Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11. Which type of budget is always of a limited time duration; such as a day, a week, or a month? A. Achievement B. Long-range

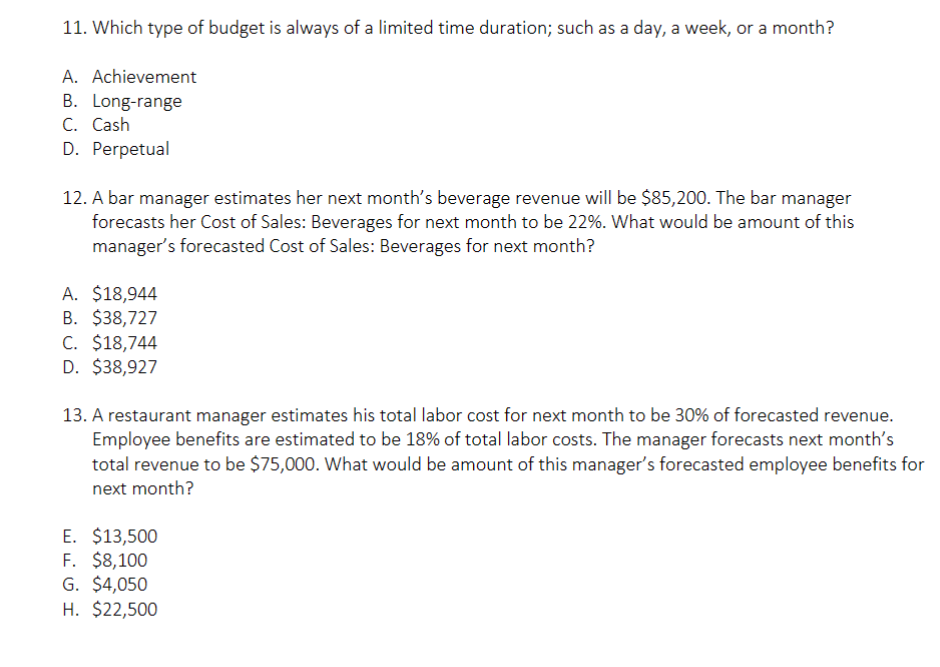

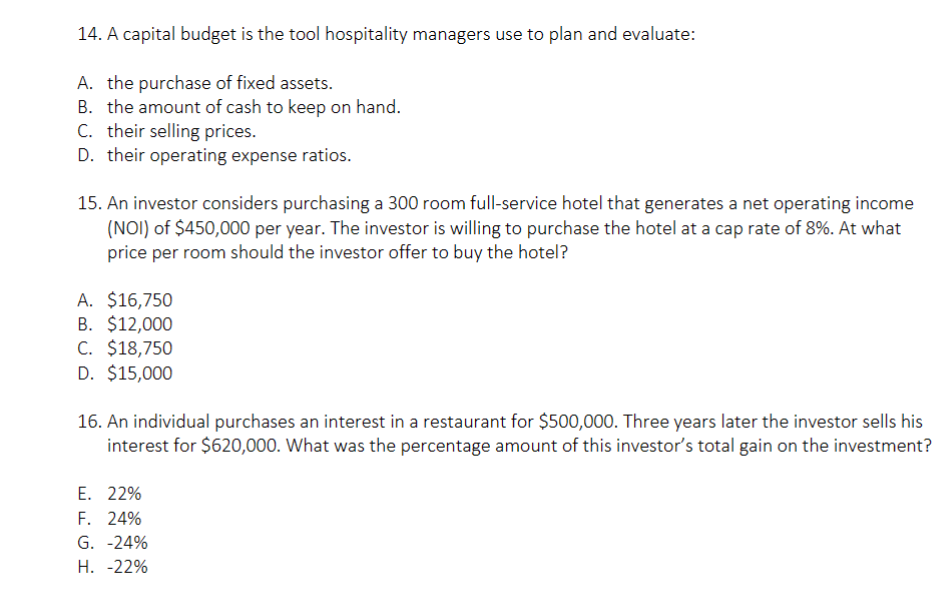

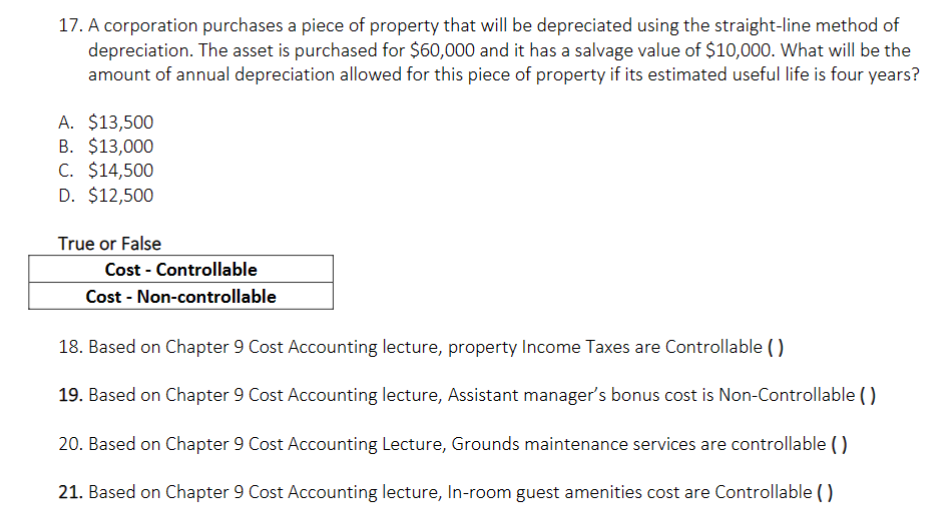

11. Which type of budget is always of a limited time duration; such as a day, a week, or a month? A. Achievement B. Long-range C. Cash D. Perpetual 12. A bar manager estimates her next month's beverage revenue will be $85,200. The bar manager forecasts her Cost of Sales: Beverages for next month to be 22%. What would be amount of this manager's forecasted Cost of Sales: Beverages for next month? A. $18,944 B. $38,727 C. $18,744 D. $38,927 13. A restaurant manager estimates his total labor cost for next month to be 30% of forecasted revenue. Employee benefits are estimated to be 18% of total labor costs. The manager forecasts next month's total revenue to be $75,000. What would be amount of this manager's forecasted employee benefits for next month? E. $13,500 F. $8,100 G. $4,050 H. $22,500 14. A capital budget is the tool hospitality managers use to plan and evaluate: A. the purchase of fixed assets. B. the amount of cash to keep on hand. C. their selling prices. D. their operating expense ratios. 15. An investor considers purchasing a 300 room full-service hotel that generates a net operating income (NOI) of $450,000 per year. The investor is willing to purchase the hotel at a cap rate of 8%. At what price per room should the investor offer to buy the hotel? A. $16,750 B. $12,000 C. $18,750 D. $15,000 16. An individual purchases an interest in a restaurant for $500,000. Three years later the investor sells his interest for $620,000. What was the percentage amount of this investor's total gain on the investment? E. 22% F. 24% G. 24% H. 22% 17. A corporation purchases a piece of property that will be depreciated using the straight-line method of depreciation. The asset is purchased for $60,000 and it has a salvage value of $10,000. What will be the amount of annual depreciation allowed for this piece of property if its estimated useful life is four years? A. $13,500 B. $13,000 C. $14,500 D. $12,500 True or False 18. Based on Chapter 9 Cost Accounting lecture, property Income Taxes are Controllable () 19. Based on Chapter 9 Cost Accounting lecture, Assistant manager's bonus cost is Non-Controllable ( ) 20. Based on Chapter 9 Cost Accounting Lecture, Grounds maintenance services are controllable () 21. Based on Chapter 9 Cost Accounting lecture, In-room guest amenities cost are Controllable ( )

11. Which type of budget is always of a limited time duration; such as a day, a week, or a month? A. Achievement B. Long-range C. Cash D. Perpetual 12. A bar manager estimates her next month's beverage revenue will be $85,200. The bar manager forecasts her Cost of Sales: Beverages for next month to be 22%. What would be amount of this manager's forecasted Cost of Sales: Beverages for next month? A. $18,944 B. $38,727 C. $18,744 D. $38,927 13. A restaurant manager estimates his total labor cost for next month to be 30% of forecasted revenue. Employee benefits are estimated to be 18% of total labor costs. The manager forecasts next month's total revenue to be $75,000. What would be amount of this manager's forecasted employee benefits for next month? E. $13,500 F. $8,100 G. $4,050 H. $22,500 14. A capital budget is the tool hospitality managers use to plan and evaluate: A. the purchase of fixed assets. B. the amount of cash to keep on hand. C. their selling prices. D. their operating expense ratios. 15. An investor considers purchasing a 300 room full-service hotel that generates a net operating income (NOI) of $450,000 per year. The investor is willing to purchase the hotel at a cap rate of 8%. At what price per room should the investor offer to buy the hotel? A. $16,750 B. $12,000 C. $18,750 D. $15,000 16. An individual purchases an interest in a restaurant for $500,000. Three years later the investor sells his interest for $620,000. What was the percentage amount of this investor's total gain on the investment? E. 22% F. 24% G. 24% H. 22% 17. A corporation purchases a piece of property that will be depreciated using the straight-line method of depreciation. The asset is purchased for $60,000 and it has a salvage value of $10,000. What will be the amount of annual depreciation allowed for this piece of property if its estimated useful life is four years? A. $13,500 B. $13,000 C. $14,500 D. $12,500 True or False 18. Based on Chapter 9 Cost Accounting lecture, property Income Taxes are Controllable () 19. Based on Chapter 9 Cost Accounting lecture, Assistant manager's bonus cost is Non-Controllable ( ) 20. Based on Chapter 9 Cost Accounting Lecture, Grounds maintenance services are controllable () 21. Based on Chapter 9 Cost Accounting lecture, In-room guest amenities cost are Controllable ( ) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started