Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11. This is a more difficult but informative problem. James Brodrick & Sons, Inc. is growing rapidly and, if at all possible, would like

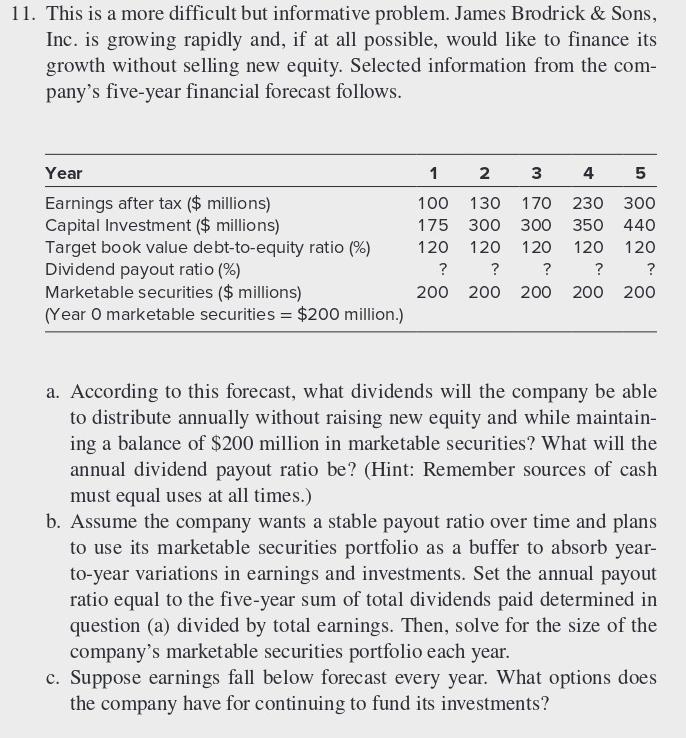

11. This is a more difficult but informative problem. James Brodrick & Sons, Inc. is growing rapidly and, if at all possible, would like to finance its growth without selling new equity. Selected information from the com- pany's five-year financial forecast follows. Year Earnings after tax ($ millions) Capital Investment ($ millions) Target book value debt-to-equity ratio (%) Dividend payout ratio (%) Marketable securities ($ millions) (Year O marketable securities = $200 million.) 2 3 4 5 170 230 300 440 120 ? 200 1 100 130 175 300 300 350 120 120 120 120 ? ? ? ? 200 200 200 200 a. According to this forecast, what dividends will the company be able to distribute annually without raising new equity and while maintain- ing a balance of $200 million in marketable securities? What will the annual dividend payout ratio be? (Hint: Remember sources of cash must equal uses at all times.) b. Assume the company wants a stable payout ratio over time and plans to use its marketable securities portfolio as a buffer to absorb year- to-year variations in earnings and investments. Set the annual payout ratio equal to the five-year sum of total dividends paid determined in question (a) divided by total earnings. Then, solve for the size of the company's marketable securities portfolio each year. c. Suppose earnings fall below forecast every year. What options does the company have for continuing to fund its investments? d. What does the pecking-order theory say about how management will rank these options? e. Why might management be inclined to follow this pecking order?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Year 1 2 3 4 5 Dividends 20 6 34 71 100 Payout ratio 20 5 20 31 33 Answer b Year 1 2 3 4 5 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started