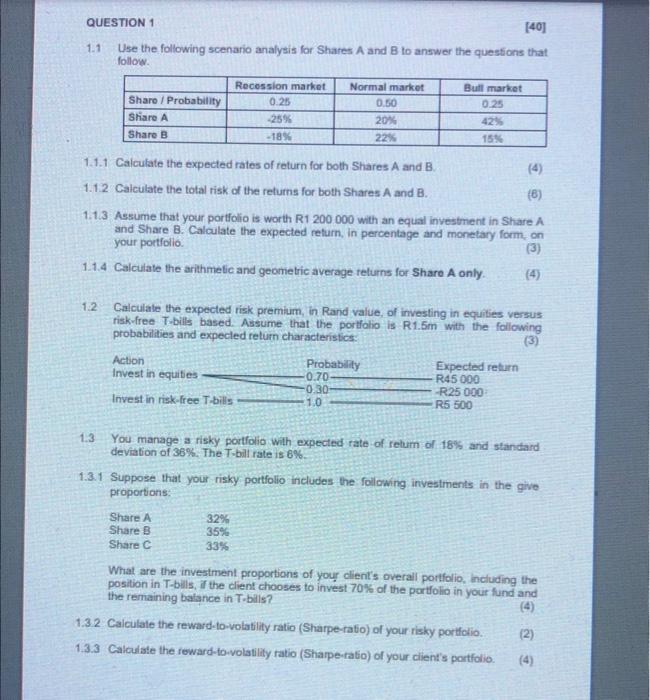

1.1 Use the following scenario analysis for Shares A and B to answer the questions that follow. 1.1.1 Calculate the expected rates of return for both Shares A and B. 1.1.2. Calculate the total risk of the returns for both Shares A and B. 1.1.3. Assume that your portfolio is worth R1 200000 with an equal investment in Share A and Share B. Calculate the expected refurn, in percentage and monetary form, on your portfolio. 1.1.4 Calculate the arithmetic and geometric average telurns for Share A only. 1.2 Calculate the expected risk premium, in Rand value, of investing in equities versus risk-free T-bills based. Assume that the portfalio is R1.5m with the following probabilities and expected return characteristics: ActionInvestinequitiesInvestinrisk-freeTbillsProbabilty0.700.301.0ExpectedreturnR.45000R.25000R2500 1.3 You manage a risky portfolio with expected rate of relurn of 18% and standard deviation of 38%. The T-bill rate is 6%. 1.3.1 Suppose that your risky portfolio includes the following investments in the give proportions: What are the investment proportions of your client's overall portfolio, including the position in T-bills, if the client chooses to invest 70% of the portfolio in your fund and the remaining balance in T-bils? 1.3.2 Calculale the reward-to-volatility ratio (Sharpe-ratio) of your risky portfolio. 1.3.3 Calculate the reward-to-volatility ratio (Sharpe-tatio) of your client's portfolio. 1.1 Use the following scenario analysis for Shares A and B to answer the questions that follow. 1.1.1 Calculate the expected rates of return for both Shares A and B. 1.1.2. Calculate the total risk of the returns for both Shares A and B. 1.1.3. Assume that your portfolio is worth R1 200000 with an equal investment in Share A and Share B. Calculate the expected refurn, in percentage and monetary form, on your portfolio. 1.1.4 Calculate the arithmetic and geometric average telurns for Share A only. 1.2 Calculate the expected risk premium, in Rand value, of investing in equities versus risk-free T-bills based. Assume that the portfalio is R1.5m with the following probabilities and expected return characteristics: ActionInvestinequitiesInvestinrisk-freeTbillsProbabilty0.700.301.0ExpectedreturnR.45000R.25000R2500 1.3 You manage a risky portfolio with expected rate of relurn of 18% and standard deviation of 38%. The T-bill rate is 6%. 1.3.1 Suppose that your risky portfolio includes the following investments in the give proportions: What are the investment proportions of your client's overall portfolio, including the position in T-bills, if the client chooses to invest 70% of the portfolio in your fund and the remaining balance in T-bils? 1.3.2 Calculale the reward-to-volatility ratio (Sharpe-ratio) of your risky portfolio. 1.3.3 Calculate the reward-to-volatility ratio (Sharpe-tatio) of your client's portfolio