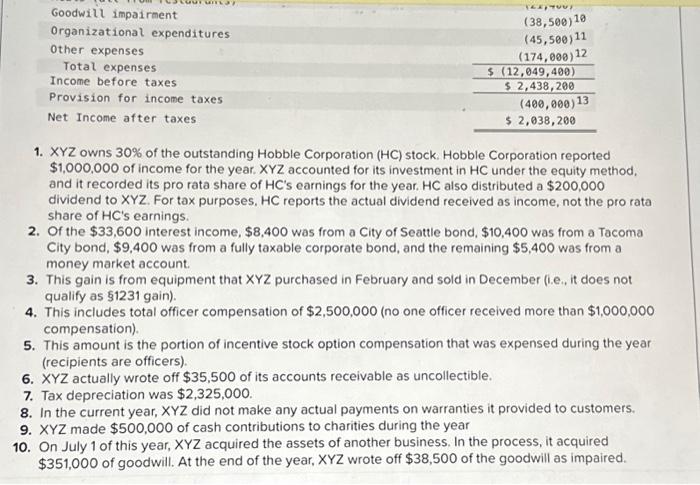

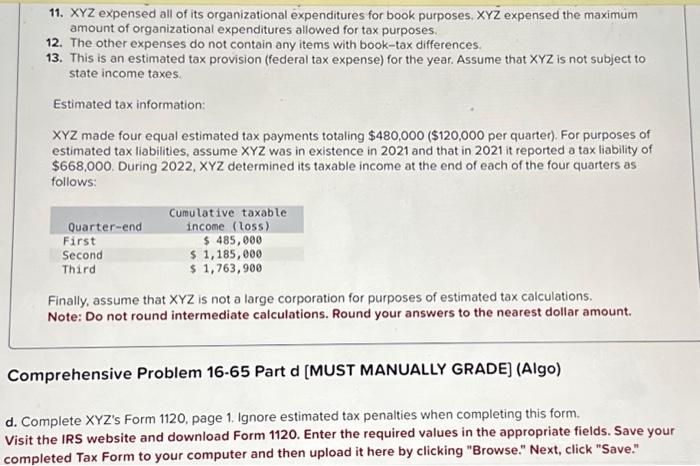

11. XYZ expensed all of its organizational expenditures for book purposes. XYZ expensed the maximum amount of organizational expenditures allowed for tax purposes. 12. The other expenses do not contain any items with book-tax differences. 13. This is an estimated tax provision (federal tax expense) for the year. Assume that XYZ is not subject to state income taxes. Estimated tax information: XYZ made four equal estimated tax payments totaling $480,000 ( $120,000 per quarter). For purposes of estimated tax liabilities, assume XYZ was in existence in 2021 and that in 2021 it reported a tax liability of $668,000. During 2022,XYZ determined its taxable income at the end of each of the four quarters as follows: Finally, assume that XYZ is not a large corporation for purposes of estimated tax calculations. Note: Do not round intermediate calculations. Round your answers to the nearest dollar amount. Comprehensive Problem 16-65 Part d [MUST MANUALLY GRADE] (Algo) d. Complete XYZ's Form 1120, page 1. Ignore estimated tax penalties when completing this form. Visit the IRS website and download Form 1120. Enter the required values in the appropriate fields. Save your completed Tax Form to your computer and then upload it here by clicking "Browse." Next, click "Save." 11. XYZ expensed all of its organizational expenditures for book purposes. XYZ expensed the maximum amount of organizational expenditures allowed for tax purposes. 12. The other expenses do not contain any items with book-tax differences. 13. This is an estimated tax provision (federal tax expense) for the year. Assume that XYZ is not subject to state income taxes. Estimated tax information: XYZ made four equal estimated tax payments totaling $480,000 ( $120,000 per quarter). For purposes of estimated tax liabilities, assume XYZ was in existence in 2021 and that in 2021 it reported a tax liability of $668,000. During 2022,XYZ determined its taxable income at the end of each of the four quarters as follows: Finally, assume that XYZ is not a large corporation for purposes of estimated tax calculations. Note: Do not round intermediate calculations. Round your answers to the nearest dollar amount. Comprehensive Problem 16-65 Part d [MUST MANUALLY GRADE] (Algo) d. Complete XYZ's Form 1120, page 1. Ignore estimated tax penalties when completing this form. Visit the IRS website and download Form 1120. Enter the required values in the appropriate fields. Save your completed Tax Form to your computer and then upload it here by clicking "Browse." Next, click "Save