Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11) Which of the following is a historical cost that is always irrelevant? A) sunk cost C) opportunity cost D differential cost B) relevant cost

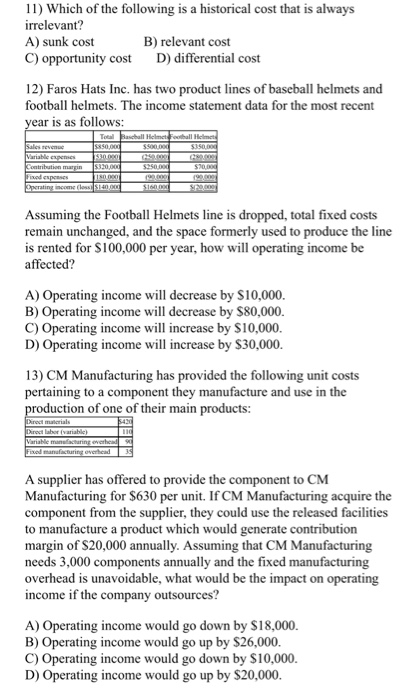

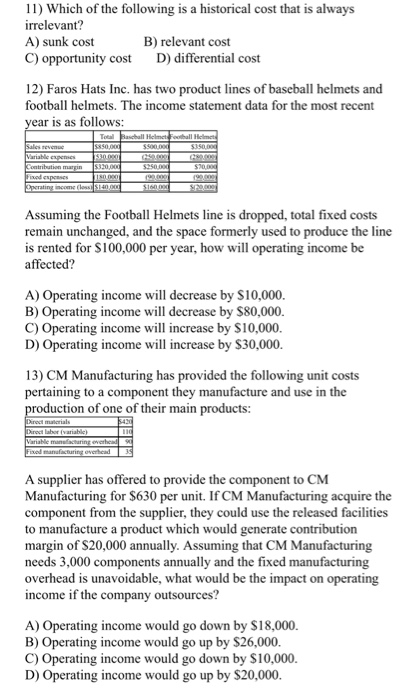

11) Which of the following is a historical cost that is always irrelevant? A) sunk cost C) opportunity cost D differential cost B) relevant cost 12) Faros Hats Inc. has two product lines of baseball helmets and football helmets. The income statement data for the most recent r is as follows: Assuming the Football Helmets line is dropped, total fixed costs remain unchanged, and the space formerly used to produce the line is rented for S100,000 per year, how will operating income be affected? A) Operating income will decrease by S10,000. B) Operating income will decrease by $80,000 C) Operating income will increase by $10,000. D) Operating income will increase by $30,000. 13) CM Manufacturing has provided the following unit costs pertaining to a component they manufacture and use in the uction of one of their main products: A supplier has offered to provide the component to CM Manufacturing for $630 per unit. If CM Manufacturing acquire the component from the supplier, they could use the released facilities to manufacture a product which would generate contribution margin of S20,000 annually. Assuming that CM Manufacturing needs 3,000 components annually and the fixed manufacturing overhead is unavoidable, what would be the impact on operating income if the company outsources? A) Operating income would go down by $18,000. B) Operating income would go up by $26,000. C) Operating income would go down by $10,000 D) Operating income would go up by $20,000

11) Which of the following is a historical cost that is always irrelevant? A) sunk cost C) opportunity cost D differential cost B) relevant cost 12) Faros Hats Inc. has two product lines of baseball helmets and football helmets. The income statement data for the most recent r is as follows: Assuming the Football Helmets line is dropped, total fixed costs remain unchanged, and the space formerly used to produce the line is rented for S100,000 per year, how will operating income be affected? A) Operating income will decrease by S10,000. B) Operating income will decrease by $80,000 C) Operating income will increase by $10,000. D) Operating income will increase by $30,000. 13) CM Manufacturing has provided the following unit costs pertaining to a component they manufacture and use in the uction of one of their main products: A supplier has offered to provide the component to CM Manufacturing for $630 per unit. If CM Manufacturing acquire the component from the supplier, they could use the released facilities to manufacture a product which would generate contribution margin of S20,000 annually. Assuming that CM Manufacturing needs 3,000 components annually and the fixed manufacturing overhead is unavoidable, what would be the impact on operating income if the company outsources? A) Operating income would go down by $18,000. B) Operating income would go up by $26,000. C) Operating income would go down by $10,000 D) Operating income would go up by $20,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started