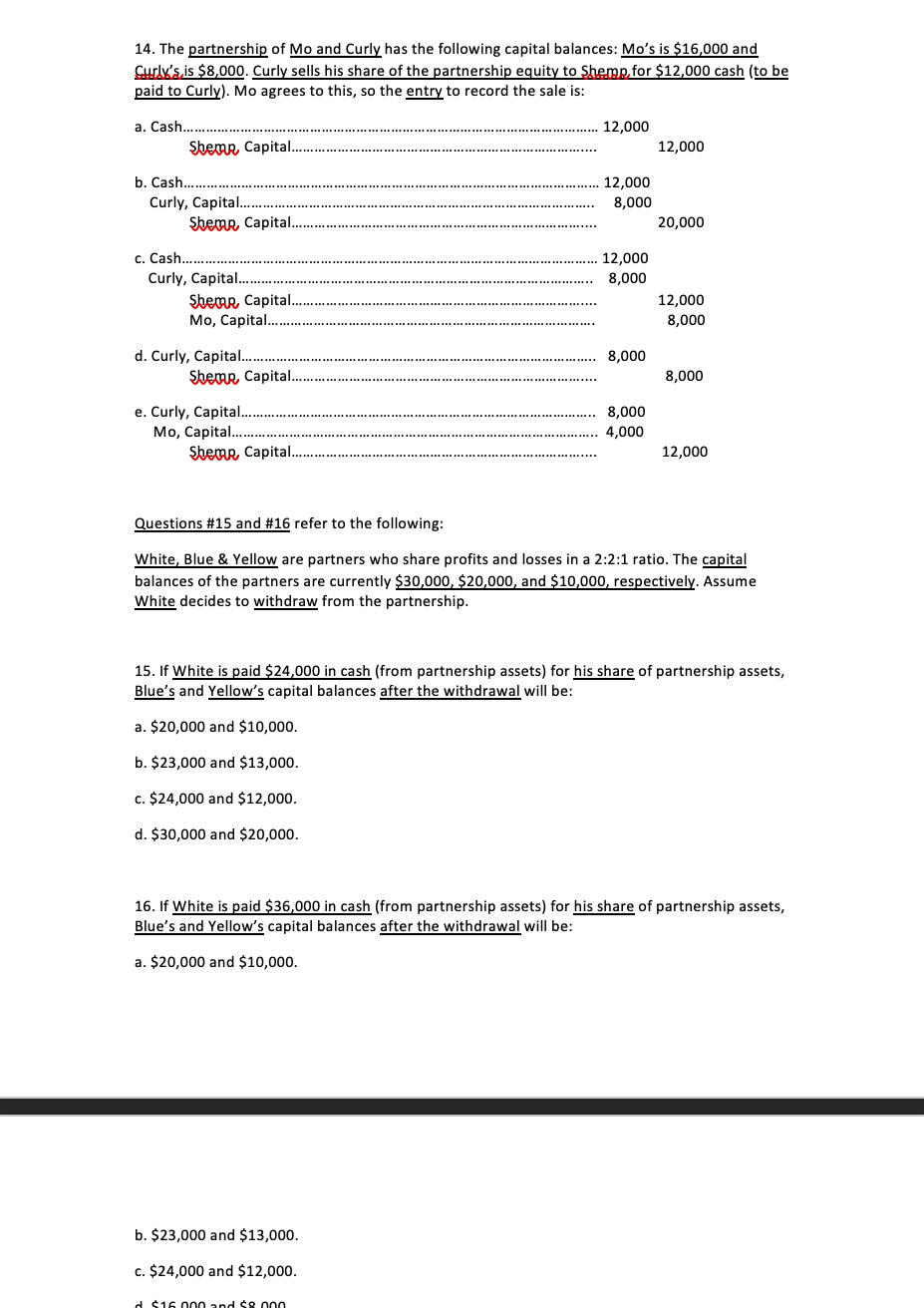

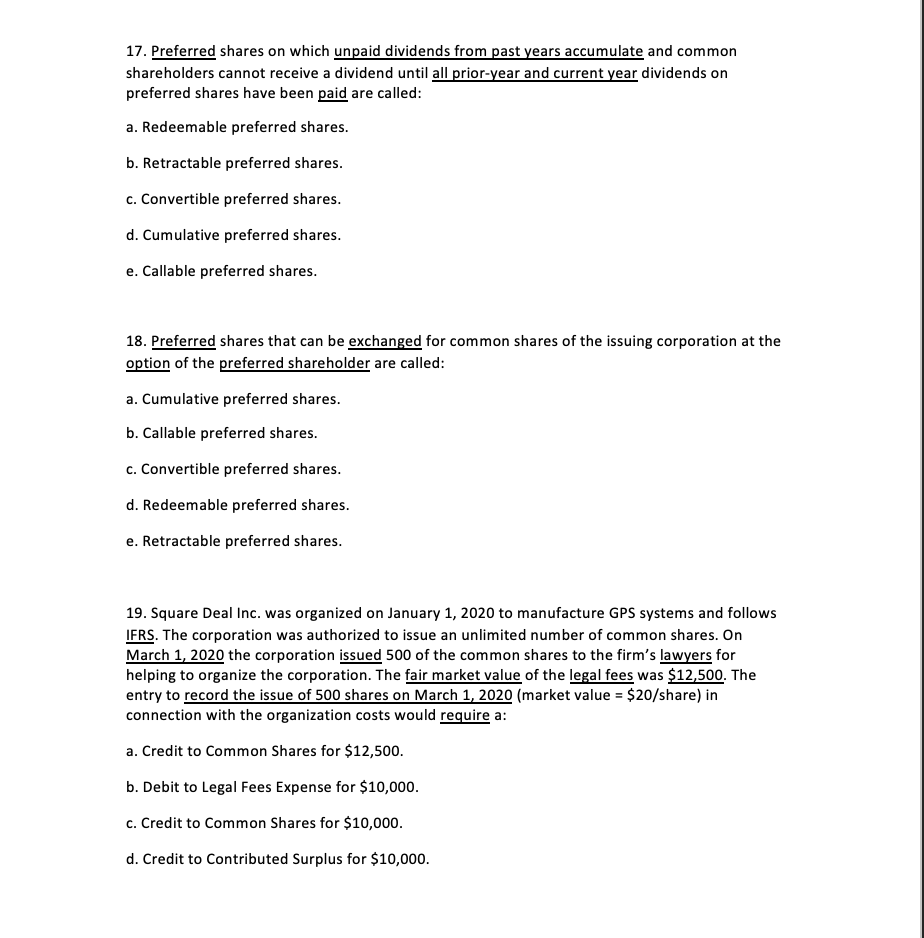

11. The legal relationship among partners whereby each partner is an agent of the partnership and is able to bind the partnership to contracts within the scope of the partnership's business is referred to as: a. Unlimited liability. b. Co-ownership of property. c. Goodwill. d. Mutual agency. e. Association of individuals. 12. Jack invested $5,000 and Jill invested $10,000 in a partnership in which they agreed to share profit and losses by allowing a $9,000 per year salary allowance to Jack and a $12,000 per year salary allowance to Jill, plus interest on the partners' investments at 10 percent and the balance to be shared equally. Under this agreement, the shares of the partners in a $21,000 profit are: a. $10,500 to Jack and $10,500 to Jill. b. $7,000 to Jack and $14,000 to Jill. c. $9,000 to Jack and $12,000 to Jill. d. $8,750 to Jack and $12,250 to Jill. e. $9,500 to Jack and $11,500 to Jill. 13. Jones and Smith are partners with capital balances of $14,000 each (equal partners). Brown is admitted as a partner by investing $23,000 cash in the partnership. Brown is to have a 1/3 interest in the partnership equity and profits. The entry to admit Brown as a partner is: 23,000 a. Cash. Jones, Capital.. Smith, Capital.. Brown, Capital. 3,000 3,000 17,000 b. Cash...... Brown, Capital... 23,000 23,000 23,000 6,000 c. Cash...... Goodwill....... Brown, Capital.. Jones, Capital... Smith, Capital.. 23,000 3,000 3,000 23,000 d. Cash... Jones, Capital.. Smith, Capital Brown, Capital.. 7,666 7,666 7,667 e. None of the above. 14. The partnership of Mo and Curly has the following capital balances: Mo's is $16,000 and Curly's is $8,000. Curly sells his share of the partnership equity to Shemp for $12,000 cash (to be paid to Curly). Mo agrees to this, so the entry to record the sale is: 12,000 a. Cash.. Sheme Capital... 12,000 b. Cash...... Curly, Capital.... Sheme Capital... 12,000 8,000 20,000 12,000 8,000 C. Cash..... Curly, Capital.. Sheme Capital. Mo, Capital. 12,000 8,000 8,000 d. Curly, Capital.... Shema Capital... 8,000 e. Curly, Capital.... Mo, Capital.......... Sheme Capital 8,000 4,000 12,000 Questions #15 and #16 refer to the following: White, Blue & Yellow are partners who share profits and losses in a 2:2:1 ratio. The capital balances of the partners are currently $30,000, $20,000, and $10,000, respectively. Assume White decides to withdraw from the partnership. 15. If White is paid $24,000 in cash (from partnership assets) for his share of partnership assets, Blue's and Yellow's capital balances after the withdrawal will be: a. $20,000 and $10,000. b. $23,000 and $13,000. c. $24,000 and $12,000. d. $30,000 and $20,000. 16. If White is paid $36,000 in cash (from partnership assets) for his share of partnership assets, Blue's and Yellow's capital balances after the withdrawal will be: a. $20,000 and $10,000. b. $23,000 and $13,000. c. $24,000 and $12,000. d16.00 and 8 000 17. Preferred shares on which unpaid dividends from past years accumulate and common shareholders cannot receive a dividend until all prior-year and current year dividends on preferred shares have been paid are called: a. Redeemable preferred shares. b. Retractable preferred shares. c. Convertible preferred shares. d. Cumulative preferred shares. e. Callable preferred shares. 18. Preferred shares that can be exchanged for common shares of the issuing corporation at the option of the preferred shareholder are called: a. Cumulative preferred shares. b. Callable preferred shares. C. Convertible preferred shares. d. Redeemable preferred shares. e. Retractable preferred shares. 19. Square Deal Inc. was organized on January 1, 2020 to manufacture GPS systems and follows IFRS. The corporation was authorized to issue an unlimited number of common shares. On March 1, 2020 the corporation issued 500 of the common shares to the firm's lawyers for helping to organize the corporation. The fair market value of the legal fees was $12,500. The entry to record the issue of 500 shares on March 1, 2020 (market value = $20/share) in connection with the organization costs would require a: a. Credit to Common Shares for $12,500. b. Debit to Legal Fees Expense for $10,000. c. Credit to Common Shares for $10,000. d. Credit to Contributed Surplus for $10,000