Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.1. What is the difference between a free cash flow and an operating cash flow? A. Operating cash flow includes the net effects that bad

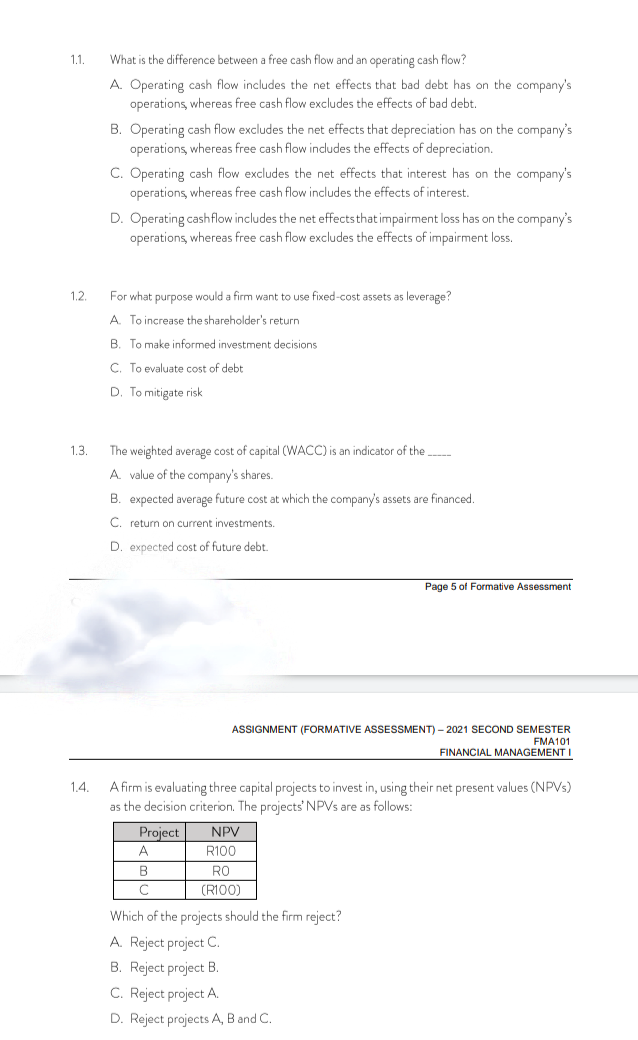

1.1. What is the difference between a free cash flow and an operating cash flow? A. Operating cash flow includes the net effects that bad debt has on the company's operations, whereas free cash flow excludes the effects of bad debt. B. Operating cash flow excludes the net effects that depreciation has on the company's operations, whereas free cash flow includes the effects of depreciation. C. Operating cash flow excludes the net effects that interest has on the company's operations, whereas free cash flow includes the effects of interest. D. Operating cash flow includes the net effects that impairment loss has on the company's operations whereas free cash flow excludes the effects of impairment loss. 1.2 For what purpose would a firm want to use fixed-cost assets as leverage? A To increase the shareholder's return B. To make informed investment decisions C. To evaluate cost of debt D. To mitigate risk 1.3 The weighted average cost of capital (WACC) is an indicator of the _____ A value of the company's shares. B. expected average future cost at which the company's assets are financed. C. return on current investments. D. expected cost of future debt. Page 5 of Formative Assessment ASSIGNMENT (FORMATIVE ASSESSMENT) - 2021 SECOND SEMESTER FMA101 FINANCIAL MANAGEMENT I 14. A firm is evaluating three capital projects to invest in, using their net present values (NPV) as the decision criterion. The projects' NPVs are as follows: Project NPV A R100 B RO (R100) Which of the projects should the firm reject? A. Reject project C. B. Reject project B. C. Reject project A. D. Reject projects A, B and C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started