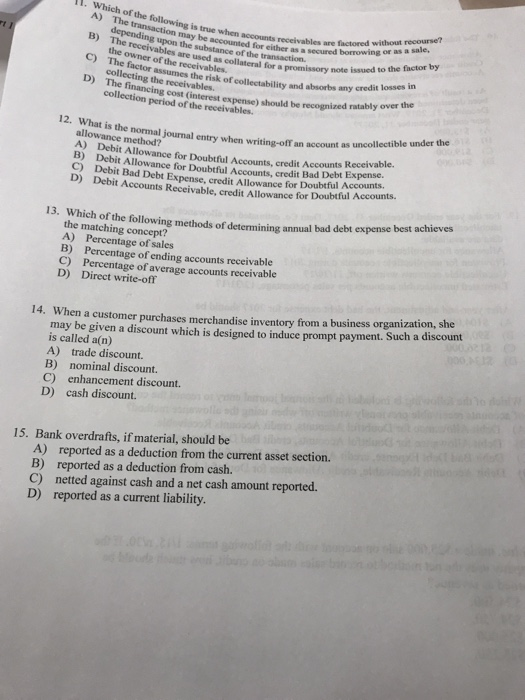

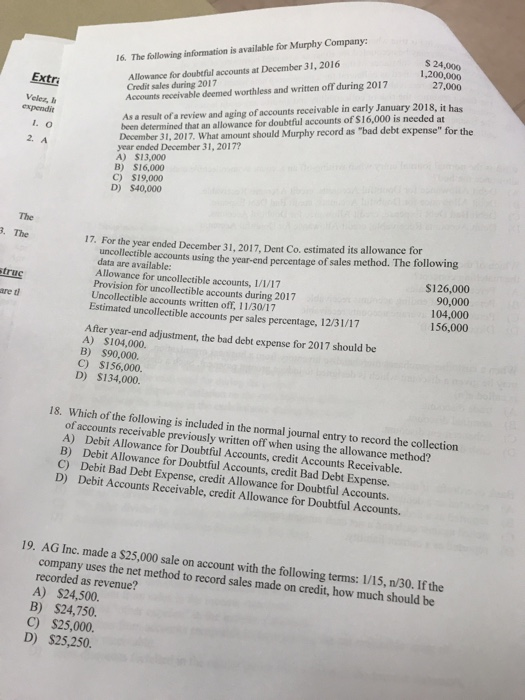

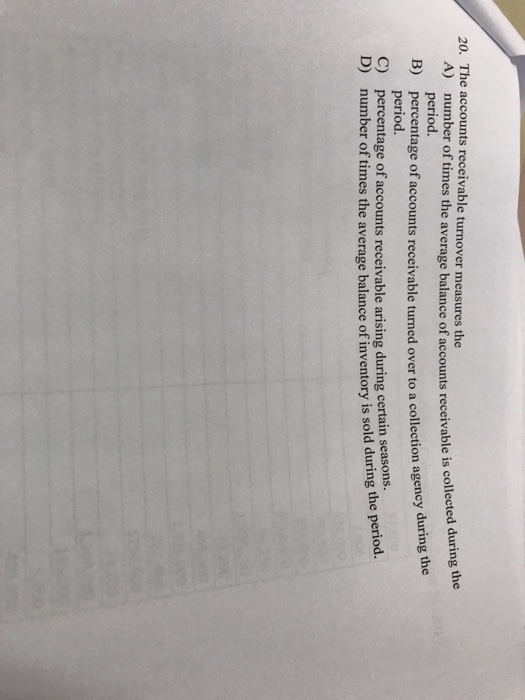

11. Which of the following is true when accounts receivables ured borrowing A) The transaction may be accounted for either as B) The receivables C) The factor D) The are factored without recourse? depending upon the substance of the transaction. The fner of t e used the owner of the receivables. collecting the receivables. are used as collateral for a promissory note issued to the factor by assumes the risk of collectability and absorbs any credit losses in tinancing cost (interest expense) should be recognized ratably over the collection period of the receivables. 12. What is the normal journal entry when writing-off an account as allowance method? A) Debit Allowance for Doubtful Accounts, credit Accounts C) Allowance for Doubtful Accounts, credit Bad Debt Expense. Debit Bad Debt Expense, credit Allowance for Doubtful Accounts. D) Debit Accounts Receivable, credit Allowance for Doubtful Accounts. 13. annual bad debt expense best achieves Which of the following methods of determining the matching concept? A) Percentage of sales B) Percentage of ending accounts receivable C) Percentage of average accounts receivable D) Direct write-off When a customer purchases merchandise inventory from a business organization, she may be given a discount which is designed to induce prompt payment. Such a 14. is called a(n) A) trade discount. B) nominal discount. C) enhancement discount. D) cash discount. 15. Bank overdrafts, if material, should be A) reported as a deduction from the current asset section. B) reported as a deduction from cash. C) netted against cash and a net cash amount reported. D) reported as a current liability. S 24,000 1,200,000 27,000 16. The following information is available for Murphy Company: Credit sales during 2017 Accounts receivable deemed worthless and written off during 2017 Extr Allowance for doubtfiul accounts at December 31, 2016 Velez, b expendit I. O As a result of a review and aging of accounts receivable in early January 2018, it has been determined that an allowance for doubtful accounts of $16,000 is needed at December 31, 2017. What amount should Murphy record as "bad debt expense" for the year ended December 31, 2017? A) $13,000 B) $16,000 C) $19,000 D) $40,000 The . The 17. For the year ended December 31, 2017, Dent Co. estimated its allowance for uncollectible data are availabsounts using the year end percentage of sales method. The following Allowance for uncollectible accounts, 1/1/17 Provision for uncollectible accounts during 2017 Uncollectible accounts written off, i 1/30/17 Estimated uncollectible accounts per sales percentage, 12/31/17 $126,000 90,000 104,000 156,000 truc are ti After year-end adjustment, the bad debt expense for 2017 should be A) S104,000. B) $90,000. C) $156,000. D) $134,000. 18. Which of the following is included in the normal journal entry to record the collection of accounts receivable previously written off when using the allowance method? A) Debit Allowance for Doubtful Accounts, credit Accounts Receivable. B) Debit Allowance for Doubtful Accounts, credit Bad Debt Expense. C) Debit Bad Debt Expense, credit Allowance for Doubtful Accounts. D) Debit Accounts Receivable, credit Allowance for Doubtful Accounts. 19. AG Inc. made a $25,000 sale on account with the following terms: 1/15, n/30. If the company uses the net method to record sales made on credit, how much should be recorded as revenue? A) $24,500. B) $24,750. C) $25,000. D) $25,250 20. The accounts receivable turnover measures the A) B) C) number of times th period. percentage of accounts receivable turned over to a collection ageney durin period percentage of accounts receivable arising during certain seasons. number of times the average balance of inventory is sold during e average balance of accounts receivable is collected during the D) the period