Answered step by step

Verified Expert Solution

Question

1 Approved Answer

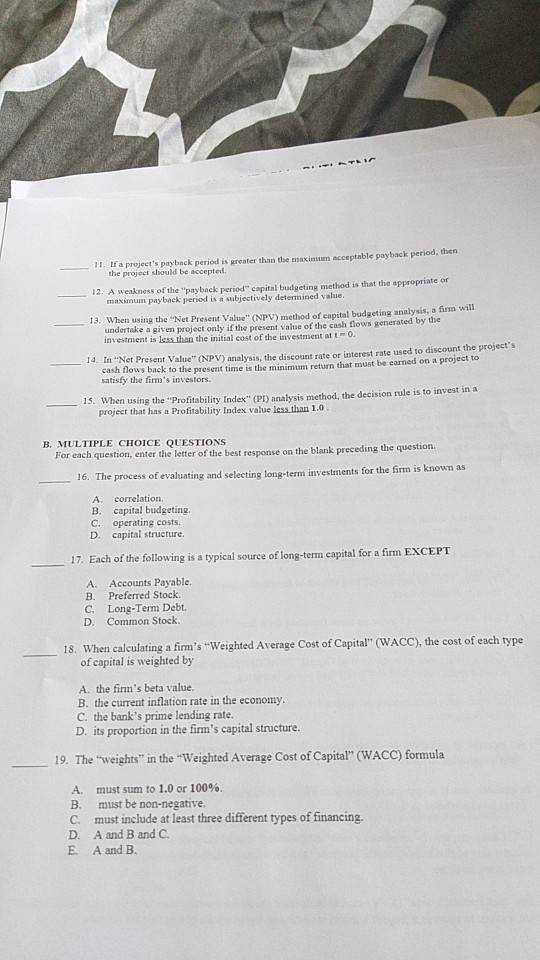

11 to 15 is true or false.. the pjerayback period is greater than the maximum acceptable payback period, then should be accepted. 12. A weakness

11 to 15 is true or false..

the pjerayback period is greater than the maximum acceptable payback period, then should be accepted. 12. A weakness of the "payback period" capital budgeting method is that the appropriate or maximum payback period is a subjectively determined value 13. When using the Net Present Value" (NPV) method of capital budgeting analysis, a firm will undertake a given project only if the present value of the cash flows generated by the investment is less than the initial cost of the investment at t o. In "Net Present Value" (NPV) analysis, the discount rate or interest rate used to discount the project's cash flows back 14. to the present time is the minimum return that must be earned on a project to satisfy the firm's investors. 15. When using the "Profitability Index"(Pt) analysis method, the decision rule is to invest in a project that has a Profitability Index value less than 1.0 B. MULTIPLE CHOICE QUESTIONS For each question, enter the letter of the best response on the blank preceding t e process of evaluating and selecting long-term investments for the firm is known as 16. Th A. correlation. B. capital budgeting. C. operating costs. D. capital structure. 17. Each of the following is a typical source of long-term capital for a firm EXCEPT A. Accounts Payable B. Preferred Stock. C. Long-Term Debt. D. Common Stock 18. When caleulating a fim's "Weighted Average Cost of Capital" (WACC), the cost of each type a firm's "Weighted Average Cost of Capital" (WACC), the cost of each type of capital is weighted by A. the finn's beta value B. the current inflation rate in the economy C. the bank's prime lending rate. D. its proportion in the fim's capital structure. 19. The "weights" in the "Weighted Average Cost of Capital" (WACC) formula A. must sum to 1.0 or 100%. B. must be non-negative. C. must include at least three different types of financing. D. A and B and C E A and BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started